- China

- /

- Electrical

- /

- SZSE:001359

Global's Top Growth Companies With Insider Ownership March 2025

Reviewed by Simply Wall St

As global markets face economic uncertainty and inflationary pressures, with U.S. stocks experiencing a decline amid trade policy concerns and consumer sentiment hitting a 12-year low, investors are increasingly turning their attention to growth companies with high insider ownership. In such volatile conditions, these firms can offer a unique appeal due to the potential alignment of interests between insiders and shareholders, which may provide some stability in navigating the challenges of today's market environment.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| AcrelLtd (SZSE:300286) | 40% | 32% |

| Pharma Mar (BME:PHM) | 11.8% | 40.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 47.2% |

| Vow (OB:VOW) | 13.1% | 111.2% |

| Global Tax Free (KOSDAQ:A204620) | 21.8% | 89.3% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| CD Projekt (WSE:CDR) | 29.7% | 36.8% |

| Nordic Halibut (OB:NOHAL) | 29.8% | 56.3% |

| Synspective (TSE:290A) | 13.2% | 37.4% |

| Ascentage Pharma Group International (SEHK:6855) | 17.9% | 83.6% |

Let's review some notable picks from our screened stocks.

Lontium Semiconductor (SHSE:688486)

Simply Wall St Growth Rating: ★★★★★★

Overview: Lontium Semiconductor Corporation develops and markets semiconductor products globally, with a market cap of CN¥10.41 billion.

Operations: The company's revenue primarily comes from its HD Video Bridge and Processing Chip segment, generating CN¥425.69 million, followed by the High-Speed Signal Transmission Chip segment at CN¥28.99 million.

Insider Ownership: 38.7%

Revenue Growth Forecast: 35.3% p.a.

Lontium Semiconductor demonstrates strong growth potential with its earnings expected to grow significantly at 36% annually, outpacing the CN market. The company's revenue is forecasted to increase by 35.3% per year, surpassing market expectations. Despite high volatility in its share price and an unstable dividend track record, Lontium's recent financial results show robust performance with sales reaching CNY 466 million and net income at CNY 144.41 million for the year ended December 2024.

- Unlock comprehensive insights into our analysis of Lontium Semiconductor stock in this growth report.

- Our expertly prepared valuation report Lontium Semiconductor implies its share price may be too high.

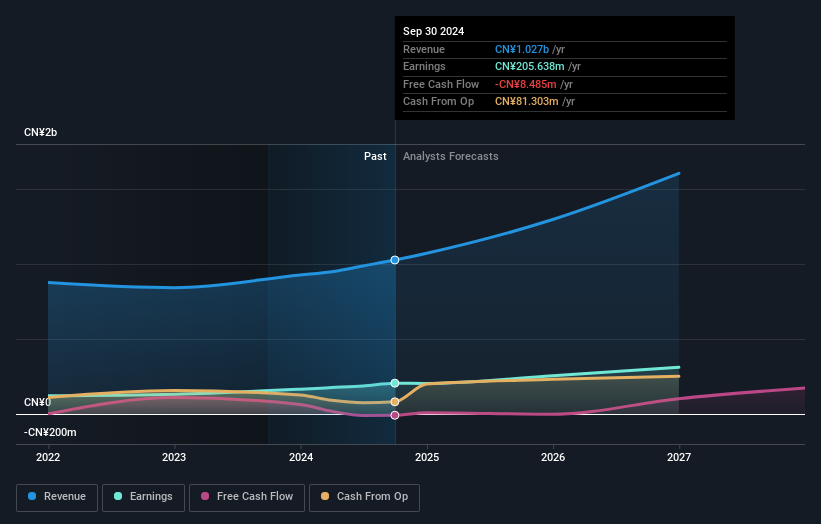

Pamica Technology (SZSE:001359)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pamica Technology Corporation focuses on the R&D, production, and sale of mica insulation materials, glass fiber cloth, and new energy insulation materials with a market cap of CN¥5.87 billion.

Operations: Pamica Technology's revenue is derived from its activities in mica insulation materials, glass fiber cloth, and new energy insulation materials.

Insider Ownership: 30.1%

Revenue Growth Forecast: 20.5% p.a.

Pamica Technology shows promising growth with its revenue projected to increase by 20.5% annually, exceeding the CN market's rate. While its earnings are also expected to grow significantly at over 20% per year, this is slower than the market's pace. The company's price-to-earnings ratio of 29.6x suggests good value compared to the broader CN market average of 37.6x, though its return on equity is forecasted to remain low at 13%.

- Click here to discover the nuances of Pamica Technology with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Pamica Technology is priced higher than what may be justified by its financials.

Guangzhou Sie Consulting (SZSE:300687)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guangzhou Sie Consulting Co., Ltd. is a solution provider specializing in industrial Internet and intelligent manufacturing, core ERP, and business operation centers in China, with a market cap of CN¥11.02 billion.

Operations: The company's revenue primarily comes from Software Services, totaling CN¥2.28 billion.

Insider Ownership: 29.1%

Revenue Growth Forecast: 13.8% p.a.

Guangzhou Sie Consulting demonstrates growth potential with earnings projected to rise significantly at 27% annually, outpacing the CN market. Its revenue is expected to grow at 13.8% per year, slightly above the market rate. The company's price-to-earnings ratio of 59.9x offers relative value against the software industry average of 89.6x, despite a forecasted low return on equity of 11.8%. Recent share buybacks indicate active capital management strategies amidst no substantial insider trading activity recently noted.

- Navigate through the intricacies of Guangzhou Sie Consulting with our comprehensive analyst estimates report here.

- The analysis detailed in our Guangzhou Sie Consulting valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Explore the 919 names from our Fast Growing Global Companies With High Insider Ownership screener here.

- Looking For Alternative Opportunities? Trump has pledged to "unleash" American oil and gas and these 20 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Pamica Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001359

Pamica Technology

Engages in the research and development, production, and sale of mica insulation materials, glass fiber cloth, and new energy insulation materials.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives