- China

- /

- Semiconductors

- /

- SHSE:688167

February 2025 Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets navigate uncertainties surrounding tariffs and mixed economic indicators, investors are closely watching the impact on indices such as the S&P 500, which saw a slight decline amid these developments. Despite these challenges, growth companies with high insider ownership often attract attention due to their potential resilience and alignment of interests between management and shareholders. In this environment, stocks with strong insider ownership can offer a compelling proposition for those seeking growth opportunities while navigating market volatility.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.9% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.1% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 111.4% |

Underneath we present a selection of stocks filtered out by our screen.

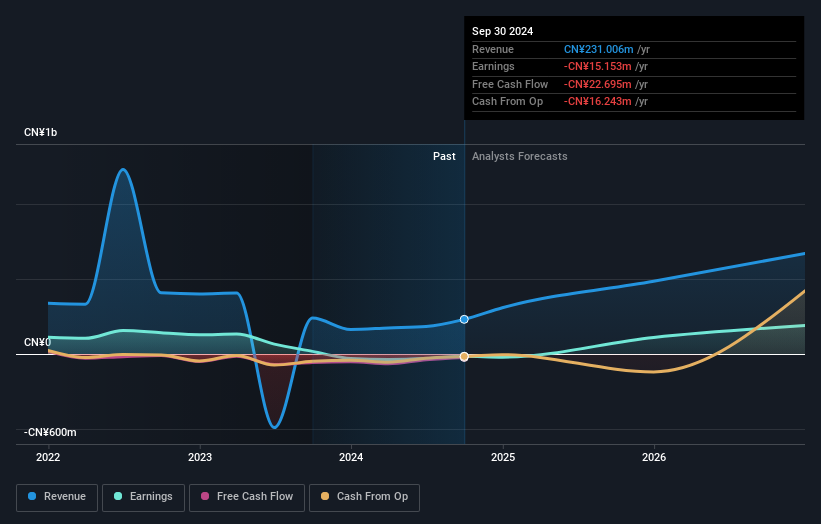

Hunan Kylinsec Technology (SHSE:688152)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hunan Kylinsec Technology Co., Ltd. supplies software products and has a market cap of approximately CN¥4.99 billion.

Operations: The company generates revenue from its software products.

Insider Ownership: 38.3%

Earnings Growth Forecast: 117% p.a.

Hunan Kylinsec Technology is expected to experience significant growth, with revenue projected to increase by 44.9% annually, outpacing the Chinese market average of 13.6%. Despite being dropped from the S&P Global BMI Index in December 2024, it aims for profitability within three years. However, its forecasted Return on Equity remains low at 11.2%. No substantial insider trading activity has been reported recently, which may indicate stable insider confidence in its growth trajectory.

- Click here to discover the nuances of Hunan Kylinsec Technology with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Hunan Kylinsec Technology's current price could be inflated.

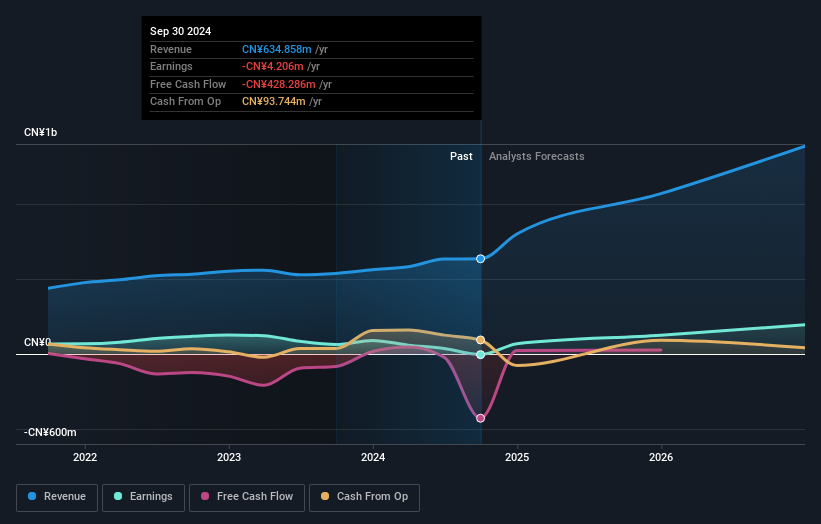

Focuslight Technologies (SHSE:688167)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Focuslight Technologies Inc. is involved in the research, development, production, and sale of semiconductor laser components and laser optics components both in China and internationally, with a market cap of CN¥6.58 billion.

Operations: Focuslight Technologies Inc.'s revenue is primarily derived from its semiconductor laser components and laser optics components businesses, serving both domestic and international markets.

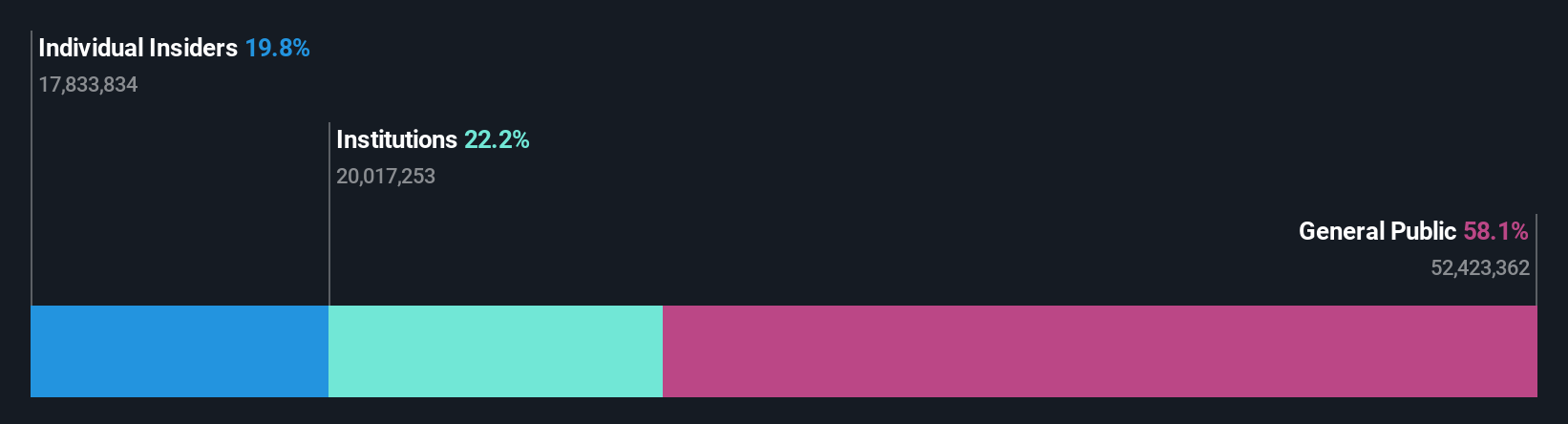

Insider Ownership: 20.4%

Earnings Growth Forecast: 85.4% p.a.

Focuslight Technologies is poised for robust growth, with revenue expected to rise by 32.8% annually, surpassing the Chinese market's average. Analysts anticipate profitability within three years, marking above-average market growth. Earnings are projected to expand at an impressive rate of 85.39% per year, though Return on Equity is forecasted to remain low at 6.4%. Recent investor communications focus on M&A integration progress; no significant insider trading activity has been reported recently.

- Click here and access our complete growth analysis report to understand the dynamics of Focuslight Technologies.

- The analysis detailed in our Focuslight Technologies valuation report hints at an inflated share price compared to its estimated value.

Auras Technology (TPEX:3324)

Simply Wall St Growth Rating: ★★★★★★

Overview: Auras Technology Co., Ltd. is involved in the manufacturing, processing, and retailing of electronic materials and computer cooling modules across China, Taiwan, Ireland, Singapore, the United States, and other international markets with a market cap of NT$52.98 billion.

Operations: The company generates revenue of NT$14.99 billion from its electronic components and parts segment.

Insider Ownership: 19.7%

Earnings Growth Forecast: 42% p.a.

Auras Technology is positioned for significant growth, with revenue expected to increase by 28.5% annually, outpacing the Taiwanese market. Earnings are projected to grow at a notable rate of 42.04% per year, indicating strong potential despite recent share price volatility. The company recently announced a private placement of corporate bonds worth TWD 2.37 billion, highlighting its capital-raising efforts amidst high-quality earnings and undervaluation relative to fair value estimates.

- Dive into the specifics of Auras Technology here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Auras Technology is trading behind its estimated value.

Where To Now?

- Navigate through the entire inventory of 1439 Fast Growing Companies With High Insider Ownership here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688167

Focuslight Technologies

Engages in the research and development, production, and sale of semiconductor laser components and laser optics components in China and internationally.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives