- China

- /

- Semiconductors

- /

- SHSE:688270

Great Microwave Technology Co., Ltd.'s (SHSE:688270) 29% Cheaper Price Remains In Tune With Revenues

Great Microwave Technology Co., Ltd. (SHSE:688270) shareholders won't be pleased to see that the share price has had a very rough month, dropping 29% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 44% share price drop.

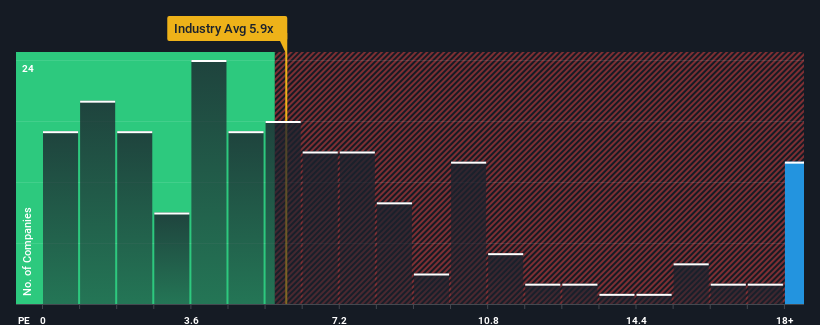

Even after such a large drop in price, Great Microwave Technology may still be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 22.1x, since almost half of all companies in the Semiconductor industry in China have P/S ratios under 5.9x and even P/S lower than 2x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Great Microwave Technology

What Does Great Microwave Technology's P/S Mean For Shareholders?

Recent times haven't been great for Great Microwave Technology as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Great Microwave Technology's future stacks up against the industry? In that case, our free report is a great place to start.How Is Great Microwave Technology's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Great Microwave Technology's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. The strong recent performance means it was also able to grow revenue by 85% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 37% per annum as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 29% per year, which is noticeably less attractive.

In light of this, it's understandable that Great Microwave Technology's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Great Microwave Technology's P/S

Even after such a strong price drop, Great Microwave Technology's P/S still exceeds the industry median significantly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Great Microwave Technology shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Great Microwave Technology is showing 3 warning signs in our investment analysis, and 1 of those shouldn't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688270

Great Microwave Technology

Engages in the research and development, production, and sale of integrated circuit chips and microsystems in China.

High growth potential with excellent balance sheet.