- China

- /

- Semiconductors

- /

- SHSE:688595

Chipsea Technologies (shenzhen) Corp.'s (SHSE:688595) Stock Retreats 26% But Revenues Haven't Escaped The Attention Of Investors

The Chipsea Technologies (shenzhen) Corp. (SHSE:688595) share price has fared very poorly over the last month, falling by a substantial 26%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 42% share price drop.

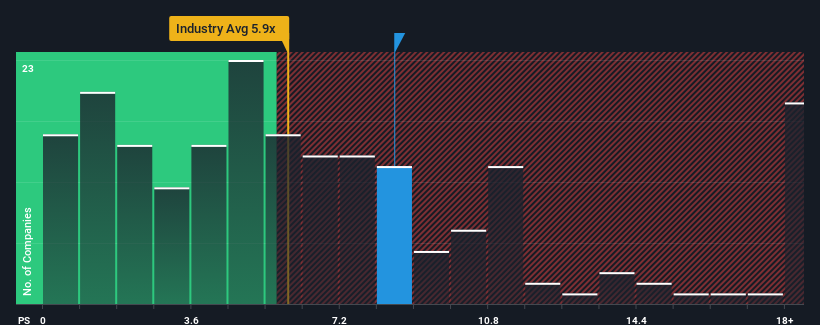

Even after such a large drop in price, Chipsea Technologies (shenzhen)'s price-to-sales (or "P/S") ratio of 8.5x might still make it look like a sell right now compared to the wider Semiconductor industry in China, where around half of the companies have P/S ratios below 5.9x and even P/S below 2x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Chipsea Technologies (shenzhen)

How Has Chipsea Technologies (shenzhen) Performed Recently?

While the industry has experienced revenue growth lately, Chipsea Technologies (shenzhen)'s revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Chipsea Technologies (shenzhen)'s future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Chipsea Technologies (shenzhen)?

In order to justify its P/S ratio, Chipsea Technologies (shenzhen) would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 30%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 19% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 39% each year over the next three years. With the industry only predicted to deliver 29% per year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Chipsea Technologies (shenzhen)'s P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

There's still some elevation in Chipsea Technologies (shenzhen)'s P/S, even if the same can't be said for its share price recently. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Chipsea Technologies (shenzhen) maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Semiconductor industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Chipsea Technologies (shenzhen) is showing 1 warning sign in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688595

Chipsea Technologies (Shenzhen)

A chip design company, focuses on the research and development, design, manufacture, and sale of analog to digital converters (ADCs), microcontroller units (MCUs), measurement algorithms, and one-stop solutions for the Internet of Things in China and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives