- China

- /

- Electrical

- /

- SHSE:601615

3 Growth Companies With High Insider Ownership And Up To 79% Earnings Growth

Reviewed by Simply Wall St

In a week marked by volatility, U.S. stocks faced downward pressure amid AI competition concerns and mixed corporate earnings, while European markets found support from strong earnings and an ECB rate cut. As global markets grapple with these shifts, identifying growth companies with high insider ownership can be particularly appealing to investors seeking alignment of interests between company leadership and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.9% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Pharma Mar (BME:PHM) | 11.9% | 44.7% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 86% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Here's a peek at a few of the choices from the screener.

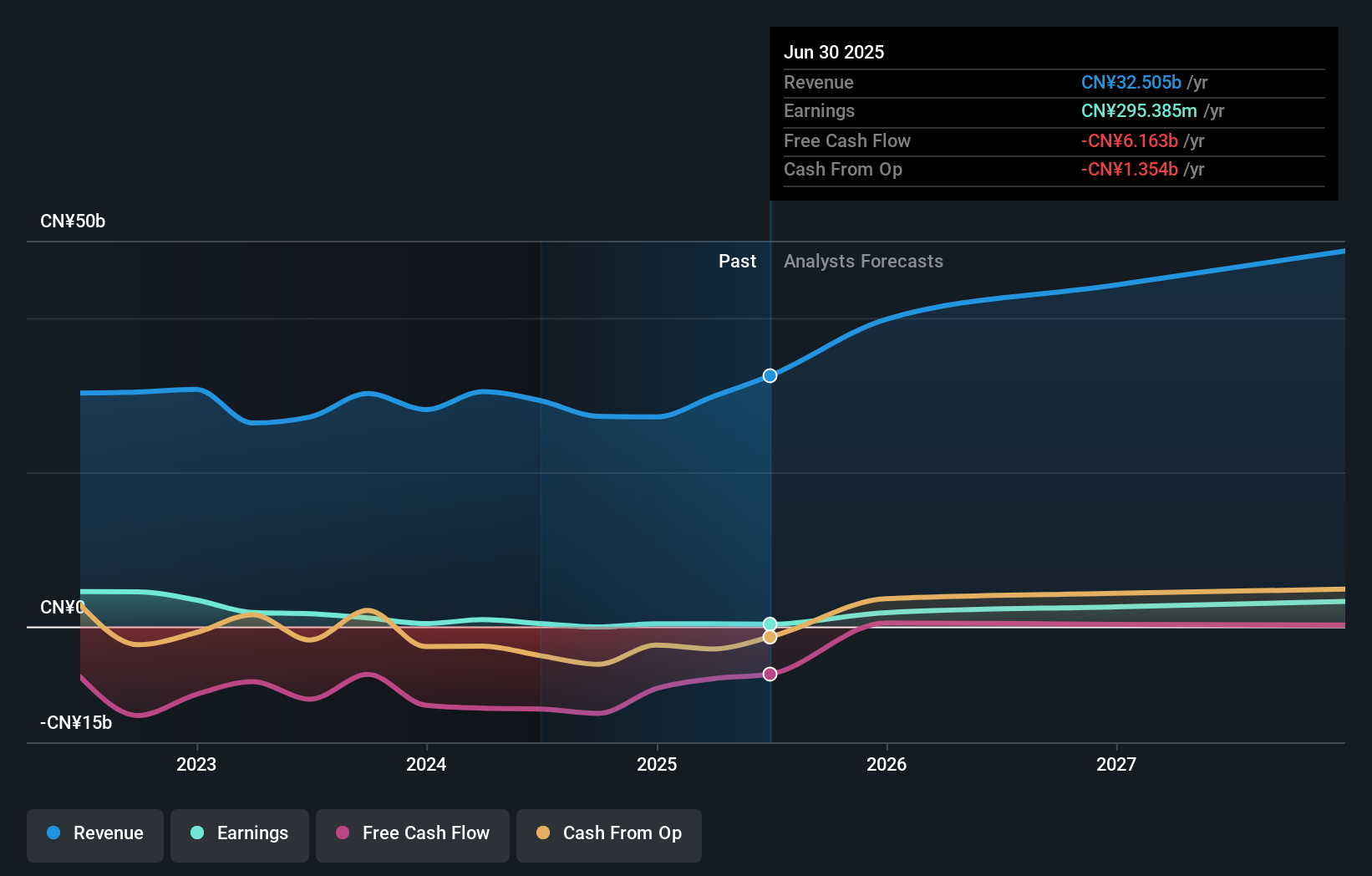

Ming Yang Smart Energy Group (SHSE:601615)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ming Yang Smart Energy Group Limited is involved in the R&D, design, manufacture, sale, maintenance, and operation of energy equipment and wind turbines in China with a market cap of CN¥22.54 billion.

Operations: Ming Yang Smart Energy Group Limited generates revenue through its activities in the research, design, manufacturing, sales, maintenance, and operation of energy equipment and wind turbines within China.

Insider Ownership: 15.7%

Earnings Growth Forecast: 79.2% p.a.

Ming Yang Smart Energy Group is positioned for substantial growth, with revenue expected to increase by 22.2% annually, outpacing the Chinese market average. Despite a low forecasted return on equity of 9.7%, its earnings are anticipated to grow significantly at 79.17% per year, moving towards profitability within three years. Recent executive changes include the appointment of Mr. Fang Meng as CFO, potentially influencing financial strategy and operational efficiency moving forward.

- Dive into the specifics of Ming Yang Smart Energy Group here with our thorough growth forecast report.

- Our expertly prepared valuation report Ming Yang Smart Energy Group implies its share price may be lower than expected.

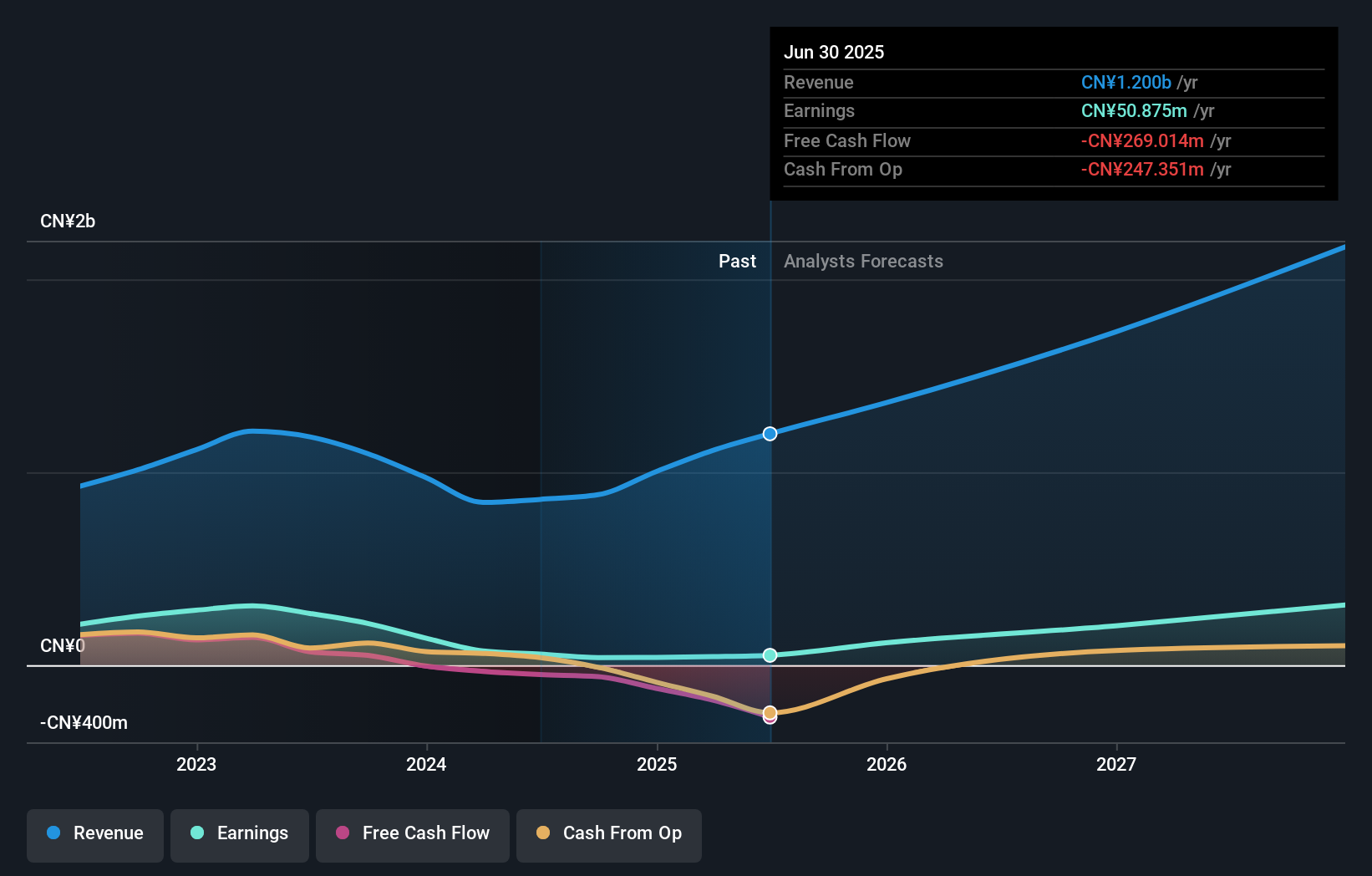

Suzhou Oriental Semiconductor (SHSE:688261)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Oriental Semiconductor Company Limited is a semiconductor technology company based in China with a market cap of CN¥4.82 billion.

Operations: The company generates revenue from its semiconductor segment, amounting to CN¥883.40 million.

Insider Ownership: 25.7%

Earnings Growth Forecast: 61.3% p.a.

Suzhou Oriental Semiconductor is poised for strong growth, with earnings projected to rise by 61.31% annually, surpassing the Chinese market's average growth rate. Revenue is also expected to grow at a robust 22.7% per year. However, challenges include a declining profit margin from last year's 19.7% to the current 4.4%, and a low forecasted return on equity of 6.2%. Recent events include an upcoming shareholders meeting in December 2024.

- Get an in-depth perspective on Suzhou Oriental Semiconductor's performance by reading our analyst estimates report here.

- The analysis detailed in our Suzhou Oriental Semiconductor valuation report hints at an inflated share price compared to its estimated value.

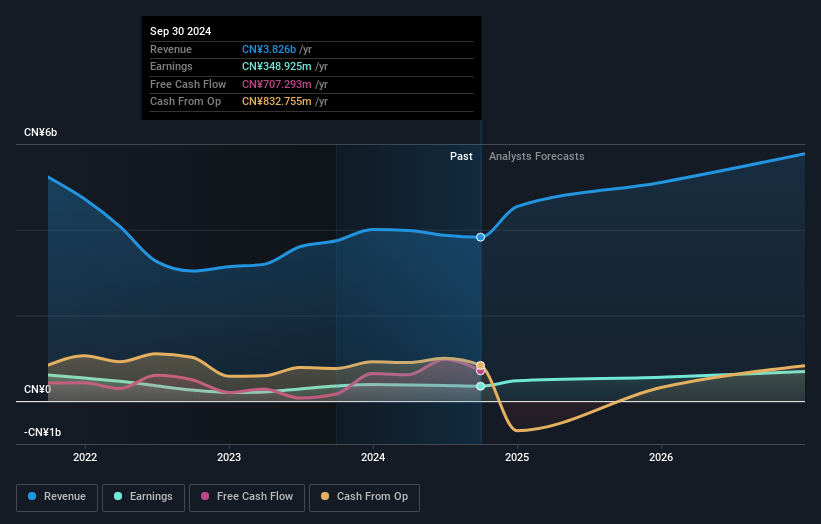

Tianrun Industry Technology (SZSE:002283)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tianrun Industry Technology Co., Ltd. manufactures and sells internal combustion engine crankshafts in China and internationally, with a market cap of CN¥6.31 billion.

Operations: Tianrun Industry Technology generates revenue primarily from the manufacturing and sale of internal combustion engine crankshafts both domestically and internationally.

Insider Ownership: 23.7%

Earnings Growth Forecast: 26.2% p.a.

Tianrun Industry Technology is experiencing strong earnings growth, forecasted at 26.2% annually, outpacing the Chinese market average. Despite a lower return on equity forecast of 9.4%, it trades at a favorable P/E ratio of 18.8x compared to the CN market's 34.9x, indicating good relative value. The company completed a share buyback program, repurchasing shares worth CNY 70.91 million by December 2024, reflecting confidence in its growth trajectory despite an unstable dividend history.

- Click here to discover the nuances of Tianrun Industry Technology with our detailed analytical future growth report.

- Our valuation report unveils the possibility Tianrun Industry Technology's shares may be trading at a discount.

Where To Now?

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1479 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601615

Ming Yang Smart Energy Group

Engages in the research and development, design, manufacture, sale, maintenance, and operation of energy equipment, wind turbines, and core components in China.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives