- China

- /

- Semiconductors

- /

- SHSE:688313

A Piece Of The Puzzle Missing From Henan Shijia Photons Technology Co., Ltd.'s (SHSE:688313) 26% Share Price Climb

Those holding Henan Shijia Photons Technology Co., Ltd. (SHSE:688313) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.5% in the last twelve months.

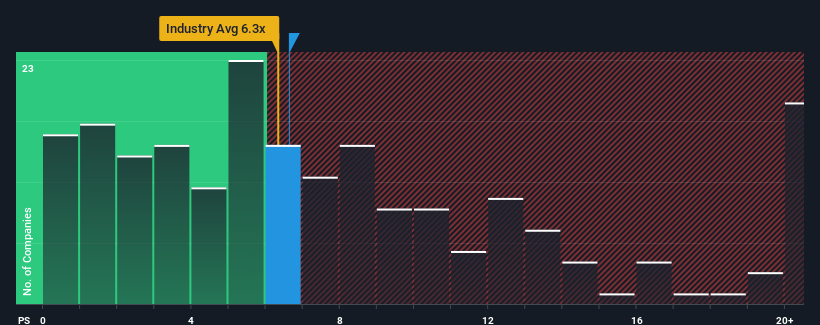

In spite of the firm bounce in price, it's still not a stretch to say that Henan Shijia Photons Technology's price-to-sales (or "P/S") ratio of 6.6x right now seems quite "middle-of-the-road" compared to the Semiconductor industry in China, where the median P/S ratio is around 6.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Henan Shijia Photons Technology

How Henan Shijia Photons Technology Has Been Performing

Henan Shijia Photons Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Henan Shijia Photons Technology will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Henan Shijia Photons Technology would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 12% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 52% over the next year. With the industry only predicted to deliver 38%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Henan Shijia Photons Technology's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Henan Shijia Photons Technology's P/S Mean For Investors?

Its shares have lifted substantially and now Henan Shijia Photons Technology's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at Henan Shijia Photons Technology's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 1 warning sign for Henan Shijia Photons Technology that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Henan Shijia Photons Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688313

Henan Shijia Photons Technology

Henan Shijia Photons Technology Co., Ltd.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives