- China

- /

- Semiconductors

- /

- SHSE:688216

Benign Growth For China Chippacking Technology Co.,Ltd. (SHSE:688216) Underpins Stock's 25% Plummet

Unfortunately for some shareholders, the China Chippacking Technology Co.,Ltd. (SHSE:688216) share price has dived 25% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 45% in that time.

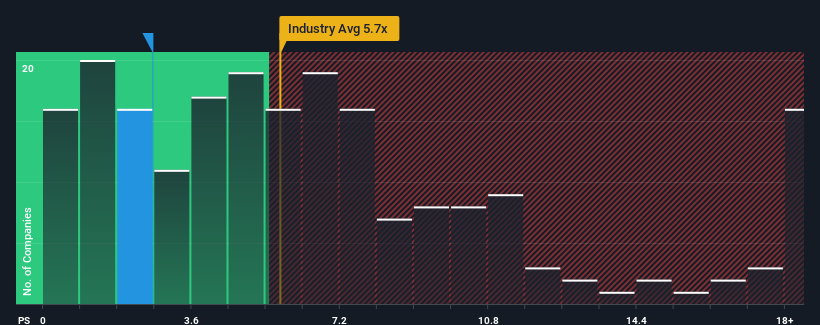

Since its price has dipped substantially, China Chippacking TechnologyLtd's price-to-sales (or "P/S") ratio of 2.7x might make it look like a strong buy right now compared to the wider Semiconductor industry in China, where around half of the companies have P/S ratios above 5.7x and even P/S above 9x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for China Chippacking TechnologyLtd

What Does China Chippacking TechnologyLtd's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, China Chippacking TechnologyLtd has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think China Chippacking TechnologyLtd's future stacks up against the industry? In that case, our free report is a great place to start.How Is China Chippacking TechnologyLtd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as China Chippacking TechnologyLtd's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 2.6% last year. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 29% over the next year. Meanwhile, the rest of the industry is forecast to expand by 34%, which is noticeably more attractive.

With this information, we can see why China Chippacking TechnologyLtd is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Shares in China Chippacking TechnologyLtd have plummeted and its P/S has followed suit. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of China Chippacking TechnologyLtd's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Having said that, be aware China Chippacking TechnologyLtd is showing 2 warning signs in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688216

China Chippacking TechnologyLtd

Engages in the integrated circuit packaging and testing business in China.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives