- China

- /

- Semiconductors

- /

- SHSE:688720

Discovering Undiscovered Gems with Potential in February 2025

Reviewed by Simply Wall St

As global markets edge toward record highs, small-cap stocks have notably lagged behind their larger counterparts, with the Russell 2000 Index trailing the S&P 500 by a significant margin. This environment of heightened inflation and economic uncertainty presents an intriguing backdrop for investors seeking undiscovered gems within the small-cap sector. Identifying promising stocks in such conditions often involves looking for companies with strong fundamentals, innovative products or services, and resilience to market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.73% | 7.10% | 12.89% | ★★★★★★ |

| Ruentex Interior Design | NA | 21.07% | 27.94% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Ampire | NA | 1.50% | 11.39% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Taiyo KagakuLtd | 0.73% | 4.83% | -2.64% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Jiangsu Aisen Semiconductor MaterialLtd (SHSE:688720)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jiangsu Aisen Semiconductor Material Co., Ltd. operates in the semiconductor industry and has a market cap of CN¥3.78 billion.

Operations: Aisen Semiconductor generates revenue through its operations in the semiconductor industry. The company reported a net profit margin of 15% in the latest financial period.

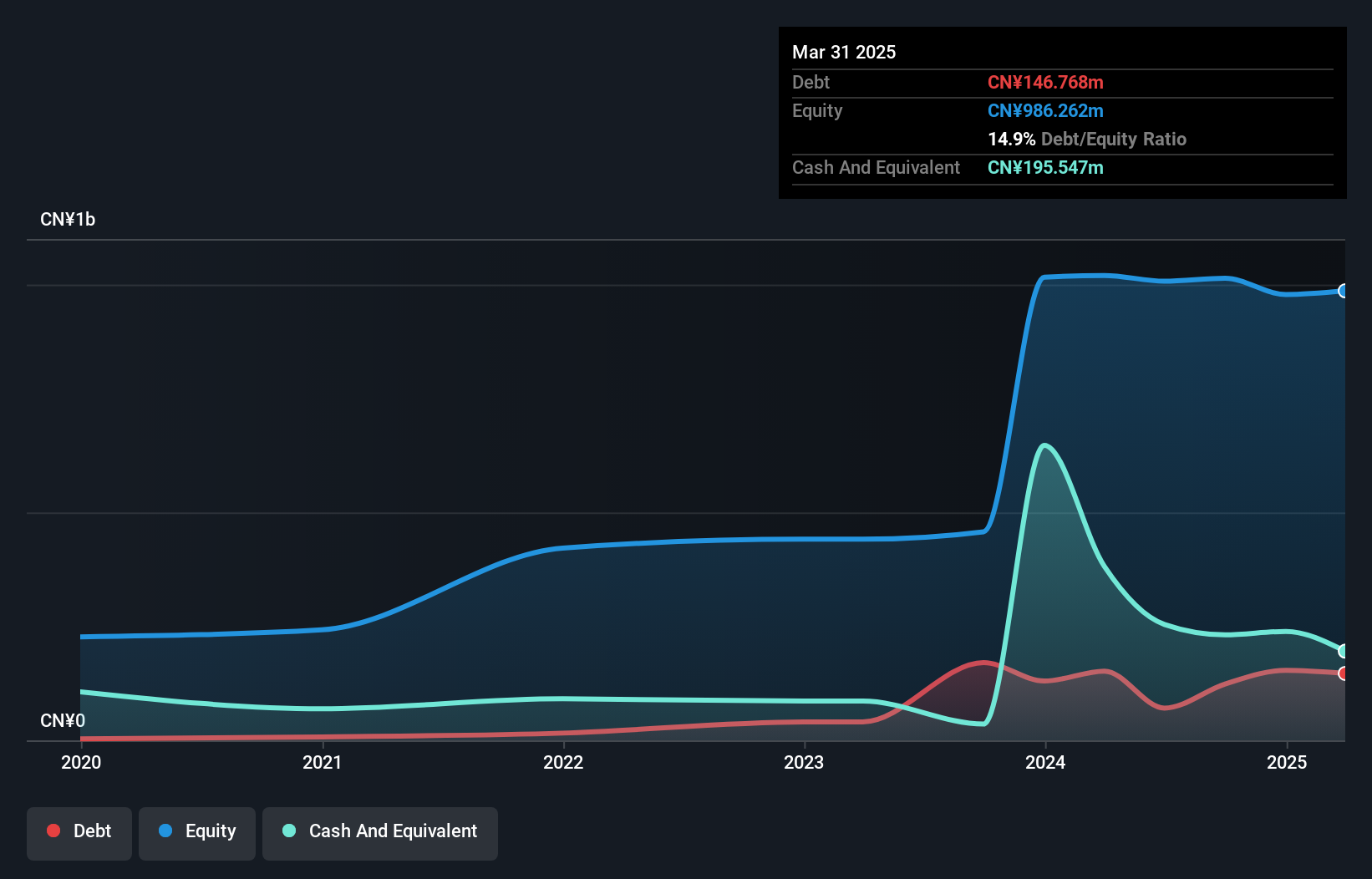

Jiangsu Aisen, a growing player in the semiconductor sector, has seen its earnings grow by 14% over the past year, surpassing the industry's 13%. With more cash than total debt and interest payments well-covered by profits, financial stability seems assured. Recently announced plans for a private placement of A shares indicate strategic capital raising efforts. Additionally, a share repurchase program worth CNY 60 million at CNY 70.58 per share reflects confidence in its stock value and aims to support employee incentives. Despite not being free cash flow positive, these moves suggest potential for long-term growth.

- Take a closer look at Jiangsu Aisen Semiconductor MaterialLtd's potential here in our health report.

Learn about Jiangsu Aisen Semiconductor MaterialLtd's historical performance.

Hwaway Technology (SZSE:001380)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hwaway Technology Corporation Limited focuses on the research, development, production, and sale of elastic components both in China and internationally, with a market capitalization of CN¥4.61 billion.

Operations: Hwaway Technology generates revenue primarily from the sale of elastic components. The company's financial performance is influenced by its ability to manage production costs and optimize its operations.

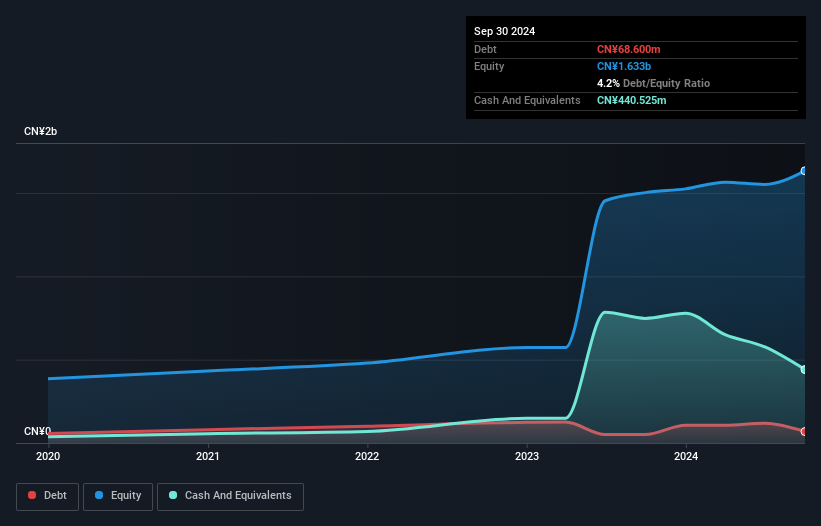

Hwaway Technology, a nimble player in the machinery sector, showcases impressive growth with earnings surging 31.8% over the past year, outpacing its industry peers. The company's price-to-earnings ratio of 24.4x undercuts the CN market average of 36.5x, suggesting potential value for investors. Despite not being free cash flow positive recently, Hwaway's interest payments are well-covered by profits and it holds more cash than total debt, indicating financial stability. A recent shareholder meeting discussed forming a joint venture through external investment, hinting at strategic expansion plans that could shape future prospects positively for this company in China.

TJK Intelligent Equipment Manufacturing (Tianjin) (SZSE:300823)

Simply Wall St Value Rating: ★★★★★★

Overview: TJK Intelligent Equipment Manufacturing (Tianjin) Co., Ltd. specializes in the production of machinery and industrial equipment, with a market capitalization of approximately CN¥1.99 billion.

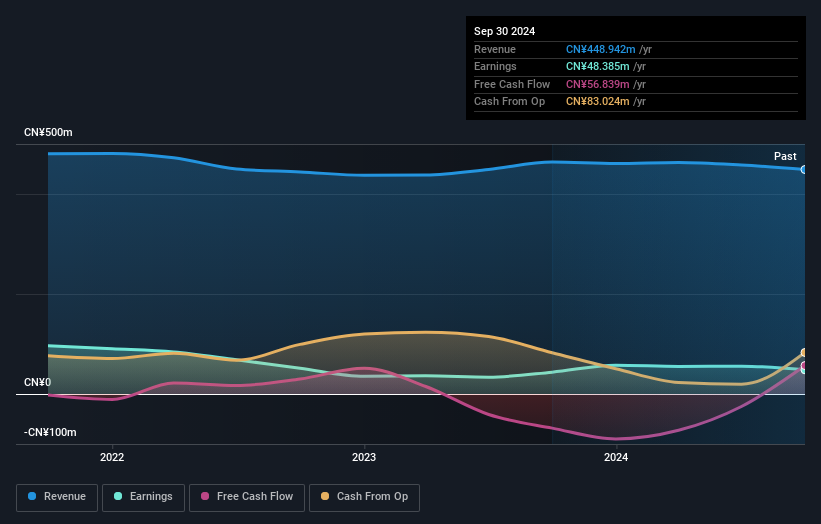

Operations: The primary revenue stream for TJK Intelligent Equipment Manufacturing (Tianjin) comes from its machinery and industrial equipment segment, generating approximately CN¥448.94 million.

TJK Intelligent Equipment Manufacturing, a small player in the machinery sector, has shown resilience with its debt to equity ratio dropping from 19.6% to 0.5% over five years. The company is profitable and boasts more cash than total debt, indicating sound financial health. Despite a challenging period where earnings fell by 16.2% annually over five years, recent performance shows an encouraging earnings growth of 10.7%, outpacing industry averages significantly. However, a notable CN¥17M one-off gain impacted recent results, suggesting that core operational strength might be less robust without such items influencing figures.

Turning Ideas Into Actions

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4722 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688720

Jiangsu Aisen Semiconductor MaterialLtd

Jiangsu Aisen Semiconductor Material Co.,Ltd.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives