- China

- /

- Semiconductors

- /

- SHSE:688303

Xinjiang Daqo New Energy Co.,Ltd. (SHSE:688303) Stock's 28% Dive Might Signal An Opportunity But It Requires Some Scrutiny

The Xinjiang Daqo New Energy Co.,Ltd. (SHSE:688303) share price has fared very poorly over the last month, falling by a substantial 28%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 51% loss during that time.

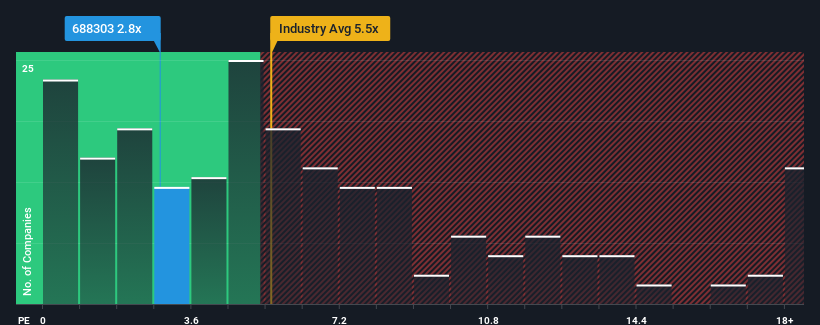

Following the heavy fall in price, Xinjiang Daqo New EnergyLtd's price-to-sales (or "P/S") ratio of 2.8x might make it look like a buy right now compared to the Semiconductor industry in China, where around half of the companies have P/S ratios above 5.5x and even P/S above 9x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Xinjiang Daqo New EnergyLtd

How Xinjiang Daqo New EnergyLtd Has Been Performing

Xinjiang Daqo New EnergyLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Xinjiang Daqo New EnergyLtd's future stacks up against the industry? In that case, our free report is a great place to start.How Is Xinjiang Daqo New EnergyLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Xinjiang Daqo New EnergyLtd would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 48%. Even so, admirably revenue has lifted 181% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 18% per annum over the next three years. With the industry predicted to deliver 20% growth each year, the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Xinjiang Daqo New EnergyLtd's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What Does Xinjiang Daqo New EnergyLtd's P/S Mean For Investors?

Xinjiang Daqo New EnergyLtd's recently weak share price has pulled its P/S back below other Semiconductor companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Xinjiang Daqo New EnergyLtd currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Xinjiang Daqo New EnergyLtd (of which 1 doesn't sit too well with us!) you should know about.

If these risks are making you reconsider your opinion on Xinjiang Daqo New EnergyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Xinjiang Daqo New EnergyLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688303

Xinjiang Daqo New EnergyLtd

Engages in the research, development, production, and sale of polysilicon in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives