Global Growth Companies With High Insider Ownership Expecting Up To 36% Revenue Growth

Reviewed by Simply Wall St

In a period marked by economic uncertainty and fluctuating market sentiments, global indices have experienced notable declines, with U.S. stocks particularly weighed down by tariff concerns and recession fears. Despite these challenges, inflation data has offered some relief, providing a complex backdrop for investors seeking opportunities in growth sectors. In such an environment, companies with high insider ownership can be appealing as they often indicate strong confidence from those who know the business best. This article explores three global growth companies that not only boast significant insider stakes but are also anticipating robust revenue growth of up to 36%, presenting intriguing prospects for investors focused on long-term potential.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| Pharma Mar (BME:PHM) | 11.8% | 40.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 45.7% |

| Vow (OB:VOW) | 13.1% | 120.9% |

| CD Projekt (WSE:CDR) | 29.7% | 39.1% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Nordic Halibut (OB:NOHAL) | 29.8% | 56.3% |

| Fulin Precision (SZSE:300432) | 13.6% | 78.6% |

| Ascentage Pharma Group International (SEHK:6855) | 17.9% | 60.9% |

| Synspective (TSE:290A) | 13.2% | 37.4% |

Let's uncover some gems from our specialized screener.

Smartsens Technology (Shanghai) (SHSE:688213)

Simply Wall St Growth Rating: ★★★★★★

Overview: Smartsens Technology (Shanghai) Co., Ltd. operates in the semiconductor industry, focusing on the design and development of CMOS image sensors, with a market cap of CN¥41.74 billion.

Operations: The company generates revenue primarily from its Semiconductor Integrated Circuit Chips segment, amounting to CN¥5.97 billion.

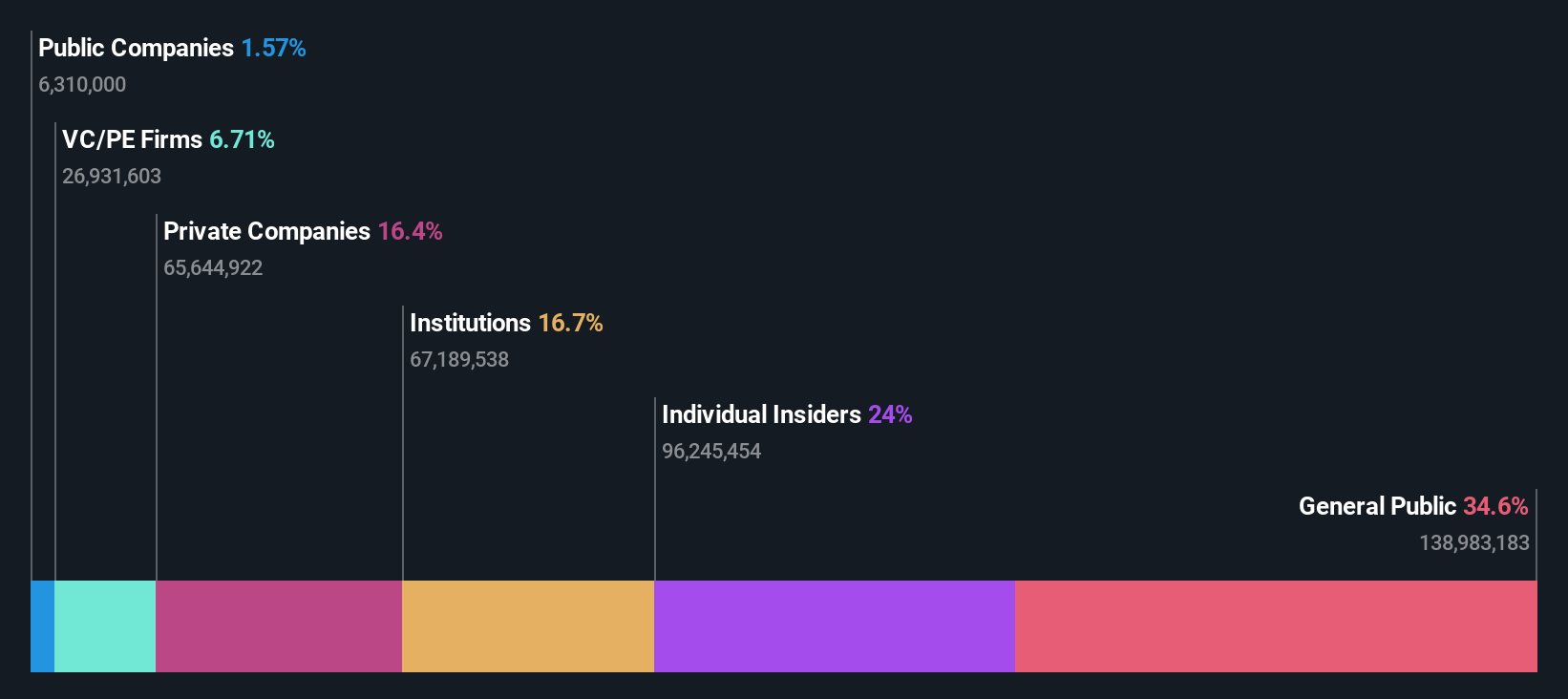

Insider Ownership: 24.3%

Revenue Growth Forecast: 26.3% p.a.

Smartsens Technology (Shanghai) demonstrated robust growth, with earnings surging from CNY 14.22 million to CNY 391.18 million in 2024, and revenue nearly doubling to CNY 5.97 billion. The company's earnings are forecasted to grow significantly at 52.1% annually, outpacing the CN market's growth rate of 25%. Despite a volatile share price recently and debt coverage concerns, Smartsens benefits from high insider ownership and strong projected revenue growth of 26.3% per year.

- Delve into the full analysis future growth report here for a deeper understanding of Smartsens Technology (Shanghai).

- Insights from our recent valuation report point to the potential overvaluation of Smartsens Technology (Shanghai) shares in the market.

Shanghai Suochen Information TechnologyLtd (SHSE:688507)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Suochen Information Technology Ltd, with a market cap of CN¥8.48 billion, operates in the technology sector providing information technology solutions.

Operations: Revenue segments for the company are not provided in the text.

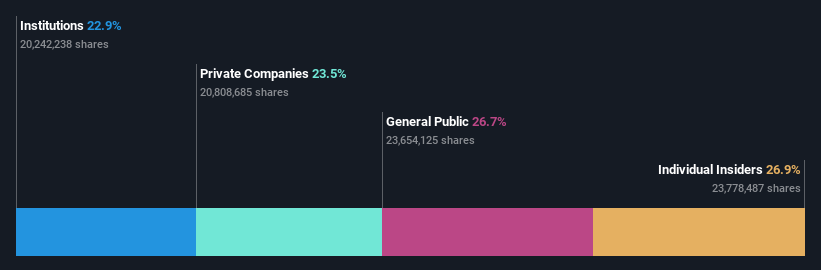

Insider Ownership: 26.9%

Revenue Growth Forecast: 36.2% p.a.

Shanghai Suochen Information Technology is experiencing significant growth, with earnings expected to increase 55.1% annually, surpassing the CN market's growth rate of 25%. Despite a decline in net income from CNY 57.48 million to CNY 41.57 million in 2024 and volatile share prices, the company anticipates robust revenue expansion at 36.2% per year. Recent buybacks totaling CNY 50.5 million highlight management's confidence, though profit margins have decreased from last year's levels.

- Take a closer look at Shanghai Suochen Information TechnologyLtd's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Shanghai Suochen Information TechnologyLtd is priced higher than what may be justified by its financials.

Estun Automation (SZSE:002747)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Estun Automation Co., Ltd. is involved in the research, development, production, and sale of intelligent equipment and its control and functional components in China with a market cap of CN¥20.69 billion.

Operations: The company's revenue is primarily derived from its Instrument and Meter Manufacturing segment, which generated CN¥4.79 billion.

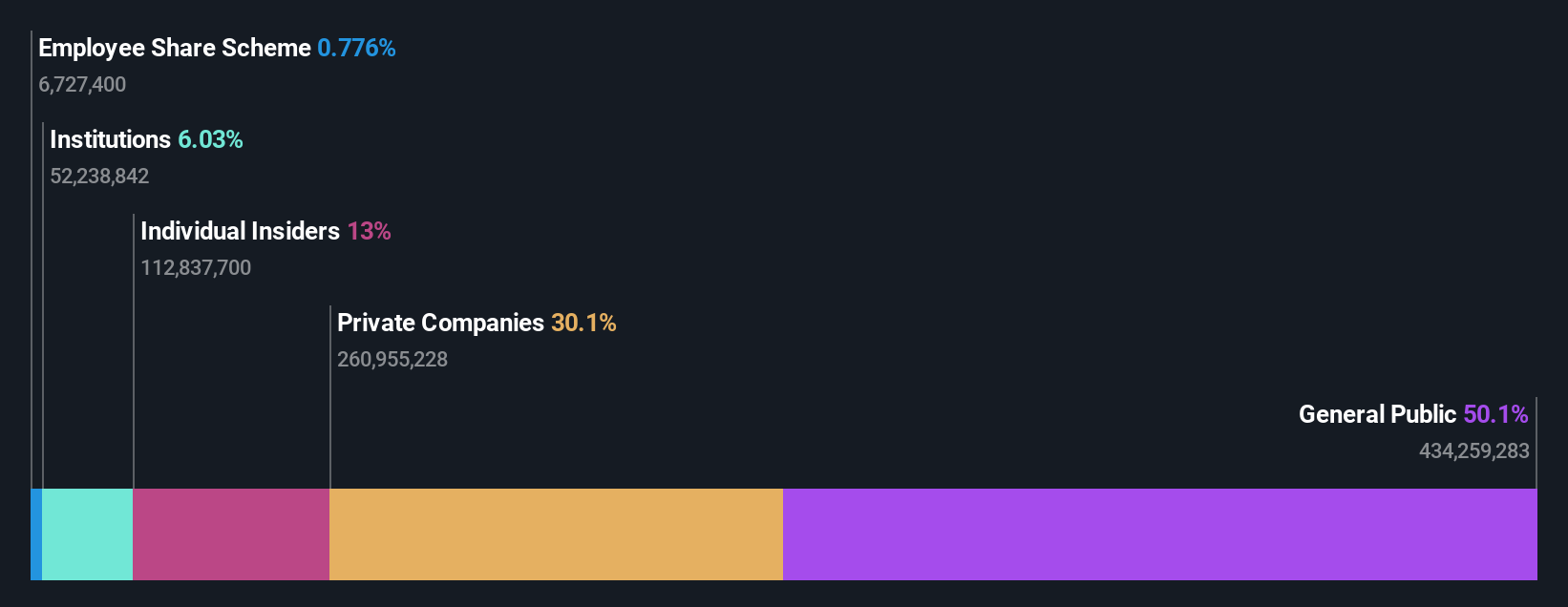

Insider Ownership: 13%

Revenue Growth Forecast: 13% p.a.

Estun Automation is projected to achieve profitability within three years, with earnings expected to grow 62.22% annually, outpacing the CN market's growth. However, its revenue growth of 13% per year is slower than desired for high-growth companies and interest payments are not well covered by earnings. The upcoming extraordinary shareholders meeting in January 2025 will address potential changes in capital structure and share repurchase plans, reflecting strategic shifts amidst volatile share prices.

- Click to explore a detailed breakdown of our findings in Estun Automation's earnings growth report.

- Our valuation report unveils the possibility Estun Automation's shares may be trading at a premium.

Taking Advantage

- Investigate our full lineup of 891 Fast Growing Global Companies With High Insider Ownership right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688507

Shanghai Suochen Information TechnologyLtd

Shanghai Suochen Information Technology Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives