- China

- /

- Semiconductors

- /

- SHSE:688172

Beijing YanDong MicroElectronic Co., Ltd.'s (SHSE:688172) 46% Share Price Surge Not Quite Adding Up

Despite an already strong run, Beijing YanDong MicroElectronic Co., Ltd. (SHSE:688172) shares have been powering on, with a gain of 46% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 28% in the last year.

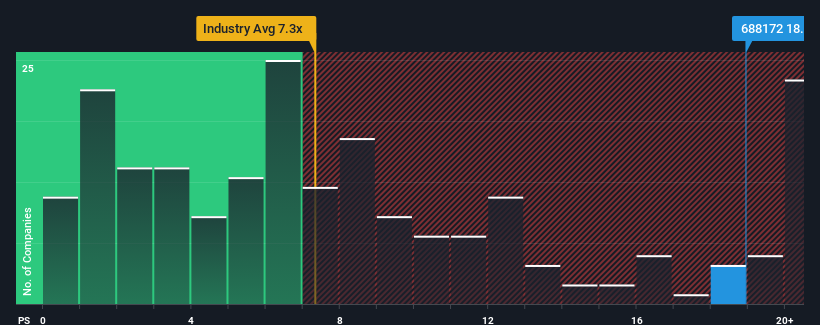

Since its price has surged higher, Beijing YanDong MicroElectronic may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 18.9x, when you consider almost half of the companies in the Semiconductor industry in China have P/S ratios under 7.3x and even P/S lower than 3x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Beijing YanDong MicroElectronic

What Does Beijing YanDong MicroElectronic's Recent Performance Look Like?

For instance, Beijing YanDong MicroElectronic's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Beijing YanDong MicroElectronic, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Beijing YanDong MicroElectronic's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Beijing YanDong MicroElectronic's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 22% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 43% shows it's an unpleasant look.

In light of this, it's alarming that Beijing YanDong MicroElectronic's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Final Word

Beijing YanDong MicroElectronic's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Beijing YanDong MicroElectronic currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Beijing YanDong MicroElectronic, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Beijing YanDong MicroElectronic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688172

Beijing YanDong MicroElectronic

Beijing YanDong MicroElectronic Co., Ltd.

Adequate balance sheet minimal.

Market Insights

Community Narratives