- China

- /

- Semiconductors

- /

- SHSE:688630

Should You Be Adding Circuit Fabology Microelectronics EquipmentLtd (SHSE:688630) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Circuit Fabology Microelectronics EquipmentLtd (SHSE:688630), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Circuit Fabology Microelectronics EquipmentLtd

How Quickly Is Circuit Fabology Microelectronics EquipmentLtd Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that Circuit Fabology Microelectronics EquipmentLtd's EPS has grown 21% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

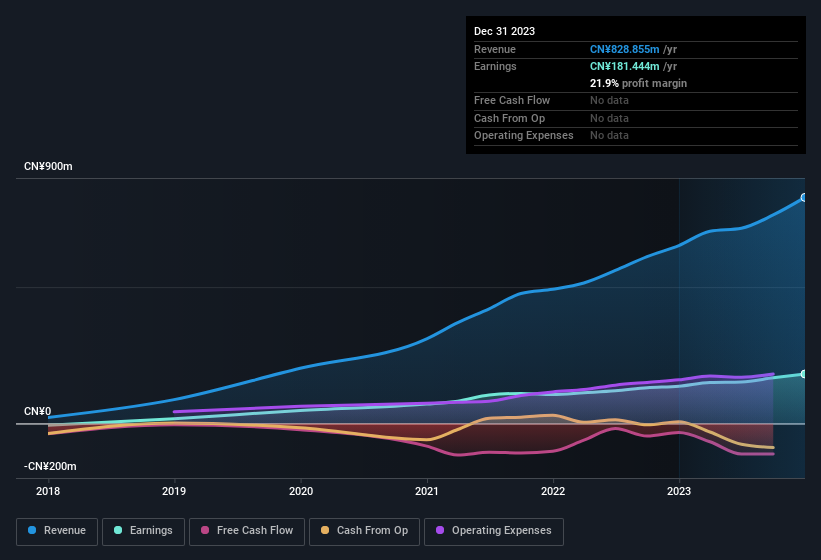

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Circuit Fabology Microelectronics EquipmentLtd shareholders is that EBIT margins have grown from 18% to 24% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Circuit Fabology Microelectronics EquipmentLtd's future EPS 100% free.

Are Circuit Fabology Microelectronics EquipmentLtd Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Shareholders will be pleased by the fact that insiders own Circuit Fabology Microelectronics EquipmentLtd shares worth a considerable sum. Indeed, they have a considerable amount of wealth invested in it, currently valued at CN¥2.5b. That equates to 30% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Well, based on the CEO pay, you'd argue that they are indeed. For companies with market capitalisations between CN¥2.9b and CN¥12b, like Circuit Fabology Microelectronics EquipmentLtd, the median CEO pay is around CN¥928k.

The Circuit Fabology Microelectronics EquipmentLtd CEO received CN¥738k in compensation for the year ending December 2022. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Circuit Fabology Microelectronics EquipmentLtd Deserve A Spot On Your Watchlist?

You can't deny that Circuit Fabology Microelectronics EquipmentLtd has grown its earnings per share at a very impressive rate. That's attractive. If you still have your doubts, remember too that company insiders have a considerable investment aligning themselves with the shareholders and CEO pay is quite modest compared to similarly sized companiess. Everyone has their own preferences when it comes to investing but it definitely makes Circuit Fabology Microelectronics EquipmentLtd look rather interesting indeed. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Circuit Fabology Microelectronics EquipmentLtd that you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Chinese companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688630

Circuit Fabology Microelectronics EquipmentLtd

Circuit Fabology Microelectronics Equipment Co.,Ltd.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026