- China

- /

- Semiconductors

- /

- SHSE:603501

Revenues Not Telling The Story For Will Semiconductor Co., Ltd. (SHSE:603501) After Shares Rise 32%

Will Semiconductor Co., Ltd. (SHSE:603501) shares have had a really impressive month, gaining 32% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 8.7% isn't as attractive.

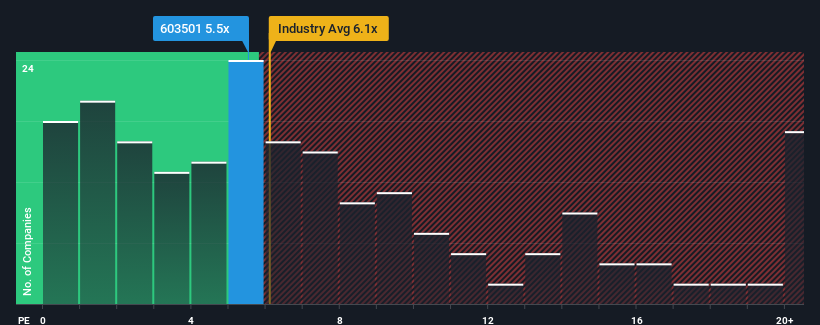

In spite of the firm bounce in price, there still wouldn't be many who think Will Semiconductor's price-to-sales (or "P/S") ratio of 5.5x is worth a mention when the median P/S in China's Semiconductor industry is similar at about 6.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Will Semiconductor

How Will Semiconductor Has Been Performing

With revenue growth that's superior to most other companies of late, Will Semiconductor has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Will Semiconductor will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Will Semiconductor?

Will Semiconductor's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 36% gain to the company's top line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 15% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 43% per annum, which is noticeably more attractive.

In light of this, it's curious that Will Semiconductor's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

Will Semiconductor appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at the analysts forecasts of Will Semiconductor's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Will Semiconductor with six simple checks.

If you're unsure about the strength of Will Semiconductor's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603501

OmniVision Integrated Circuits Group

OmniVision Integrated Circuits Group, Inc.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives