- Hong Kong

- /

- Diversified Financial

- /

- SEHK:2598

Asian Growth Companies With High Insider Ownership May 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by easing trade tensions and mixed economic signals, Asia's growth potential remains a focal point for investors seeking opportunities in emerging markets. In this context, companies with high insider ownership often attract attention due to the perceived alignment of interests between shareholders and management, offering a compelling proposition amidst the current market dynamics.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Bethel Automotive Safety Systems (SHSE:603596) | 20.2% | 24.7% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 29.0% |

| UTour Group (SZSE:002707) | 23.5% | 40.9% |

| M31 Technology (TPEX:6643) | 30.8% | 69.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Suzhou Gyz Electronic TechnologyLtd (SHSE:688260) | 16.4% | 121.7% |

| Techwing (KOSDAQ:A089030) | 18.8% | 65% |

Underneath we present a selection of stocks filtered out by our screen.

Lianlian DigiTech (SEHK:2598)

Simply Wall St Growth Rating: ★★★★★☆

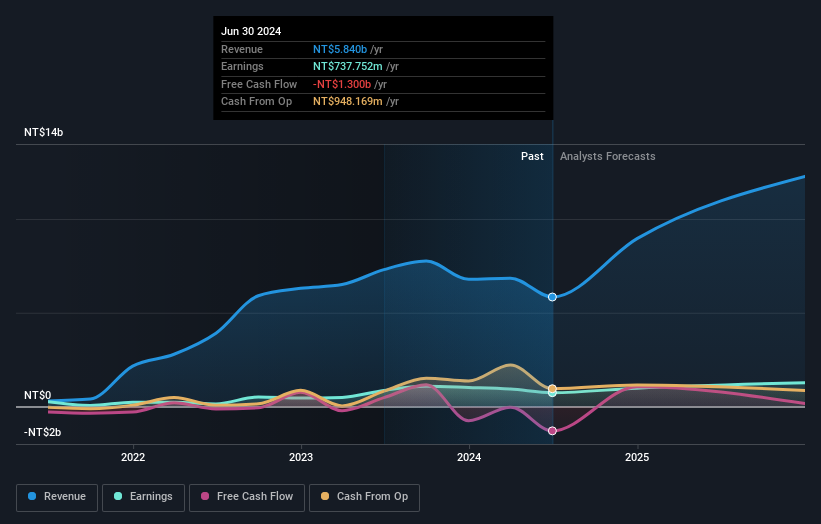

Overview: Lianlian DigiTech Co., Ltd., along with its subsidiaries, offers digital payment and value-added services to small and midsized merchants and enterprises both in China and internationally, with a market cap of approximately HK$8.08 billion.

Operations: The company's revenue is primarily derived from its Global Payment segment at CN¥807.77 million, followed by Domestic Payment at CN¥342.86 million and Value-Added Services at CN¥146.19 million.

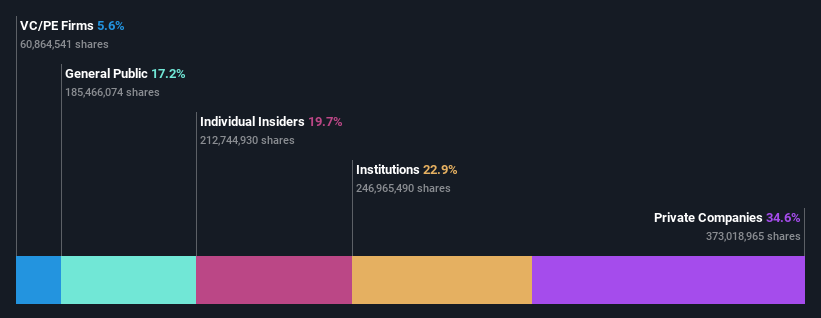

Insider Ownership: 19.7%

Revenue Growth Forecast: 21.5% p.a.

Lianlian DigiTech, with significant insider ownership, is experiencing robust growth prospects in Asia. The company reported a substantial reduction in net loss to CNY 168.22 million for 2024 and anticipates becoming profitable within three years, outpacing market averages. Revenue growth is projected at 21.5% annually, surpassing the Hong Kong market's rate. Recent share buyback initiatives could enhance earnings per share and net asset value, though volatility remains a concern for investors.

- Dive into the specifics of Lianlian DigiTech here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Lianlian DigiTech shares in the market.

3Peak (SHSE:688536)

Simply Wall St Growth Rating: ★★★★★☆

Overview: 3Peak Incorporated focuses on the research, development, and sale of analog integrated circuit products both in China and internationally, with a market capitalization of CN¥20.47 billion.

Operations: The company generates revenue through the research and development, as well as the sale of analog integrated circuit products, catering to both domestic and international markets.

Insider Ownership: 14.2%

Revenue Growth Forecast: 26.6% p.a.

3Peak, with substantial insider ownership, reported impressive Q1 2025 results, showing a significant turnaround from the previous year's loss. Sales surged to CNY 421.79 million from CNY 200.01 million, while net income reached CNY 15.56 million compared to a prior net loss of CNY 49.17 million. The company is expected to outpace the Chinese market with projected revenue growth of 26.6% annually and aims for profitability within three years despite low forecasted return on equity.

- Take a closer look at 3Peak's potential here in our earnings growth report.

- The analysis detailed in our 3Peak valuation report hints at an inflated share price compared to its estimated value.

J&V Energy Technology (TWSE:6869)

Simply Wall St Growth Rating: ★★★★★☆

Overview: J&V Energy Technology Co., Ltd. operates in Taiwan, focusing on the development, investment, maintenance, and management of renewable energy plants, with a market cap of NT$22.22 billion.

Operations: J&V Energy Technology Co., Ltd. generates revenue primarily from construction (NT$2.06 billion) and power generation and sales (NT$1.11 billion).

Insider Ownership: 19.8%

Revenue Growth Forecast: 55.5% p.a.

J&V Energy Technology, with high insider ownership, is poised for robust growth, forecasting a 55.5% annual revenue increase, surpassing the Taiwanese market's average. Despite recent shareholder dilution and volatile share prices, its price-to-earnings ratio of 19.6x offers good value compared to industry peers. The company announced a share repurchase program worth TWD 4.46 billion to transfer shares to employees while maintaining earnings growth at 16.2% annually above market rates despite unsustainable dividends and non-cash earnings concerns.

- Click here to discover the nuances of J&V Energy Technology with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that J&V Energy Technology is priced higher than what may be justified by its financials.

Make It Happen

- Embark on your investment journey to our 617 Fast Growing Asian Companies With High Insider Ownership selection here.

- Ready To Venture Into Other Investment Styles? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2598

Lianlian DigiTech

Provides digital payment services and value-added services to small and midsized merchants and enterprises in China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives