- India

- /

- Healthcare Services

- /

- NSEI:HCG

Top Growth Companies With Insider Ownership Up To 21%

Reviewed by Simply Wall St

In recent weeks, global markets have been buoyed by expectations of a "red sweep" in the U.S., with major indices like the S&P 500 and Nasdaq Composite reaching record highs as investors anticipate favorable growth and tax policies. Amid this optimism, identifying growth companies with significant insider ownership can offer insights into businesses where those closest to the operations have strong confidence in their future potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 36.6% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 42.1% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 49.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Here's a peek at a few of the choices from the screener.

Odas Elektrik Üretim Sanayi Ticaret (IBSE:ODAS)

Simply Wall St Growth Rating: ★★★★★☆

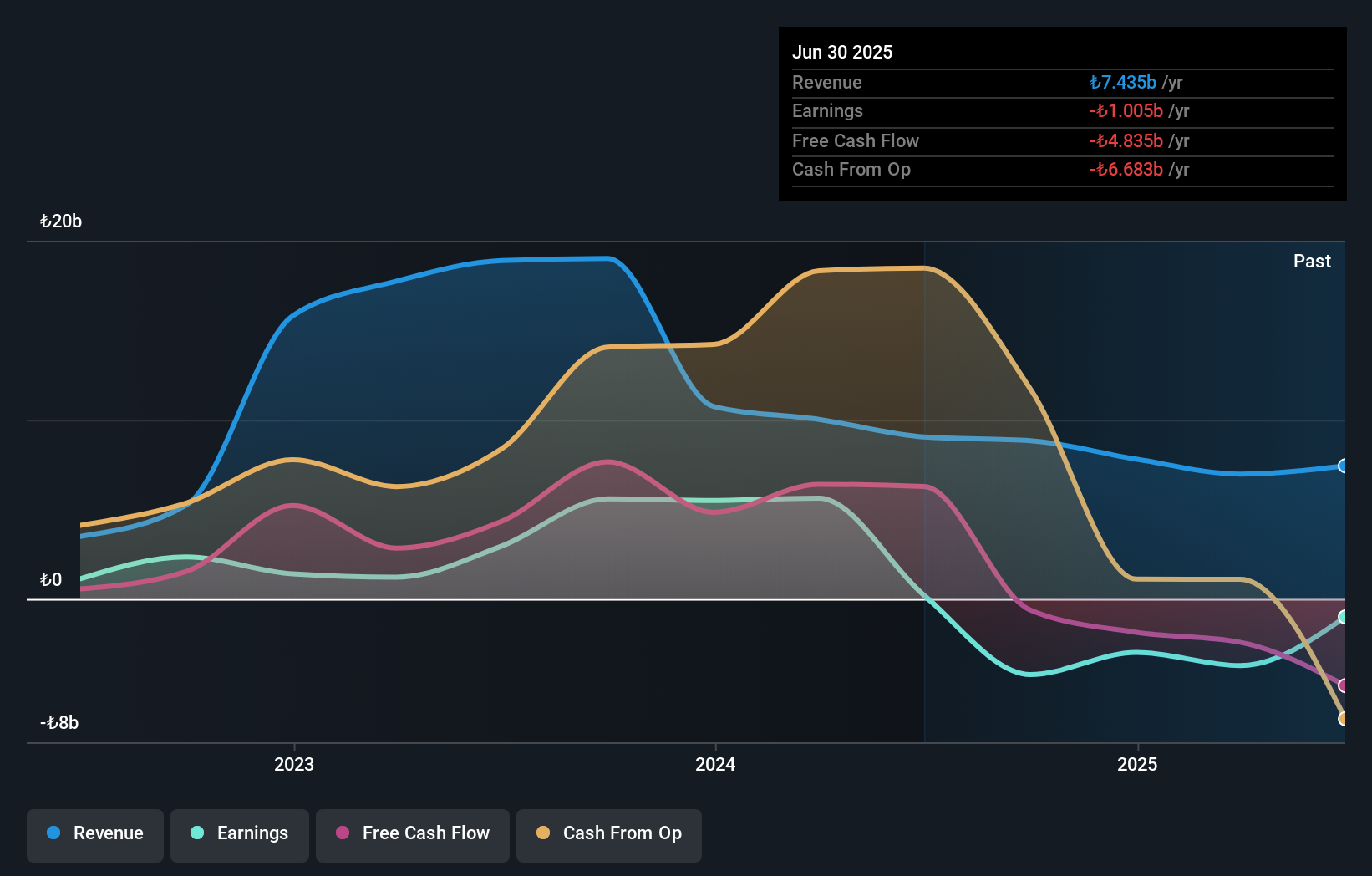

Overview: Odas Elektrik Üretim Sanayi Ticaret A.S., along with its subsidiaries, is involved in the production and sale of electricity through natural gas combined cycles both in Turkey and internationally, with a market cap of TRY8.61 billion.

Operations: The company generates revenue of TRY6.71 billion from Uzbekistan and incurs a negative revenue of TRY1.54 billion in the Republic of Turkey.

Insider Ownership: 21.5%

Odas Elektrik Üretim Sanayi Ticaret is forecasted to experience significant revenue growth at 32% annually, outpacing the Turkish market's average of 25.5%. Despite recent financial setbacks, including a TRY 2.34 billion net loss in Q2 2024, the company is expected to become profitable within three years. Currently trading at a substantial discount to its estimated fair value, Odas offers potential upside with high growth prospects despite current challenges.

- Dive into the specifics of Odas Elektrik Üretim Sanayi Ticaret here with our thorough growth forecast report.

- According our valuation report, there's an indication that Odas Elektrik Üretim Sanayi Ticaret's share price might be on the cheaper side.

HealthCare Global Enterprises (NSEI:HCG)

Simply Wall St Growth Rating: ★★★★☆☆

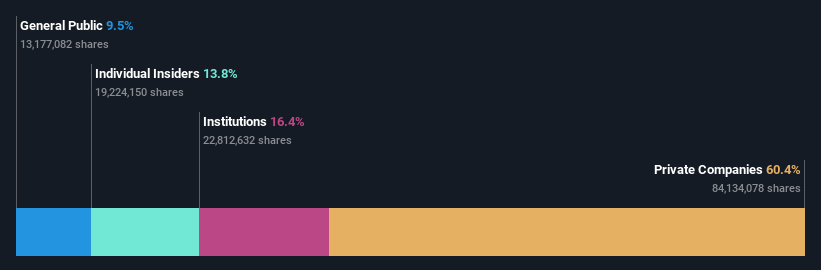

Overview: HealthCare Global Enterprises Limited, along with its subsidiaries, offers medical and healthcare services with a focus on cancer and fertility both in India and internationally, and has a market cap of ₹64.78 billion.

Operations: The company's revenue primarily comes from setting up and managing hospitals and medical diagnostic services, totaling ₹19.77 billion.

Insider Ownership: 13.8%

HealthCare Global Enterprises is set to outpace the Indian market with forecasted revenue growth of 13.1% annually and earnings growth of 44.8%. Despite low return on equity expectations, the company's recent financials show robust performance, with Q2 sales reaching ₹5.52 billion and net income rising to ₹179.9 million from ₹135.7 million a year ago. Insider activity shows more buying than selling recently, though not in significant volumes, indicating cautious optimism among insiders amidst leadership changes.

- Click here to discover the nuances of HealthCare Global Enterprises with our detailed analytical future growth report.

- The valuation report we've compiled suggests that HealthCare Global Enterprises' current price could be inflated.

Dalian Insulator Group (SZSE:002606)

Simply Wall St Growth Rating: ★★★★★☆

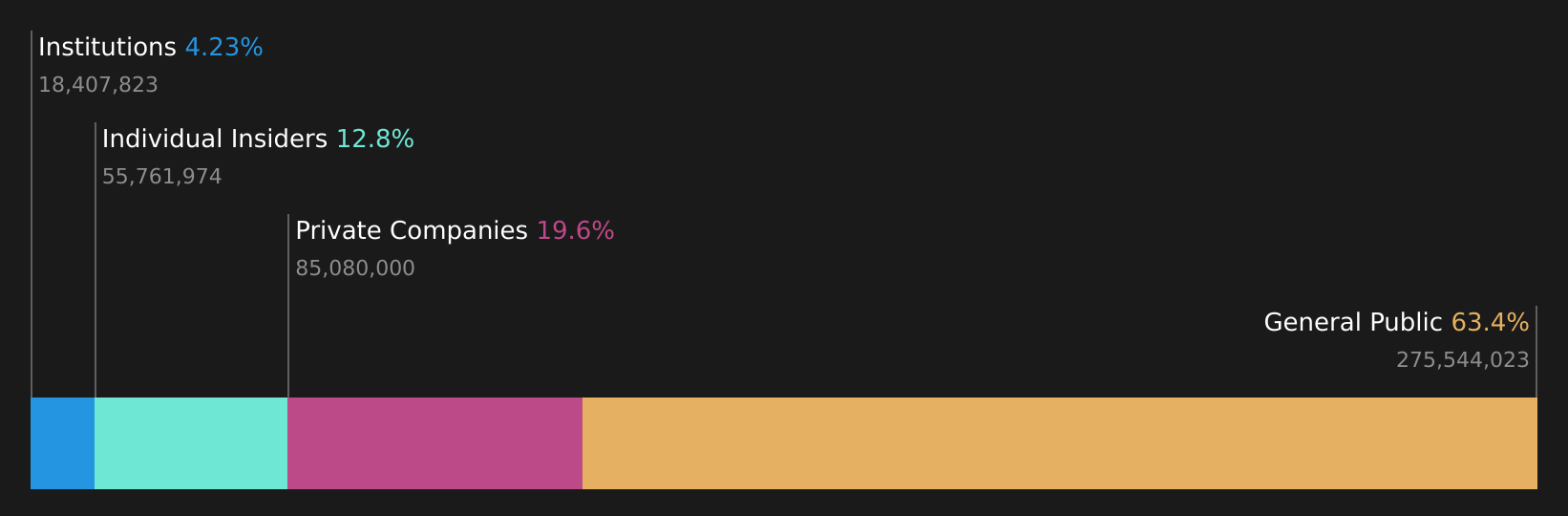

Overview: Dalian Insulator Group Co., Ltd, with a market cap of CN¥4.53 billion, is involved in the research, development, manufacture, and sale of porcelain insulators both in China and internationally.

Operations: The company's revenue primarily comes from its activities in the research, development, manufacture, and sale of porcelain insulators both domestically and abroad.

Insider Ownership: 13%

Dalian Insulator Group is experiencing robust growth, with revenue expected to increase by 27.2% annually, surpassing the Chinese market's average. The company's earnings are projected to grow significantly at 33% per year, despite a low forecasted return on equity of 14.5%. Recent financials highlight strong performance; for the nine months ended September 2024, sales reached CNY 1.04 billion and net income rose sharply to CNY 155.54 million from CNY 38.68 million a year prior.

- Take a closer look at Dalian Insulator Group's potential here in our earnings growth report.

- Our valuation report here indicates Dalian Insulator Group may be overvalued.

Key Takeaways

- Dive into all 1524 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if HealthCare Global Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:HCG

HealthCare Global Enterprises

Provides medical and healthcare services focusing on cancer and fertility in India and internationally.

Reasonable growth potential with proven track record.