- China

- /

- Semiconductors

- /

- SHSE:688126

What National Silicon Industry Group Co.,Ltd.'s (SHSE:688126) 34% Share Price Gain Is Not Telling You

National Silicon Industry Group Co.,Ltd. (SHSE:688126) shareholders have had their patience rewarded with a 34% share price jump in the last month. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.0% in the last twelve months.

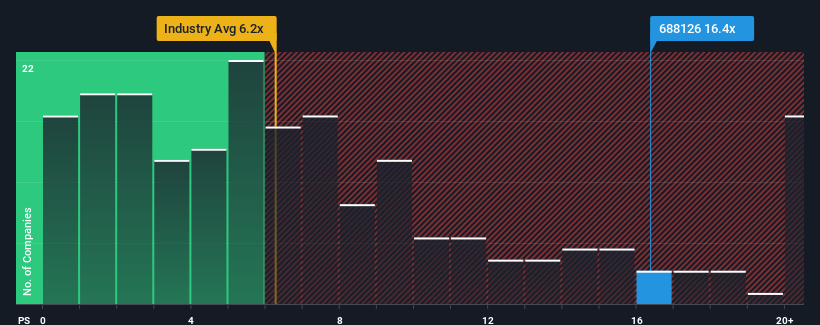

Following the firm bounce in price, National Silicon Industry GroupLtd may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 16.4x, since almost half of all companies in the Semiconductor industry in China have P/S ratios under 6.2x and even P/S lower than 3x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for National Silicon Industry GroupLtd

How National Silicon Industry GroupLtd Has Been Performing

National Silicon Industry GroupLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on National Silicon Industry GroupLtd.Is There Enough Revenue Growth Forecasted For National Silicon Industry GroupLtd?

In order to justify its P/S ratio, National Silicon Industry GroupLtd would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 9.7%. Even so, admirably revenue has lifted 53% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 24% per annum during the coming three years according to the seven analysts following the company. With the industry predicted to deliver 40% growth each year, the company is positioned for a weaker revenue result.

With this information, we find it concerning that National Silicon Industry GroupLtd is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does National Silicon Industry GroupLtd's P/S Mean For Investors?

The strong share price surge has lead to National Silicon Industry GroupLtd's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've concluded that National Silicon Industry GroupLtd currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for National Silicon Industry GroupLtd with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade National Silicon Industry GroupLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if National Silicon Industry GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688126

National Silicon Industry GroupLtd

Engages in the research and development, production, and sales of semiconductor silicon wafers.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives