As global markets edge towards record highs, driven by a robust performance in U.S. stock indexes and optimism in European and Asian markets, investors are keenly focused on inflation trends and interest rate expectations. In this climate of economic uncertainty, identifying undervalued stocks—those trading below their intrinsic value—can offer potential opportunities for investors looking to capitalize on market fluctuations while maintaining a cautious approach to risk management.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hancom (KOSDAQ:A030520) | ₩24650.00 | ₩49085.96 | 49.8% |

| Alarum Technologies (TASE:ALAR) | ₪3.297 | ₪6.55 | 49.7% |

| Insyde Software (TPEX:6231) | NT$422.00 | NT$843.52 | 50% |

| Nuvoton Technology (TWSE:4919) | NT$96.10 | NT$191.31 | 49.8% |

| Elin Electronics (NSEI:ELIN) | ₹127.89 | ₹255.04 | 49.9% |

| Saigon Thuong Tin Commercial Bank (HOSE:STB) | ₫38300.00 | ₫76325.14 | 49.8% |

| IDP Education (ASX:IEL) | A$12.12 | A$24.11 | 49.7% |

| Solum (KOSE:A248070) | ₩17580.00 | ₩34896.79 | 49.6% |

| Com2uS (KOSDAQ:A078340) | ₩48200.00 | ₩96034.13 | 49.8% |

| Array Technologies (NasdaqGM:ARRY) | US$6.79 | US$13.53 | 49.8% |

Let's review some notable picks from our screened stocks.

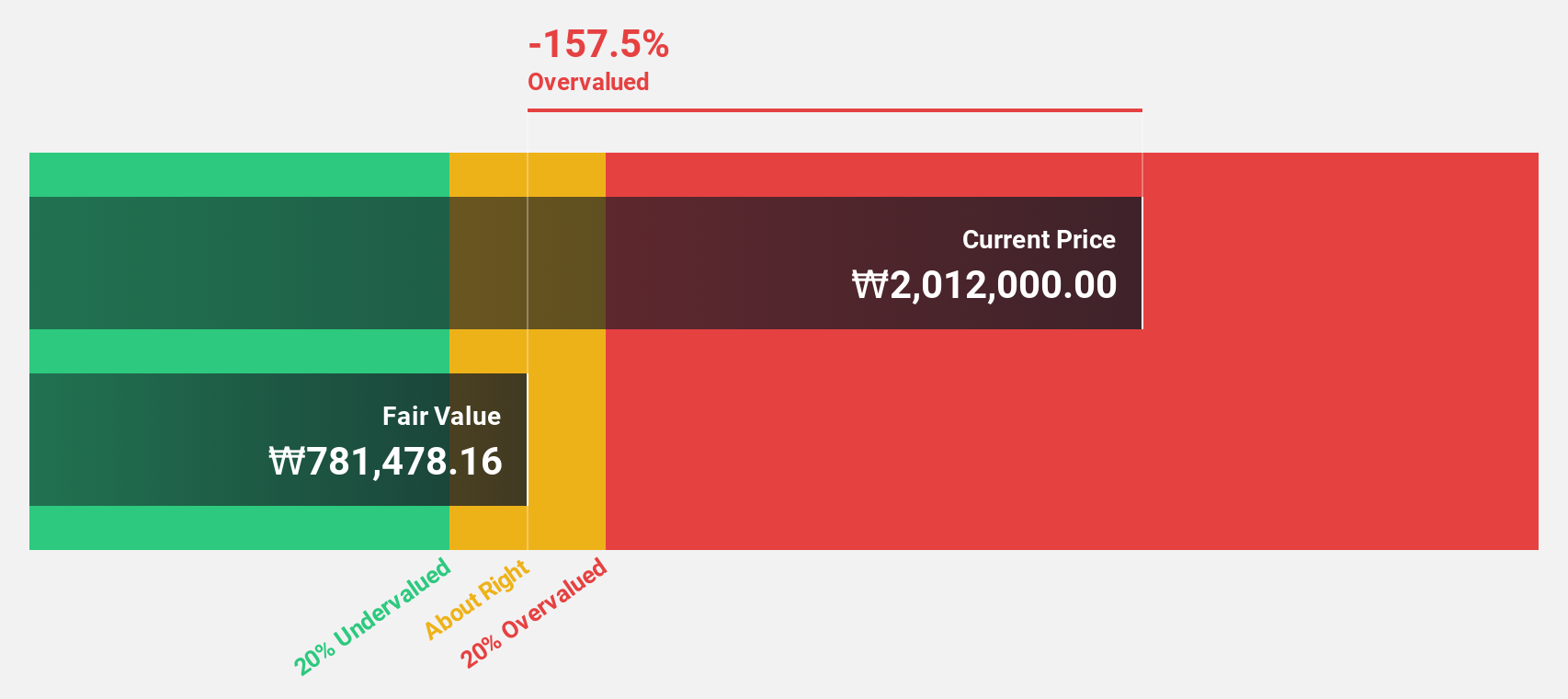

Hyosung Heavy Industries (KOSE:A298040)

Overview: Hyosung Heavy Industries Corporation manufactures and sells heavy electrical equipment both in South Korea and internationally, with a market cap of ₩4.51 trillion.

Operations: The company's revenue segments include Heavy Industry at ₩3.47 trillion and Construction at ₩1.76 trillion.

Estimated Discount To Fair Value: 42.1%

Hyosung Heavy Industries is trading at ₩504,000, significantly below its estimated fair value of ₩869,798.46. The company's earnings are expected to grow by 43% annually over the next three years, outpacing the Korean market's growth rate of 25.9%. Despite high volatility in recent months and concerns about debt coverage by operating cash flow, its inclusion in the KOSPI 200 Index highlights its market relevance.

- Our growth report here indicates Hyosung Heavy Industries may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Hyosung Heavy Industries.

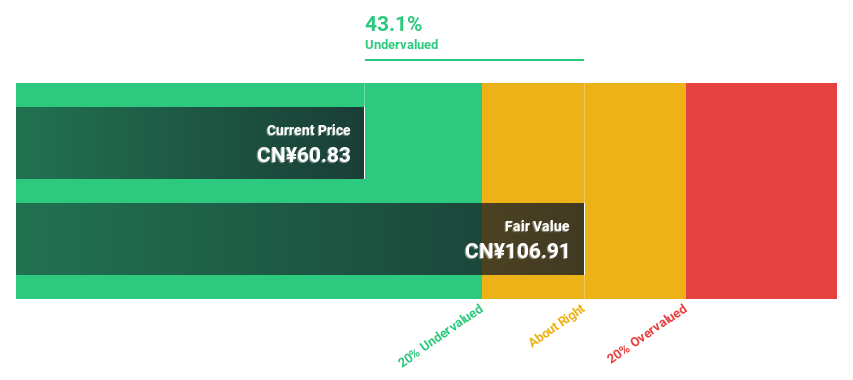

Bide Pharmatech (SHSE:688073)

Overview: Bide Pharmatech Co., Ltd. is involved in the research, development, production, and sale of pharmaceutical products in China with a market cap of CN¥4.86 billion.

Operations: The company generates revenue of CN¥1.10 billion from its Research and Experimental Development Industry segment.

Estimated Discount To Fair Value: 48.7%

Bide Pharmatech is trading at CN¥54.85, significantly below its estimated fair value of CN¥106.91, indicating potential undervaluation based on cash flows. Despite a recent decline in profit margins from 15.4% to 7.3%, earnings are forecasted to grow significantly at 28.1% annually, outpacing the Chinese market's growth rate of 25.2%. Recent announcements include a share buyback program worth up to CN¥100 million, aimed at enhancing employee incentives and promoting long-term development.

- The analysis detailed in our Bide Pharmatech growth report hints at robust future financial performance.

- Click here to discover the nuances of Bide Pharmatech with our detailed financial health report.

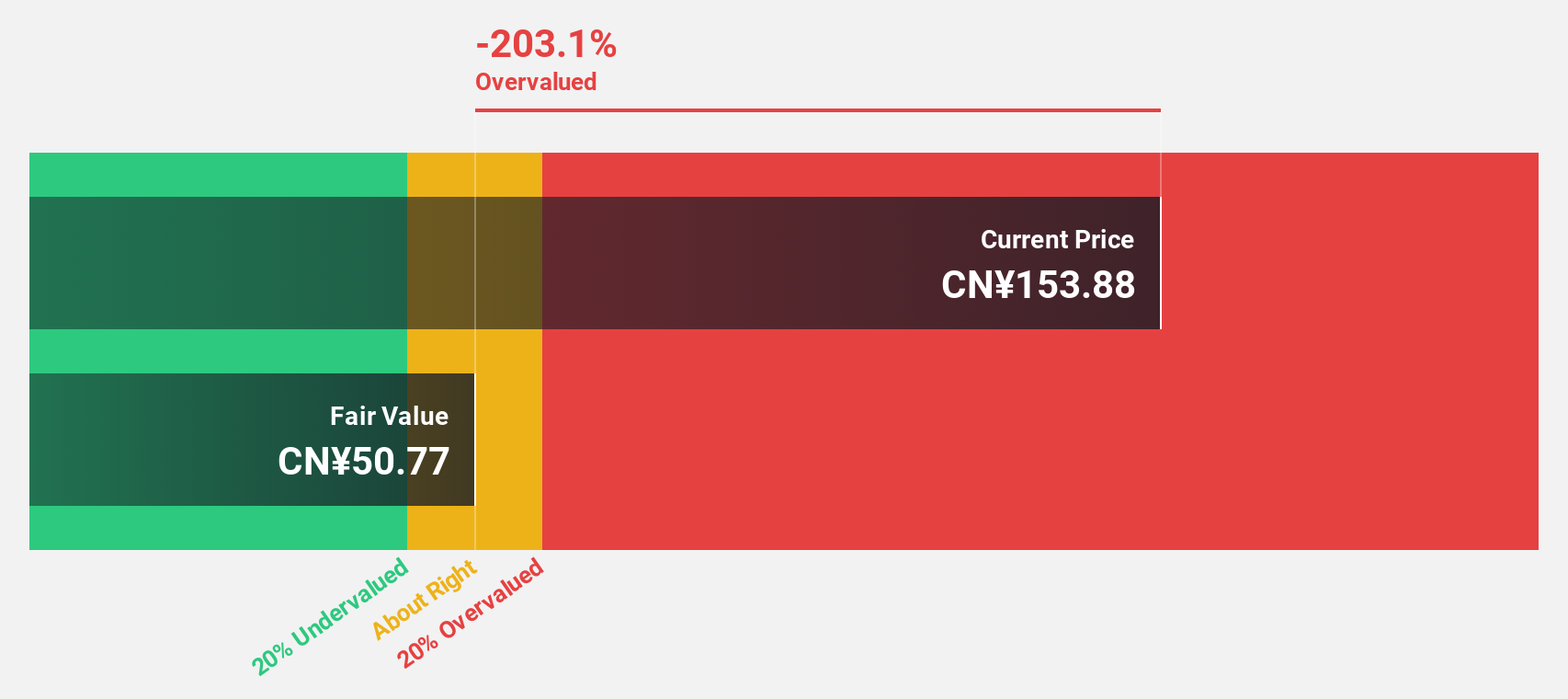

Hwatsing Technology (SHSE:688120)

Overview: Hwatsing Technology Co., Ltd. manufactures semiconductor equipment products in China and has a market cap of CN¥37.77 billion.

Operations: The company's revenue primarily comes from its Semiconductor Equipment and Services segment, which generated CN¥3.12 billion.

Estimated Discount To Fair Value: 25%

Hwatsing Technology is trading at CN¥169.2, below its estimated fair value of CN¥225.69, reflecting potential undervaluation based on cash flows. With forecasted revenue growth of 27.7% annually, it outpaces the Chinese market's 13.3% growth rate and aligns with earnings expected to rise significantly by 28.1%. Analysts anticipate a stock price increase of 27.6%. A Special Shareholders Meeting is scheduled for December 17, 2024, in Tianjin, China.

- Upon reviewing our latest growth report, Hwatsing Technology's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Hwatsing Technology's balance sheet by reading our health report here.

Summing It All Up

- Investigate our full lineup of 923 Undervalued Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bide Pharmatech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688073

Bide Pharmatech

Engages in the research, development, production, and sale of pharmaceutical products in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives