- China

- /

- Semiconductors

- /

- SHSE:688709

Investors Appear Satisfied With Chengdu Sino-Microelectronics Tech. Co., Ltd.'s (SHSE:688709) Prospects As Shares Rocket 29%

Despite an already strong run, Chengdu Sino-Microelectronics Tech. Co., Ltd. (SHSE:688709) shares have been powering on, with a gain of 29% in the last thirty days. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

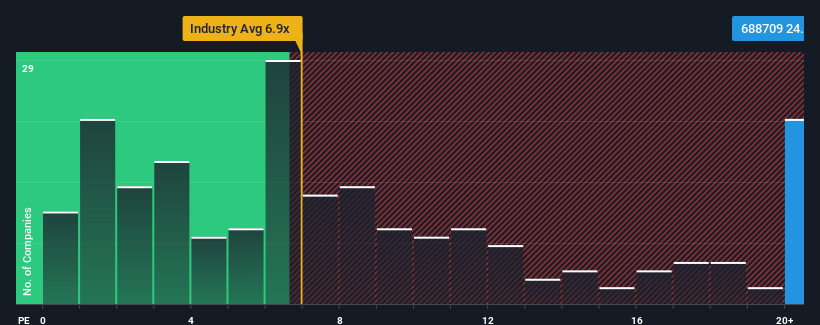

After such a large jump in price, Chengdu Sino-Microelectronics Tech may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 24.1x, since almost half of all companies in the Semiconductor industry in China have P/S ratios under 6.9x and even P/S lower than 3x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Chengdu Sino-Microelectronics Tech

What Does Chengdu Sino-Microelectronics Tech's Recent Performance Look Like?

Chengdu Sino-Microelectronics Tech hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Chengdu Sino-Microelectronics Tech will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Chengdu Sino-Microelectronics Tech's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 34% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 77% over the next year. That's shaping up to be materially higher than the 46% growth forecast for the broader industry.

With this information, we can see why Chengdu Sino-Microelectronics Tech is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shares in Chengdu Sino-Microelectronics Tech have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Chengdu Sino-Microelectronics Tech maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Semiconductor industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Chengdu Sino-Microelectronics Tech (1 is potentially serious!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688709

Chengdu Sino-Microelectronics Tech

Research and development, production, testing, sale, and service of special integrated circuits in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026