- India

- /

- Diversified Financial

- /

- NSEI:PAYTM

Three Growth Companies With High Insider Ownership And Up To 60% Earnings Growth

Reviewed by Simply Wall St

As global markets continue to navigate through a landscape marked by fluctuating interest rates and mixed economic signals, investors are keenly observing trends that could influence their strategies. In such an environment, growth companies with high insider ownership can be particularly appealing, as significant insider stakes often signal confidence in the company's future prospects amidst broader market uncertainties.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Gaming Innovation Group (OB:GIG) | 26.7% | 36.9% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.7% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.7% | 52.9% |

| Vow (OB:VOW) | 31.8% | 97.6% |

| Adocia (ENXTPA:ADOC) | 12.1% | 59.8% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

Let's dive into some prime choices out of from the screener.

Cury Construtora e Incorporadora (BOVESPA:CURY3)

Simply Wall St Growth Rating: ★★★★☆☆

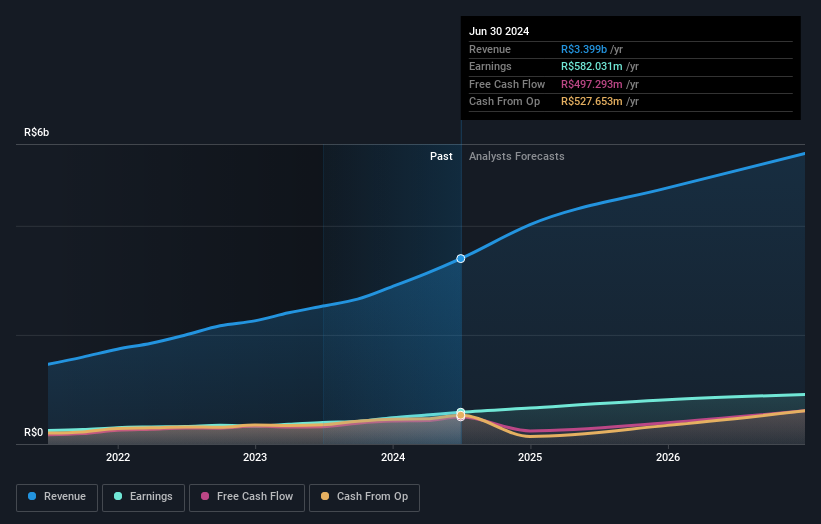

Overview: Cury Construtora e Incorporadora S.A. is a company engaged in real estate development, with a market capitalization of approximately R$6.30 billion.

Operations: The company generates its revenue primarily from real estate development, totaling R$3.13 billion.

Insider Ownership: 22%

Earnings Growth Forecast: 16.8% p.a.

Cury Construtora e Incorporadora has demonstrated robust growth, with earnings increasing by 30.1% annually over the past five years and forecasts suggesting a 16.77% yearly increase moving forward. Revenue growth is also strong at 17.1% per year, outpacing the Brazilian market's 7.1%. Despite an unstable dividend track record, recent substantial increases in net income and dividends highlight potential for continued financial health. However, it's worth noting that insider trading data over the last three months is unavailable, adding a layer of uncertainty regarding insider confidence in the company's future performance.

- Unlock comprehensive insights into our analysis of Cury Construtora e Incorporadora stock in this growth report.

- According our valuation report, there's an indication that Cury Construtora e Incorporadora's share price might be on the expensive side.

One97 Communications (NSEI:PAYTM)

Simply Wall St Growth Rating: ★★★★☆☆

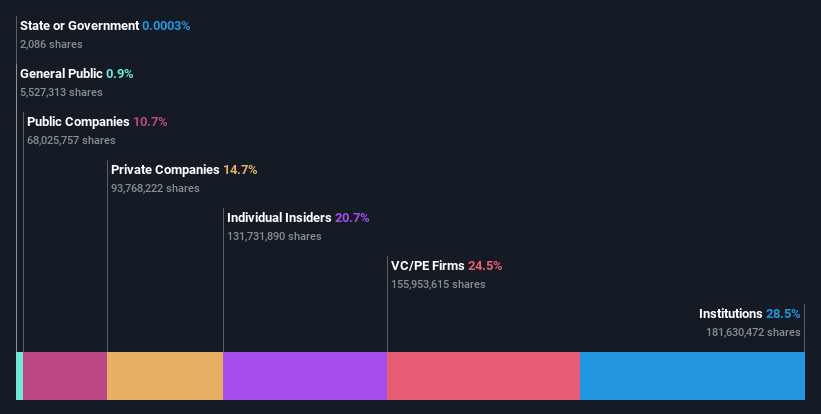

Overview: One97 Communications Limited, operating under the brand name Paytm, offers payment, commerce and cloud, and financial services in India with a market capitalization of approximately ₹277.77 billion.

Operations: The company generates revenue primarily from data processing services, totaling ₹99.78 billion.

Insider Ownership: 19.5%

Earnings Growth Forecast: 60% p.a.

One97 Communications, known for its Paytm brand, is expected to achieve profitability within three years, outpacing average market growth. Despite recent losses, revenue has grown at 9.9% annually and is projected to continue this trend. The company recently launched 'Paytm Health Saathi', enhancing its merchant support services. However, there's no substantial insider buying reported in the past three months, which could raise concerns about insider confidence in its short-term prospects.

- Dive into the specifics of One97 Communications here with our thorough growth forecast report.

- According our valuation report, there's an indication that One97 Communications' share price might be on the cheaper side.

Will Semiconductor (SHSE:603501)

Simply Wall St Growth Rating: ★★★★☆☆

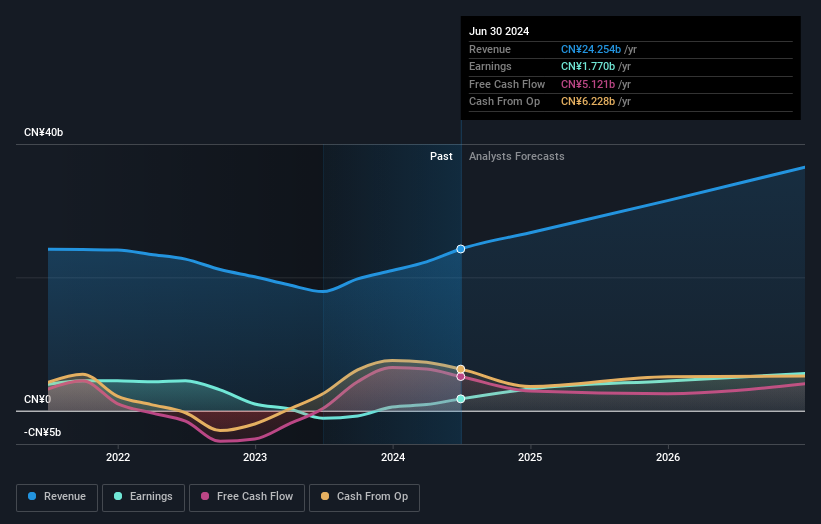

Overview: Will Semiconductor Co., Ltd. is a semiconductor design company specializing in sensor solutions, analog solutions, and touch screen and display solutions, with a market capitalization of approximately CN¥117.07 billion.

Operations: The firm specializes in three key areas: sensor solutions, analog solutions, and touch screen and display solutions.

Insider Ownership: 30.7%

Earnings Growth Forecast: 47.8% p.a.

Will Semiconductor has demonstrated robust earnings growth, with a 212.2% increase last year and an expected annual growth of 47.83% over the next three years, outpacing the CN market significantly. Despite this, its forecasted Return on Equity of 16.7% is considered low, and there has been no substantial insider trading recently to indicate strong insider confidence. Recent corporate events include quarterly earnings that showed substantial revenue and net income increases compared to the previous year.

- Click here to discover the nuances of Will Semiconductor with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Will Semiconductor's current price could be inflated.

Next Steps

- Delve into our full catalog of 1450 Fast Growing Companies With High Insider Ownership here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PAYTM

One97 Communications

Provides payment, commerce and cloud, and financial services to consumers and merchants in India.

Excellent balance sheet with reasonable growth potential.