- China

- /

- Semiconductors

- /

- SZSE:002865

Hainan Drinda New Energy Technology Co., Ltd. (SZSE:002865) Stock's 28% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Unfortunately for some shareholders, the Hainan Drinda New Energy Technology Co., Ltd. (SZSE:002865) share price has dived 28% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 74% loss during that time.

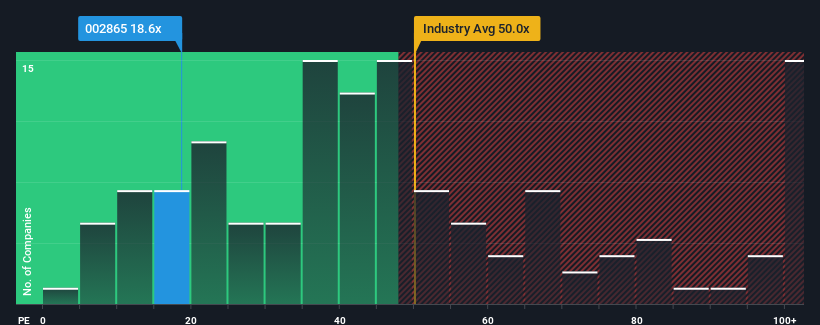

Following the heavy fall in price, Hainan Drinda New Energy Technology may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 18.6x, since almost half of all companies in China have P/E ratios greater than 29x and even P/E's higher than 53x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Hainan Drinda New Energy Technology's earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Hainan Drinda New Energy Technology

How Is Hainan Drinda New Energy Technology's Growth Trending?

In order to justify its P/E ratio, Hainan Drinda New Energy Technology would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 58%. Still, the latest three year period has seen an excellent 934% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 62% per annum over the next three years. That's shaping up to be materially higher than the 25% each year growth forecast for the broader market.

In light of this, it's peculiar that Hainan Drinda New Energy Technology's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Hainan Drinda New Energy Technology's recently weak share price has pulled its P/E below most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Hainan Drinda New Energy Technology's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Hainan Drinda New Energy Technology (1 shouldn't be ignored) you should be aware of.

Of course, you might also be able to find a better stock than Hainan Drinda New Energy Technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hainan Drinda New Energy Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002865

Hainan Drinda New Energy Technology

Hainan Drinda New Energy Technology Co., Ltd.

Exceptional growth potential and fair value.

Market Insights

Community Narratives