- China

- /

- Semiconductors

- /

- SHSE:603688

Jiangsu Pacific Quartz Co., Ltd (SHSE:603688) Stock Rockets 29% As Investors Are Less Pessimistic Than Expected

Jiangsu Pacific Quartz Co., Ltd (SHSE:603688) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 45% in the last twelve months.

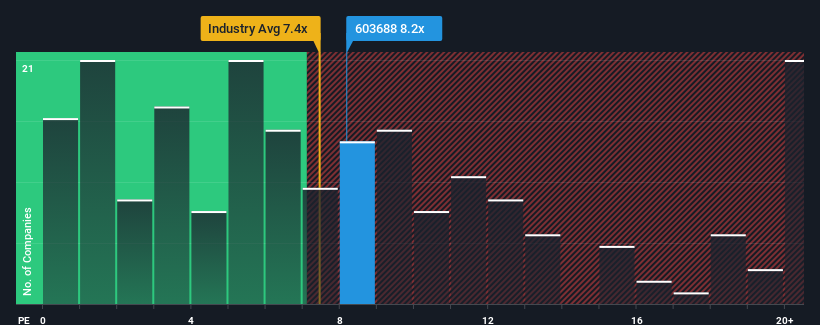

Even after such a large jump in price, it's still not a stretch to say that Jiangsu Pacific Quartz's price-to-sales (or "P/S") ratio of 8.2x right now seems quite "middle-of-the-road" compared to the Semiconductor industry in China, where the median P/S ratio is around 7.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Jiangsu Pacific Quartz

How Jiangsu Pacific Quartz Has Been Performing

Jiangsu Pacific Quartz could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Jiangsu Pacific Quartz's future stacks up against the industry? In that case, our free report is a great place to start.How Is Jiangsu Pacific Quartz's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Jiangsu Pacific Quartz's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 66%. Even so, admirably revenue has lifted 167% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 21% during the coming year according to the dual analysts following the company. With the industry predicted to deliver 45% growth, that's a disappointing outcome.

In light of this, it's somewhat alarming that Jiangsu Pacific Quartz's P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Bottom Line On Jiangsu Pacific Quartz's P/S

Jiangsu Pacific Quartz appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It appears that Jiangsu Pacific Quartz currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Before you settle on your opinion, we've discovered 1 warning sign for Jiangsu Pacific Quartz that you should be aware of.

If these risks are making you reconsider your opinion on Jiangsu Pacific Quartz, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603688

Jiangsu Pacific Quartz

Engages in the research and development, manufacture, marketing, and sale of quartz materials in China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives