- China

- /

- Semiconductors

- /

- SHSE:688702

Suzhou Centec Communications Co., Ltd.'s (SHSE:688702) Shares Climb 29% But Its Business Is Yet to Catch Up

Those holding Suzhou Centec Communications Co., Ltd. (SHSE:688702) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

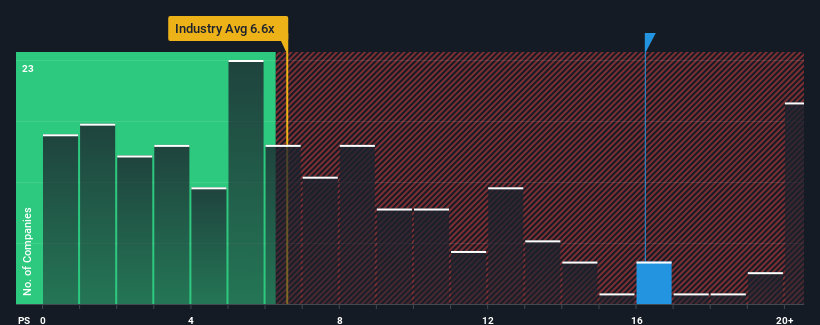

Since its price has surged higher, Suzhou Centec Communications may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 16.2x, when you consider almost half of the companies in the Semiconductor industry in China have P/S ratios under 6.6x and even P/S lower than 3x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Suzhou Centec Communications

How Has Suzhou Centec Communications Performed Recently?

Recent times have been advantageous for Suzhou Centec Communications as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Suzhou Centec Communications will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Suzhou Centec Communications' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 35% last year. The latest three year period has also seen an excellent 293% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 24% per annum over the next three years. With the industry predicted to deliver 31% growth each year, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Suzhou Centec Communications' P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Suzhou Centec Communications' P/S?

Shares in Suzhou Centec Communications have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It comes as a surprise to see Suzhou Centec Communications trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about this 1 warning sign we've spotted with Suzhou Centec Communications.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688702

Suzhou Centec Communications

Provides ethernet switch silicon products and network solutions for 5G, cloud computing, machine learning and industrial markets.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives