- China

- /

- Semiconductors

- /

- SHSE:688525

Asian Growth Companies With High Insider Ownership For March 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by trade tensions and economic uncertainties, Asian indices have shown resilience amid these challenges. In this context, growth companies with high insider ownership can be particularly appealing, as they often indicate strong confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 34.3% |

| Sineng ElectricLtd (SZSE:300827) | 36.3% | 41.4% |

| Laopu Gold (SEHK:6181) | 36.4% | 45.7% |

| Global Tax Free (KOSDAQ:A204620) | 20.4% | 89.3% |

| Oscotec (KOSDAQ:A039200) | 21.2% | 148.5% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 125.9% |

| Fulin Precision (SZSE:300432) | 13.6% | 78.6% |

| Ascentage Pharma Group International (SEHK:6855) | 17.9% | 60.9% |

| Synspective (TSE:290A) | 13.2% | 37.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

RemeGen (SEHK:9995)

Simply Wall St Growth Rating: ★★★★★★

Overview: RemeGen Co., Ltd. is a biopharmaceutical company focused on discovering, developing, and commercializing biologics for autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States, with a market cap of approximately HK$17.47 billion.

Operations: The company's revenue primarily stems from its biopharmaceutical research, service, production, and sales segment, which generated CN¥1.72 billion.

Insider Ownership: 11.4%

RemeGen, a biopharmaceutical company in Asia, is expected to achieve profitability within three years with revenue forecasted to grow annually at 21.6%. Despite recent volatility in its share price and a current net loss of CNY 1.47 billion for 2024, the company's innovative therapies like Disitamab Vedotin show promising clinical results, potentially enhancing future growth prospects. Trading significantly below fair value estimates, RemeGen presents an intriguing opportunity amidst ongoing strategic board changes and product advancements.

- Navigate through the intricacies of RemeGen with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that RemeGen is priced lower than what may be justified by its financials.

BIWIN Storage Technology (SHSE:688525)

Simply Wall St Growth Rating: ★★★★★★

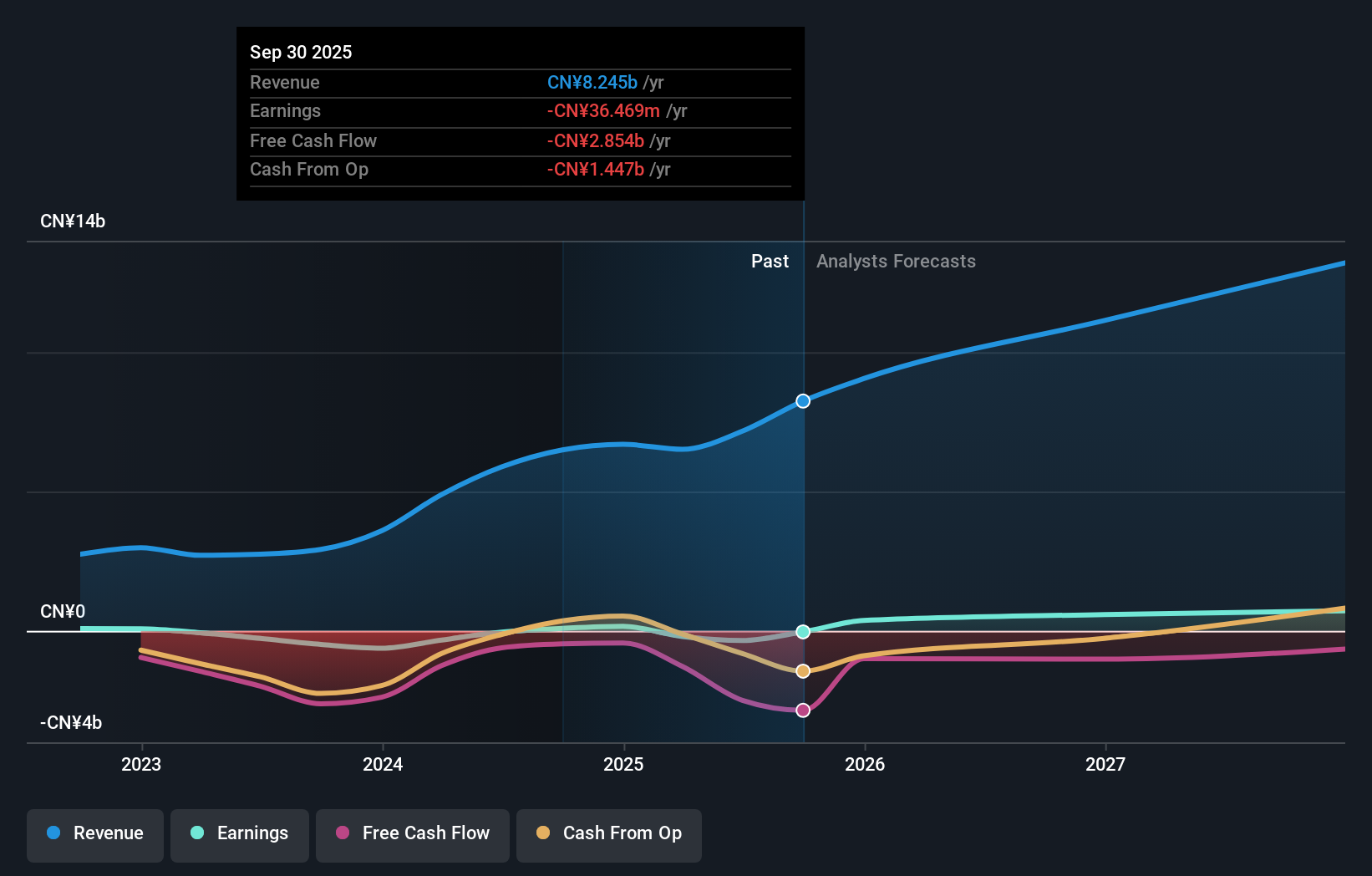

Overview: BIWIN Storage Technology Co., Ltd. engages in the research, development, design, packaging, testing, production, and sale of semiconductor memories and has a market cap of approximately CN¥33.77 billion.

Operations: The company's revenue primarily comes from its semiconductor segment, which generated CN¥6.70 billion.

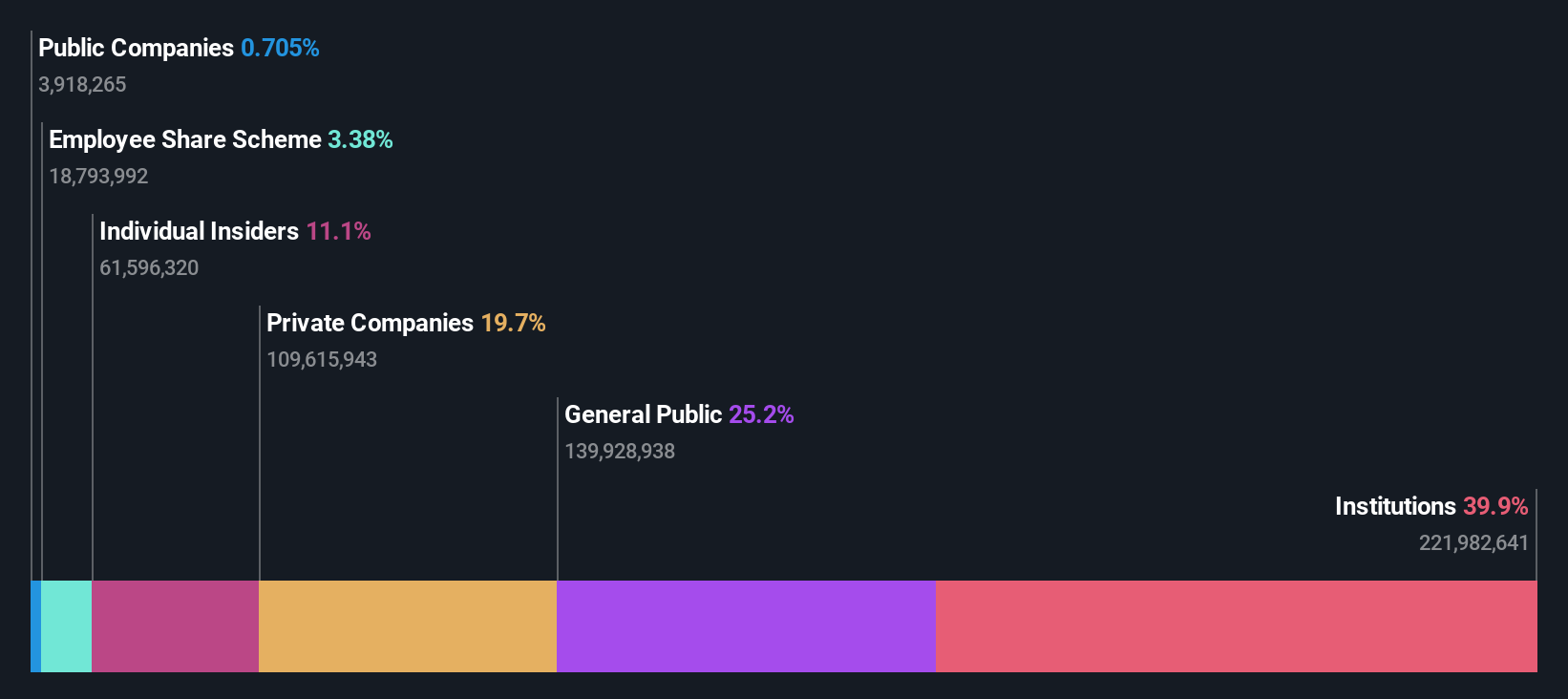

Insider Ownership: 18.9%

BIWIN Storage Technology, with substantial insider ownership, has demonstrated significant growth potential. The company's revenue surged to CNY 6.70 billion in 2024 from CNY 3.59 billion the previous year, marking a return to profitability with a net income of CNY 175.67 million compared to a prior loss. Revenue and earnings are forecasted to grow significantly faster than the market at rates of 26.5% and 57.64% per year respectively; however, interest payments remain poorly covered by earnings.

- Dive into the specifics of BIWIN Storage Technology here with our thorough growth forecast report.

- Our expertly prepared valuation report BIWIN Storage Technology implies its share price may be too high.

Silergy (TWSE:6415)

Simply Wall St Growth Rating: ★★★★★☆

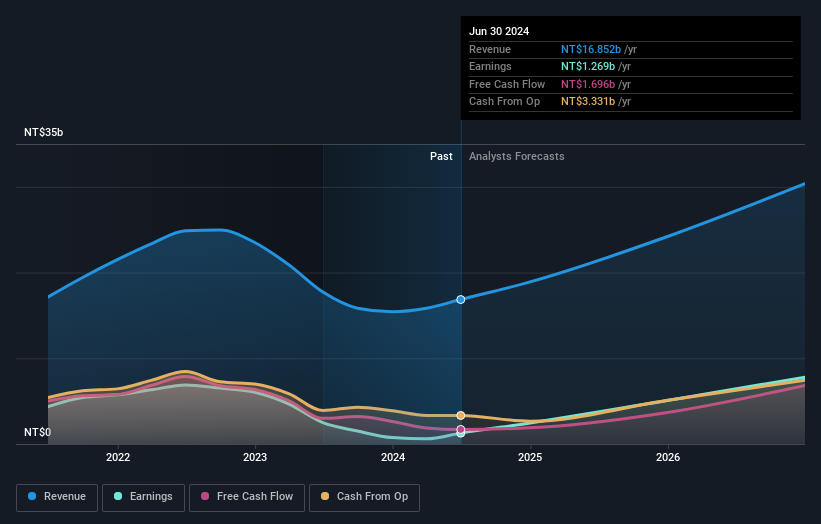

Overview: Silergy Corp. designs, manufactures, and sells integrated circuit products and provides related technical services both in China and internationally, with a market cap of NT$175.19 billion.

Operations: The company's revenue primarily comes from its semiconductor segment, which generated NT$18.45 billion.

Insider Ownership: 14.3%

Silergy's strong insider ownership aligns with its robust growth trajectory, as evidenced by a substantial increase in net income to TWD 2.29 billion for 2024, up from TWD 746 million the previous year. Earnings are projected to grow significantly at 34.7% annually, outpacing the TW market average of 15.7%. Despite high share price volatility and no recent insider trading activity, Silergy remains positioned for continued revenue expansion and profitability enhancement amidst competitive pressures.

- Delve into the full analysis future growth report here for a deeper understanding of Silergy.

- In light of our recent valuation report, it seems possible that Silergy is trading beyond its estimated value.

Summing It All Up

- Discover the full array of 640 Fast Growing Asian Companies With High Insider Ownership right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if BIWIN Storage Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688525

BIWIN Storage Technology

Research, develops, designs, packs, tests, produces, and sells semiconductor memories.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives