- China

- /

- Semiconductors

- /

- SHSE:688601

What Wuxi ETEK Microelectronics Co.,Ltd.'s (SHSE:688601) 25% Share Price Gain Is Not Telling You

Wuxi ETEK Microelectronics Co.,Ltd. (SHSE:688601) shares have had a really impressive month, gaining 25% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 5.6% over the last year.

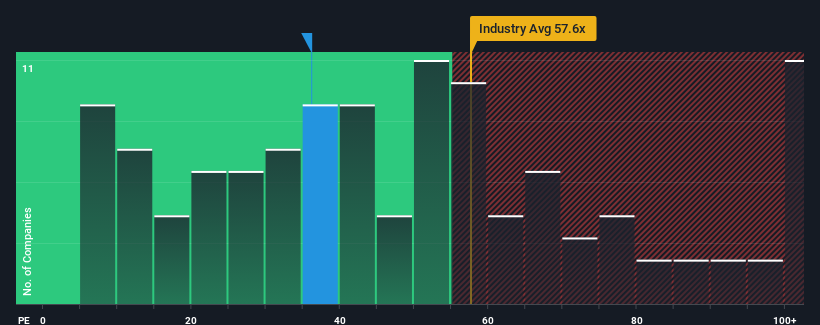

Following the firm bounce in price, Wuxi ETEK MicroelectronicsLtd may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 36.2x, since almost half of all companies in China have P/E ratios under 32x and even P/E's lower than 19x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Wuxi ETEK MicroelectronicsLtd certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Wuxi ETEK MicroelectronicsLtd

Does Growth Match The High P/E?

In order to justify its P/E ratio, Wuxi ETEK MicroelectronicsLtd would need to produce impressive growth in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 37% last year. The latest three year period has also seen an excellent 124% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 41% over the next year. That's shaping up to be similar to the 40% growth forecast for the broader market.

In light of this, it's curious that Wuxi ETEK MicroelectronicsLtd's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Bottom Line On Wuxi ETEK MicroelectronicsLtd's P/E

Wuxi ETEK MicroelectronicsLtd's P/E is getting right up there since its shares have risen strongly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Wuxi ETEK MicroelectronicsLtd's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 2 warning signs for Wuxi ETEK MicroelectronicsLtd that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi ETEK MicroelectronicsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688601

Wuxi ETEK MicroelectronicsLtd

Engages in the research and development, manufacture, and sale of analog integrated circuits (ICs) in China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026