- China

- /

- Semiconductors

- /

- SHSE:688141

JoulWatt Technology Co., Ltd. (SHSE:688141) Stock's 30% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Unfortunately for some shareholders, the JoulWatt Technology Co., Ltd. (SHSE:688141) share price has dived 30% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 75% share price decline.

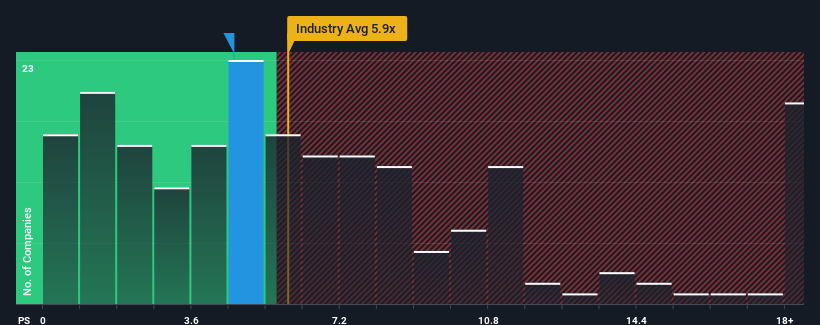

Since its price has dipped substantially, JoulWatt Technology's price-to-sales (or "P/S") ratio of 4.6x might make it look like a buy right now compared to the Semiconductor industry in China, where around half of the companies have P/S ratios above 5.9x and even P/S above 10x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for JoulWatt Technology

What Does JoulWatt Technology's Recent Performance Look Like?

While the industry has experienced revenue growth lately, JoulWatt Technology's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on JoulWatt Technology.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like JoulWatt Technology's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 8.0% decrease to the company's top line. Still, the latest three year period has seen an excellent 227% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 52% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 34% growth forecast for the broader industry.

With this in consideration, we find it intriguing that JoulWatt Technology's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

JoulWatt Technology's recently weak share price has pulled its P/S back below other Semiconductor companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To us, it seems JoulWatt Technology currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It is also worth noting that we have found 1 warning sign for JoulWatt Technology that you need to take into consideration.

If these risks are making you reconsider your opinion on JoulWatt Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688141

JoulWatt Technology

An analog integrated circuit design company, engages in the research and development, and sale of integrated circuits in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives