- China

- /

- Semiconductors

- /

- SHSE:688691

Pinning Down Brite Semiconductor (Shanghai) Co., Ltd.'s (SHSE:688691) P/S Is Difficult Right Now

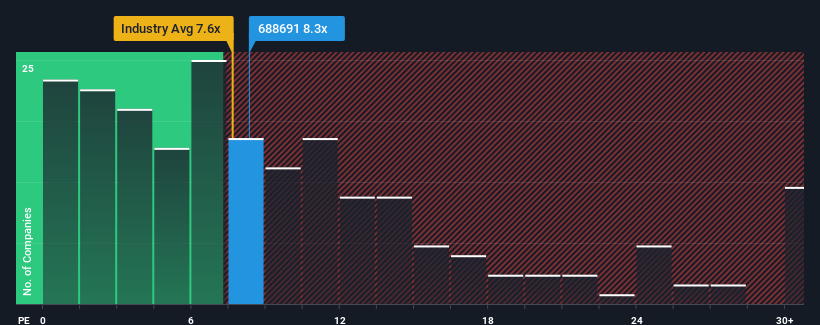

With a median price-to-sales (or "P/S") ratio of close to 7.6x in the Semiconductor industry in China, you could be forgiven for feeling indifferent about Brite Semiconductor (Shanghai) Co., Ltd.'s (SHSE:688691) P/S ratio of 8.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Brite Semiconductor (Shanghai)

What Does Brite Semiconductor (Shanghai)'s P/S Mean For Shareholders?

For instance, Brite Semiconductor (Shanghai)'s receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Brite Semiconductor (Shanghai)'s earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Brite Semiconductor (Shanghai)'s to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 26% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 52% shows it's noticeably less attractive.

With this information, we find it interesting that Brite Semiconductor (Shanghai) is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Brite Semiconductor (Shanghai)'s average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Brite Semiconductor (Shanghai) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Brite Semiconductor (Shanghai) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688691

Brite Semiconductor (Shanghai)

Operates as an integrated circuit design service company that offers chip customization services in China.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives