- China

- /

- Electronic Equipment and Components

- /

- SZSE:300440

Discovering Undiscovered Gems on None Exchange December 2024

Reviewed by Simply Wall St

As global markets continue to reach record highs, with indices like the Russell 2000 hitting new peaks, small-cap stocks are capturing attention amid a backdrop of economic shifts and geopolitical developments. Despite challenges such as manufacturing slumps and tariff uncertainties, the resilience of consumer spending and strategic policy decisions have bolstered market sentiment. In this dynamic environment, identifying promising stocks involves looking for companies that demonstrate strong fundamentals and adaptability to changing conditions—a key focus in our exploration of undiscovered gems on the None Exchange.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Jiangsu Aisen Semiconductor MaterialLtd (SHSE:688720)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jiangsu Aisen Semiconductor Material Co., Ltd. operates in the semiconductor materials industry and has a market capitalization of CN¥4.27 billion.

Operations: Jiangsu Aisen Semiconductor Material Co., Ltd. derives its revenue primarily from the semiconductor materials sector. The company has a market capitalization of CN¥4.27 billion, reflecting its scale in the industry.

Jiangsu Aisen Semiconductor Material, a notable player in the semiconductor sector, has shown impressive earnings growth of 14.2% over the past year, outpacing the industry average of 12.1%. The company reported sales of CNY 312.29 million for the first nine months of 2024, up from CNY 247.93 million a year earlier, with net income rising to CNY 23.83 million from CNY 18.54 million. Despite its volatile share price recently, Jiangsu Aisen is embarking on a share repurchase program worth up to CNY 60 million to support equity incentives and employee stock ownership plans (ESOP).

- Take a closer look at Jiangsu Aisen Semiconductor MaterialLtd's potential here in our health report.

Chengdu Yunda Technology (SZSE:300440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Chengdu Yunda Technology Co., Ltd. specializes in the research, development, production, and sale of rail transit intelligent systems and solutions in China, with a market capitalization of CN¥3.72 billion.

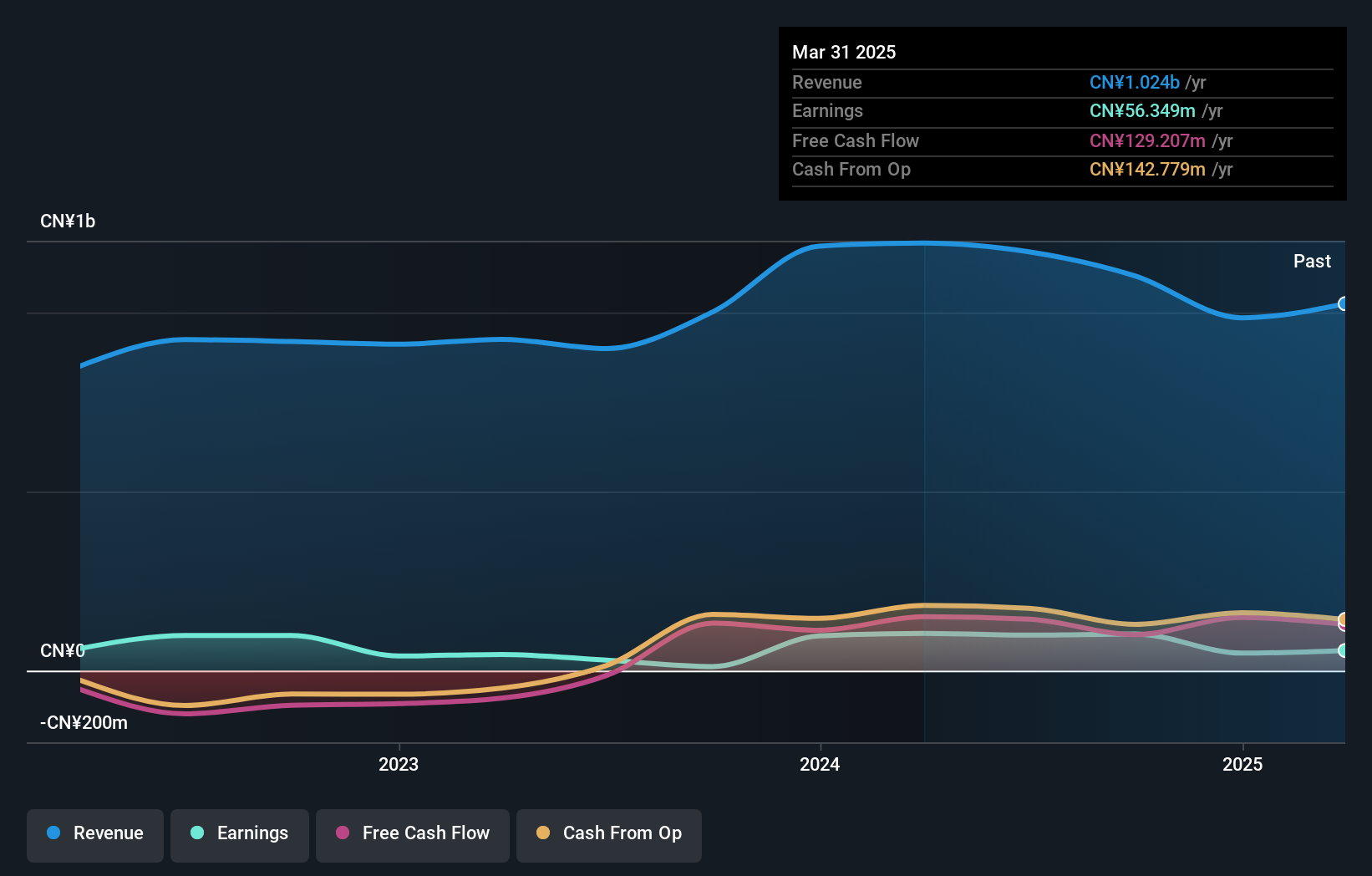

Operations: Yunda Technology generates revenue primarily from its Software and Information Technical Service segment, amounting to CN¥1.10 billion. The company operates within the rail transit intelligent systems and solutions sector in China.

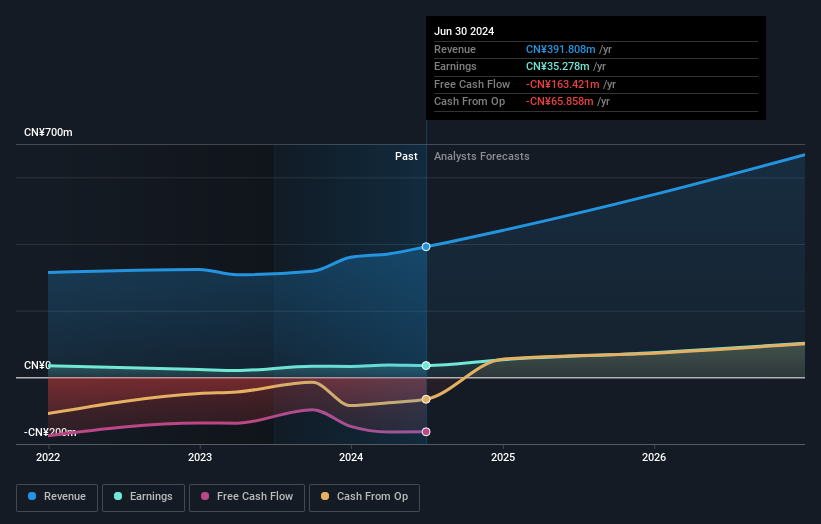

Yunda Technology, a smaller player in the electronics sector, has shown an impressive earnings growth of 808.4% over the past year, significantly outpacing the industry average of 1.8%. Despite a decline in sales from CN¥536.44 million to CN¥453.27 million for the nine months ending September 2024, net income increased to CN¥39.54 million from CN¥34.09 million, aided by a one-off gain of CN¥39.2 million. The company appears financially sound with more cash than total debt and maintains interest coverage comfortably; however, its share price has been highly volatile recently and its debt-to-equity ratio rose to 5.2% over five years.

Xi'an Peri Power Semiconductor Converting TechnologyLtd (SZSE:300831)

Simply Wall St Value Rating: ★★★★★★

Overview: Xi'an Peri Power Semiconductor Converting Technology Co., Ltd. is engaged in the development and production of semiconductor power conversion technologies, with a market cap of CN¥5.23 billion.

Operations: Xi'an Peri Power generates revenue primarily through its semiconductor power conversion technologies. The company has a market capitalization of CN¥5.23 billion, reflecting its position in the industry.

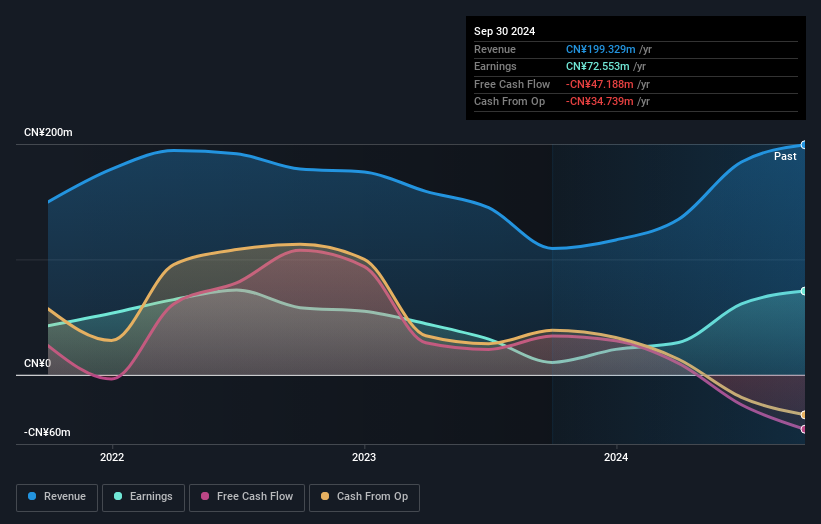

Xi'an Peri Power Semiconductor Converting Technology Ltd. shines in the semiconductor arena with a notable earnings surge of 575.5% over the past year, outpacing the industry's 12.1% growth rate. Despite a historical earnings dip of 3.6% annually over five years, recent momentum is strong, bolstered by revenue reaching CNY 152.66 million for nine months ending September 2024 compared to CNY 70.19 million previously. The company's debt-free status since reducing its debt-to-equity ratio from 19.2% five years ago adds financial stability, while high non-cash earnings underscore robust quality in reported profits.

Make It Happen

- Delve into our full catalog of 4645 Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300440

Chengdu Yunda Technology

Engages in the research and development, production, and sale of rail transit intelligent systems and solutions in China.

Excellent balance sheet with acceptable track record.