- China

- /

- Oil and Gas

- /

- SZSE:000571

Discover January 2025's Standout Penny Stocks

Reviewed by Simply Wall St

Global markets have been on an upward trajectory, with U.S. stocks nearing record highs amid optimism over potential trade deals and AI advancements. In this context, understanding what makes a good investment is crucial, especially when considering smaller or newer companies often referred to as penny stocks. While the term 'penny stock' may seem outdated, these investments can still offer significant opportunities for growth when they are backed by strong financials and strategic market positioning.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.59B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £176.46M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.75 | HK$43.09B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.11 | HK$704.62M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.945 | £465.11M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.705 | MYR423.03M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$142.2M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £4.32 | £84.3M | ★★★★☆☆ |

Click here to see the full list of 5,711 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Sundiro Holding (SZSE:000571)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sundiro Holding Co., Ltd. operates in the coal industry both in China and internationally, with a market cap of CN¥2.92 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥2.92B

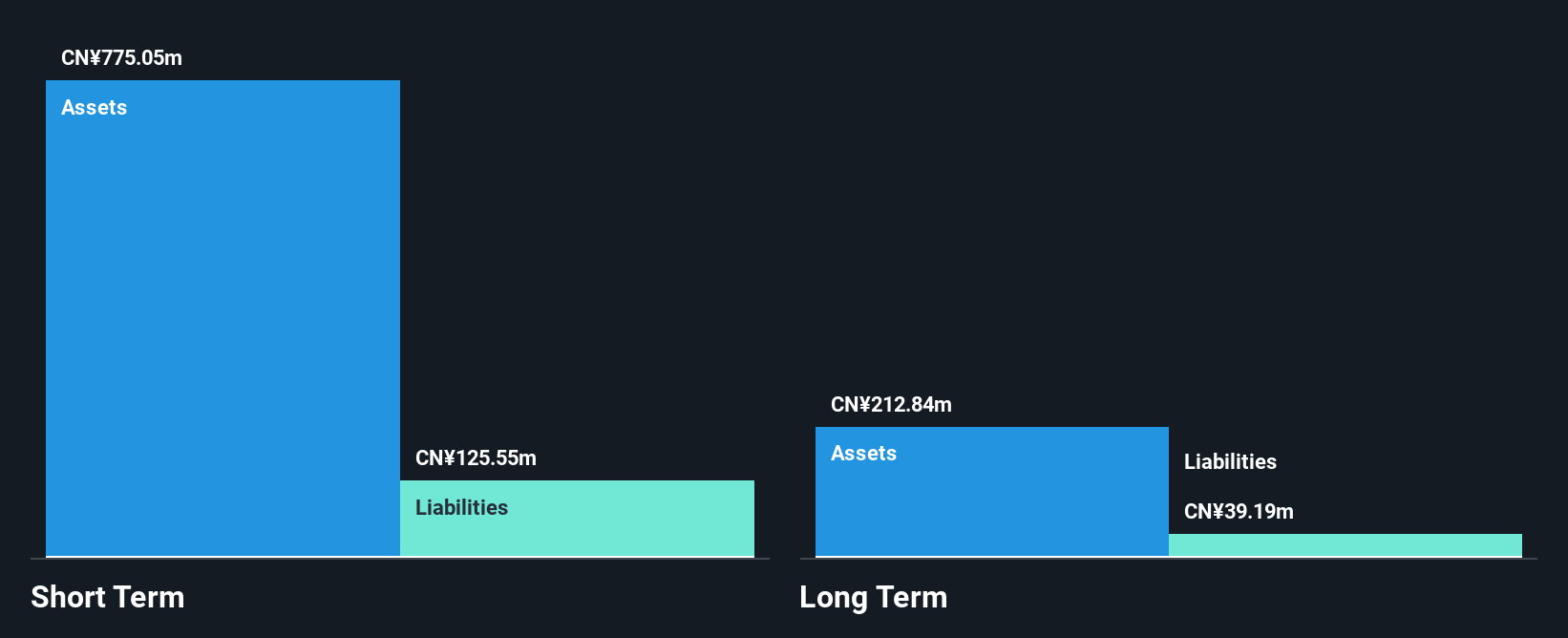

Sundiro Holding Co., Ltd. operates with a market cap of CN¥2.92 billion, yet remains pre-revenue, indicating potential early-stage risks typical of penny stocks. Despite being unprofitable, the company has managed to reduce its debt-to-equity ratio from 45.8% to 32.3% over five years and maintains a positive free cash flow with a sufficient cash runway exceeding three years. Short-term assets fall short of covering short-term liabilities but exceed long-term liabilities, suggesting some financial stability amid challenges. Recent shareholder meetings focused on strategic governance changes and project implementations which may impact future operations and financial health.

- Take a closer look at Sundiro Holding's potential here in our financial health report.

- Review our historical performance report to gain insights into Sundiro Holding's track record.

Shenzhen Hemei GroupLTD (SZSE:002356)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shenzhen Hemei Group Co., Ltd. operates in the sale of clothing and accessories both in China and internationally, with a market capitalization of CN¥4.12 billion.

Operations: There are no specific revenue segments reported for Shenzhen Hemei Group Co., Ltd.

Market Cap: CN¥4.12B

Shenzhen Hemei Group Co., Ltd., with a market cap of CN¥4.12 billion, is currently unprofitable but debt-free, offering some financial stability despite its volatile share price. The company has sufficient cash runway for over a year based on current free cash flow and 1.4 years if growth continues at historical rates. Its short-term assets significantly exceed both short and long-term liabilities, indicating sound liquidity management. Recent developments include the acquisition of a 5% stake by Beijing Yuan Program Asset Management Co., Ltd., suggesting external interest in the company's potential amid ongoing shareholder meetings addressing connected transactions.

- Get an in-depth perspective on Shenzhen Hemei GroupLTD's performance by reading our balance sheet health report here.

- Gain insights into Shenzhen Hemei GroupLTD's historical outcomes by reviewing our past performance report.

Zhejiang Sunflower Great Health (SZSE:300111)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhejiang Sunflower Great Health Co., Ltd. operates in the health industry with a market capitalization of CN¥4.16 billion.

Operations: The company generates revenue of CN¥330.25 million from its pharmaceutical industry segment.

Market Cap: CN¥4.16B

Zhejiang Sunflower Great Health Co., Ltd., with a market cap of CN¥4.16 billion, operates in the health industry and generates CN¥330.25 million in revenue from its pharmaceutical segment. The company demonstrates strong financial management, as its debt is well covered by operating cash flow and short-term assets exceed both short and long-term liabilities. Despite a reduction in profit margins to 0.2% from last year's 10.6%, the company's debt-to-equity ratio has significantly decreased over five years, indicating improved financial stability. The experienced board and management team further support operational oversight amidst ongoing shareholder meetings for director elections.

- Click here and access our complete financial health analysis report to understand the dynamics of Zhejiang Sunflower Great Health.

- Assess Zhejiang Sunflower Great Health's previous results with our detailed historical performance reports.

Make It Happen

- Click here to access our complete index of 5,711 Penny Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000571

Sundiro Holding

Operates in the coal industry in China and internationally.

Excellent balance sheet with weak fundamentals.

Market Insights

Community Narratives