- China

- /

- Semiconductors

- /

- SHSE:688702

Suzhou Centec Communications Co., Ltd.'s (SHSE:688702) 25% Share Price Plunge Could Signal Some Risk

The Suzhou Centec Communications Co., Ltd. (SHSE:688702) share price has fared very poorly over the last month, falling by a substantial 25%. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

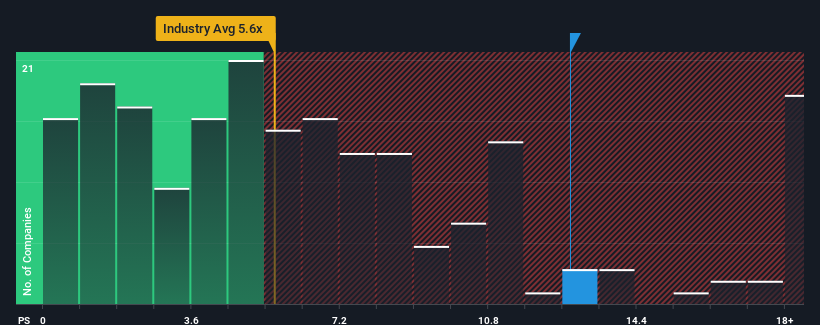

In spite of the heavy fall in price, Suzhou Centec Communications may still be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 12.8x, when you consider almost half of the companies in the Semiconductor industry in China have P/S ratios under 5.6x and even P/S lower than 2x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Suzhou Centec Communications

How Suzhou Centec Communications Has Been Performing

Recent times have been advantageous for Suzhou Centec Communications as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Suzhou Centec Communications' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Suzhou Centec Communications?

The only time you'd be truly comfortable seeing a P/S as steep as Suzhou Centec Communications' is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 35%. Pleasingly, revenue has also lifted 293% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 24% per year over the next three years. With the industry predicted to deliver 29% growth per year, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Suzhou Centec Communications' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Even after such a strong price drop, Suzhou Centec Communications' P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see Suzhou Centec Communications trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Suzhou Centec Communications with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Suzhou Centec Communications' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688702

Suzhou Centec Communications

Provides ethernet switch silicon products and network solutions for 5G, cloud computing, machine learning and industrial markets.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives