- China

- /

- Semiconductors

- /

- SHSE:688429

More Unpleasant Surprises Could Be In Store For Changzhou Shichuang Energy Co.,Ltd.'s (SHSE:688429) Shares After Tumbling 26%

The Changzhou Shichuang Energy Co.,Ltd. (SHSE:688429) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

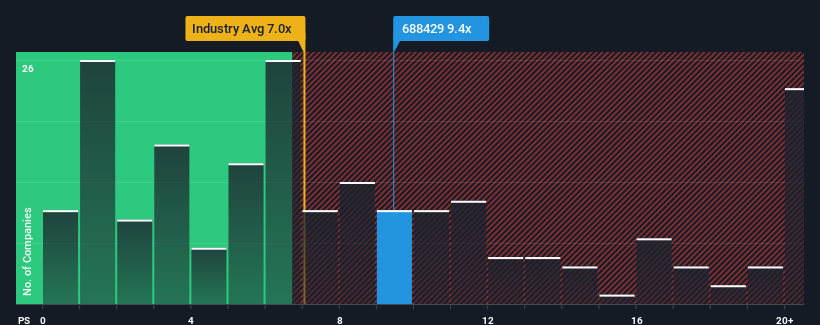

Although its price has dipped substantially, Changzhou Shichuang EnergyLtd may still be sending sell signals at present with a price-to-sales (or "P/S") ratio of 9.4x, when you consider almost half of the companies in the Semiconductor industry in China have P/S ratios under 7x and even P/S lower than 3x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Changzhou Shichuang EnergyLtd

What Does Changzhou Shichuang EnergyLtd's P/S Mean For Shareholders?

For instance, Changzhou Shichuang EnergyLtd's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Changzhou Shichuang EnergyLtd will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Changzhou Shichuang EnergyLtd?

The only time you'd be truly comfortable seeing a P/S as high as Changzhou Shichuang EnergyLtd's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 59% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 18% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is predicted to deliver 47% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's alarming that Changzhou Shichuang EnergyLtd's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does Changzhou Shichuang EnergyLtd's P/S Mean For Investors?

There's still some elevation in Changzhou Shichuang EnergyLtd's P/S, even if the same can't be said for its share price recently. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Changzhou Shichuang EnergyLtd currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

Having said that, be aware Changzhou Shichuang EnergyLtd is showing 2 warning signs in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688429

Changzhou Shichuang EnergyLtd

Engages in the research, development, production, and sale of photovoltaic wet process auxiliary products, photovoltaic equipment, and photovoltaic cells in China and internationally.

Imperfect balance sheet and overvalued.

Market Insights

Community Narratives