- China

- /

- Semiconductors

- /

- SHSE:688049

Actions Technology And 2 Promising Small Caps To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and shifting trade policies, major U.S. stock indexes are climbing toward record highs, with growth stocks notably outperforming value shares. However, small-cap stocks have lagged behind their larger counterparts, presenting a unique opportunity for investors to explore promising small-cap companies that could enhance portfolio diversification and potential returns. In this context, identifying stocks with strong fundamentals and innovative potential can be particularly advantageous in today's dynamic market environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AOKI Holdings | 27.05% | 3.74% | 52.54% | ★★★★★★ |

| NS United Kaiun Kaisha | 55.99% | 13.51% | 20.23% | ★★★★★★ |

| Shenzhen Farben Information TechnologyLtd | 7.69% | 21.56% | 3.60% | ★★★★★★ |

| AJIS | 0.78% | 2.14% | -13.06% | ★★★★★☆ |

| Eclatorq Technology | 37.47% | 8.43% | 18.41% | ★★★★★☆ |

| ASTERASYSLtd | 6.62% | 16.45% | 6.42% | ★★★★★☆ |

| Wema Bank | 45.02% | 36.14% | 60.04% | ★★★★☆☆ |

| Britam Holdings | 8.55% | -2.40% | 35.94% | ★★★★☆☆ |

| Sanstar | 9.90% | 23.18% | 36.19% | ★★★★☆☆ |

| MNtech | 65.44% | 16.96% | -17.92% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Actions Technology (SHSE:688049)

Simply Wall St Value Rating: ★★★★★★

Overview: Actions Technology Co., Ltd. is a fabless semiconductor company that designs and produces system-on-chips (SoCs) for portable multimedia products in China, with a market cap of approximately CN¥7.15 billion.

Operations: Actions Technology generates revenue primarily from its semiconductor segment, amounting to CN¥610.57 million.

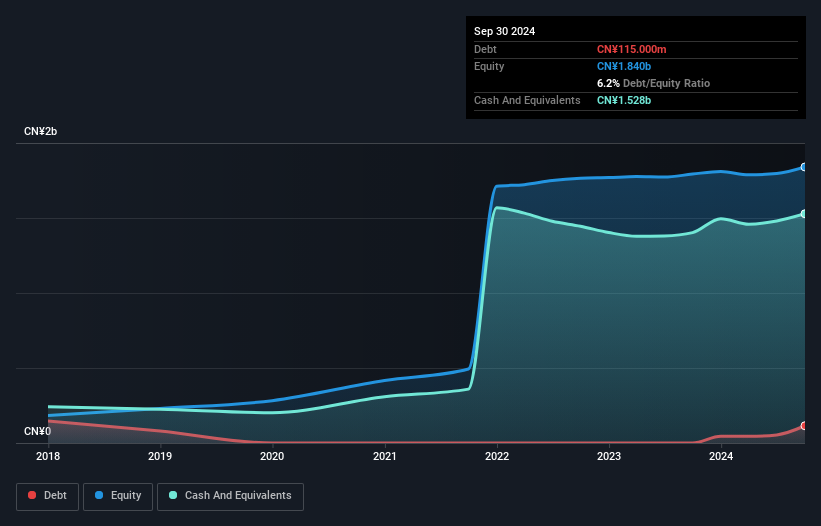

Actions Technology, a small-cap player in the semiconductor industry, has shown remarkable earnings growth of 71.2% over the past year, surpassing the industry's 12.9%. With more cash than total debt and a reduced debt-to-equity ratio from 7.5% to 6.2% over five years, financial stability seems solid despite recent volatility in its share price. A notable CN¥26M one-off gain impacted last year's results but doesn't overshadow its free cash flow positivity and interest coverage strength. Looking ahead, earnings are forecasted to grow at an annual rate of 24%, hinting at potential future value for investors seeking growth opportunities in this sector.

HangzhouS MedTech (SHSE:688581)

Simply Wall St Value Rating: ★★★★★★

Overview: Hangzhou AGS MedTech Co., Ltd. focuses on the research, development, production, sale, and service of endoscopic surgery equipment and accessories in China with a market cap of CN¥4.95 billion.

Operations: HangzhouS MedTech generates revenue primarily from the sale of endoscopic surgery equipment and accessories. The company's financials reveal a market cap of CN¥4.95 billion, indicating its significant presence in the medical device sector within China.

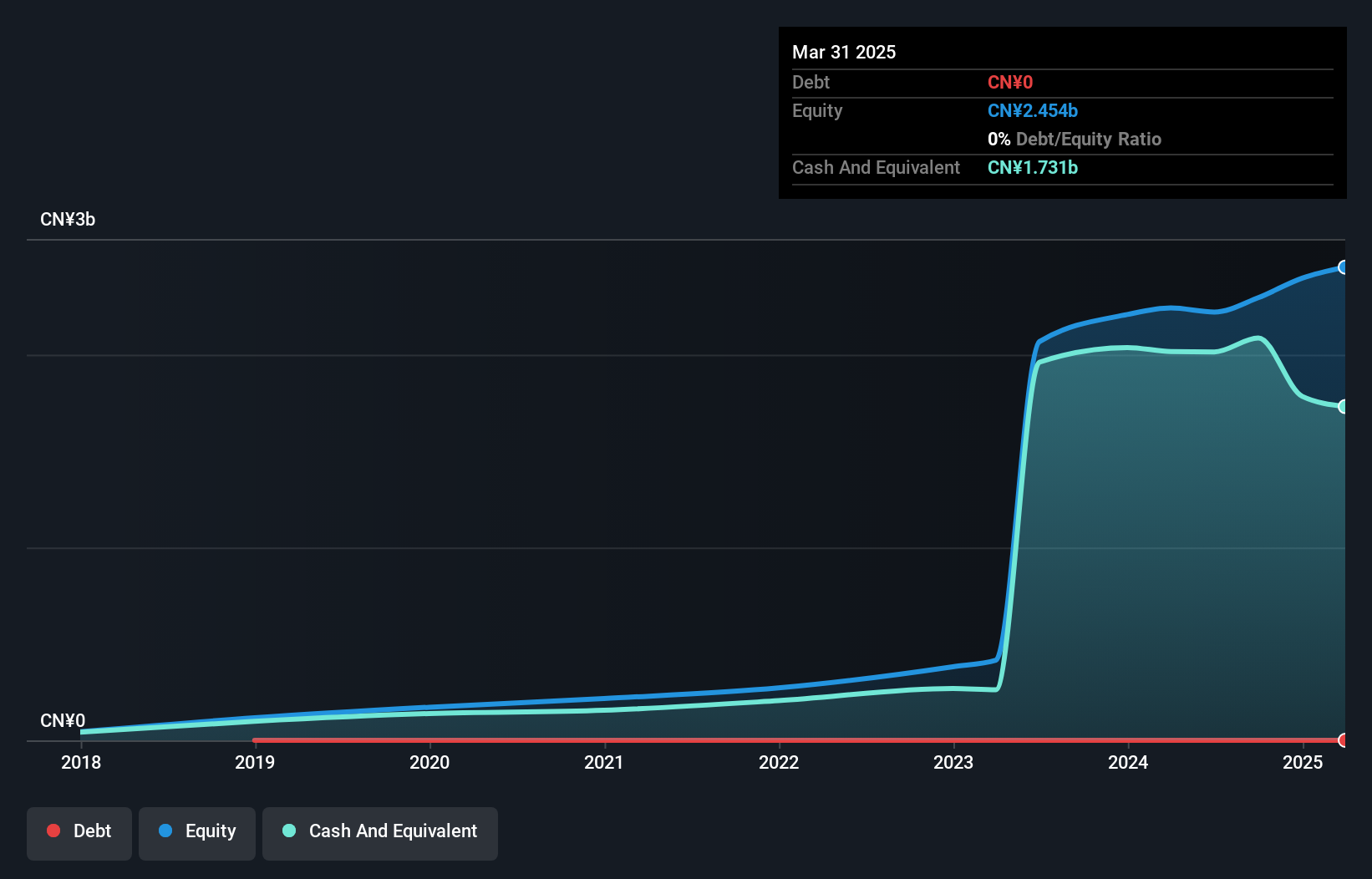

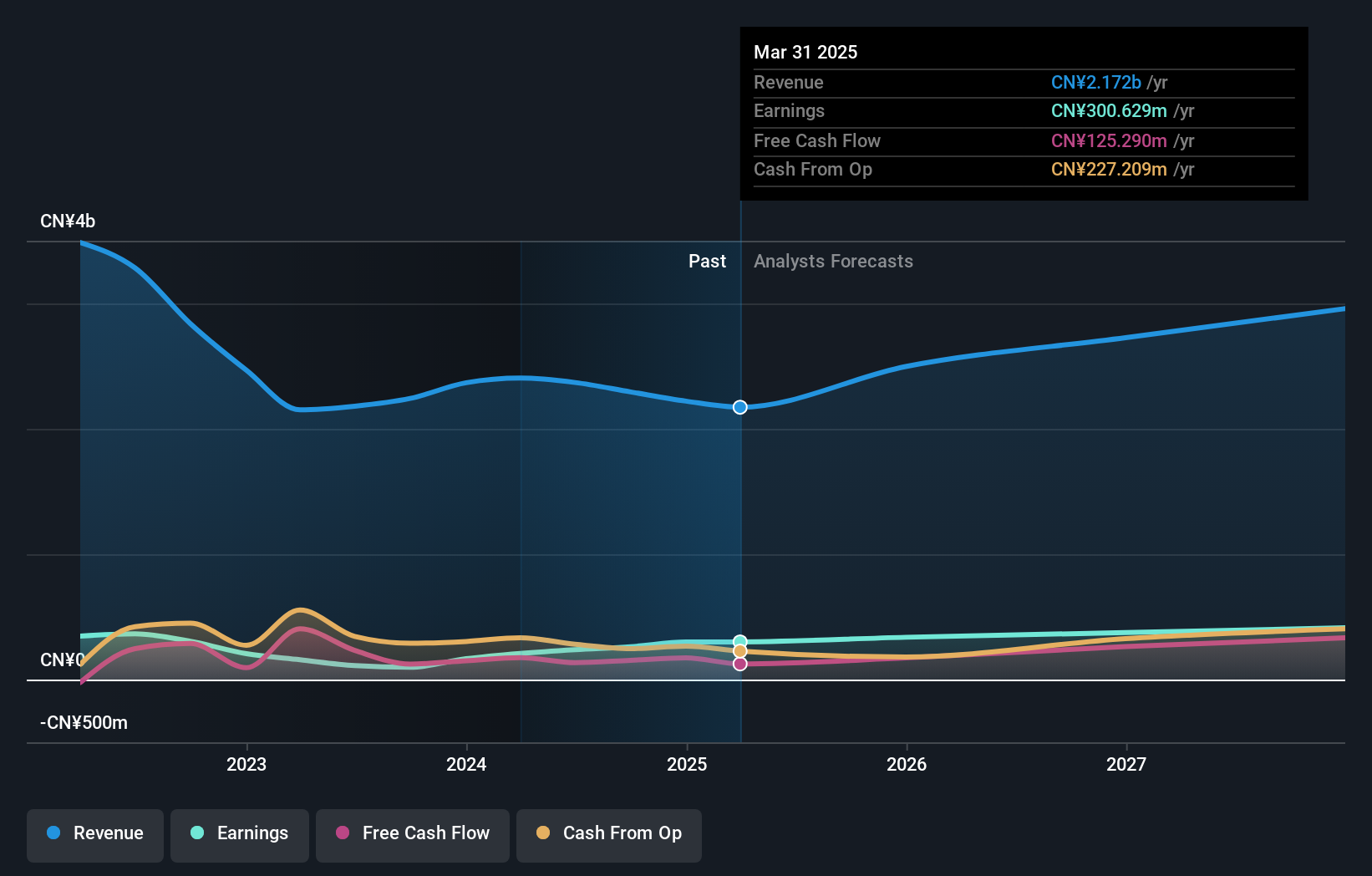

HangzhouS MedTech, a nimble player in the medical equipment sector, has shown impressive earnings growth of 44.2% over the past year, outpacing its industry peers who faced an 8.8% decline. The company trades at a value 46.5% below its estimated fair value and operates debt-free for five years, highlighting financial prudence and stability. With high-quality earnings and a strong cash runway due to profitability, it seems well-positioned for future growth with earnings forecasted to rise by 22.3% annually. Recently completing a share buyback of CNY 30.97 million indicates confidence in its market valuation strategy.

- Delve into the full analysis health report here for a deeper understanding of HangzhouS MedTech.

Gain insights into HangzhouS MedTech's past trends and performance with our Past report.

Shandong Weida Machinery (SZSE:002026)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shandong Weida Machinery Co., Ltd. is involved in the manufacture and sale of drill chucks both in China and internationally, with a market cap of CN¥4.88 billion.

Operations: The company's revenue primarily stems from the manufacture and sale of drill chucks. The net profit margin has shown fluctuations across recent periods, reflecting changes in cost structures and market conditions.

Shandong Weida Machinery is making waves with its impressive earnings growth of 167.2% over the past year, outpacing the broader machinery industry. The company's debt-to-equity ratio has risen to 15.6% over five years, yet it holds more cash than total debt, indicating a strong balance sheet position. With a price-to-earnings ratio of 18.6x, significantly lower than the CN market average of 36.5x, it appears undervalued in comparison to peers. Additionally, positive free cash flow and high-quality earnings further bolster its financial health while interest coverage remains robust ensuring stability in operations moving forward.

Seize The Opportunity

- Click through to start exploring the rest of the 4742 Undiscovered Gems With Strong Fundamentals now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688049

Actions Technology

A fabless semiconductor company, designs and produces SoCs for portable multimedia products in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives