- China

- /

- Semiconductors

- /

- SHSE:603290

Husqvarna And 2 Other Stocks That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

In the midst of global market fluctuations driven by tariff uncertainties and mixed economic data, investors are keenly watching for opportunities to capitalize on undervalued stocks. With U.S. job growth falling short of expectations and manufacturing activity showing signs of recovery, identifying stocks priced below their estimated value can be a strategic move in navigating these complex market conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| DIP (TSE:2379) | ¥2275.00 | ¥4529.30 | 49.8% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | US$29.57 | US$58.94 | 49.8% |

| Biotage (OM:BIOT) | SEK138.70 | SEK273.61 | 49.3% |

| People & Technology (KOSDAQ:A137400) | ₩41400.00 | ₩81928.41 | 49.5% |

| Solum (KOSE:A248070) | ₩17570.00 | ₩34836.48 | 49.6% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.19 | CN¥29.99 | 49.3% |

| Canatu Oyj (HLSE:CANATU) | €12.50 | €24.79 | 49.6% |

| RENK Group (DB:R3NK) | €24.94 | €49.37 | 49.5% |

| Marcus & Millichap (NYSE:MMI) | US$37.27 | US$73.76 | 49.5% |

| Kyndryl Holdings (NYSE:KD) | US$41.54 | US$82.14 | 49.4% |

Let's review some notable picks from our screened stocks.

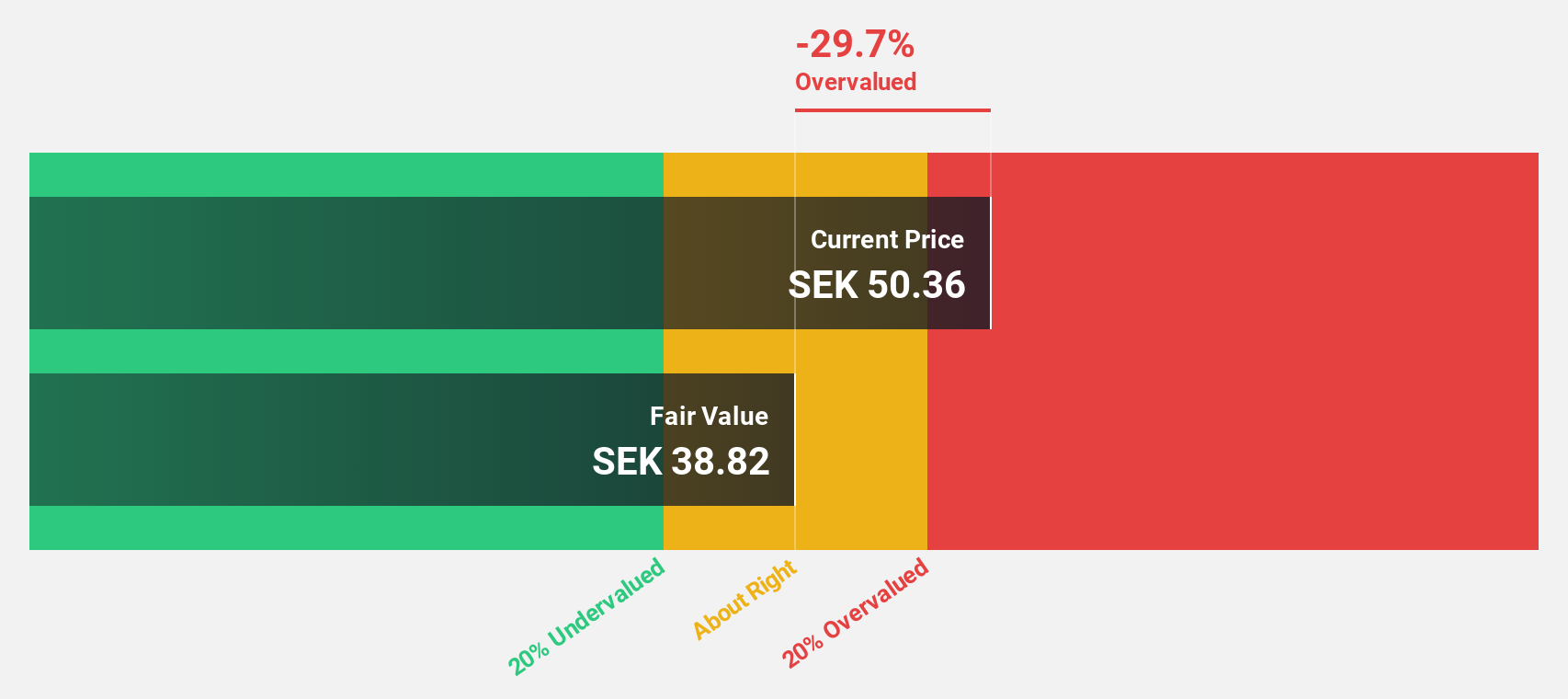

Husqvarna (OM:HUSQ B)

Overview: Husqvarna AB (publ) is a company that produces and sells outdoor power products, watering products, and lawn care power equipment, with a market cap of SEK32.12 billion.

Operations: The revenue segments for Husqvarna AB include Gardena at SEK12.28 billion, Husqvarna Construction at SEK7.77 billion, and Husqvarna Forest & Garden at SEK28.15 billion.

Estimated Discount To Fair Value: 34.2%

Husqvarna is trading at SEK 56.18, significantly below its estimated fair value of SEK 85.4, suggesting it may be undervalued based on cash flows. Despite a challenging year with decreased net income and reduced dividends, the company is expected to grow earnings by over 26% annually, outpacing the Swedish market. Recent strategic partnerships and product expansions in autonomous lawnmowers could bolster future growth prospects despite a high level of debt.

- Our earnings growth report unveils the potential for significant increases in Husqvarna's future results.

- Click here to discover the nuances of Husqvarna with our detailed financial health report.

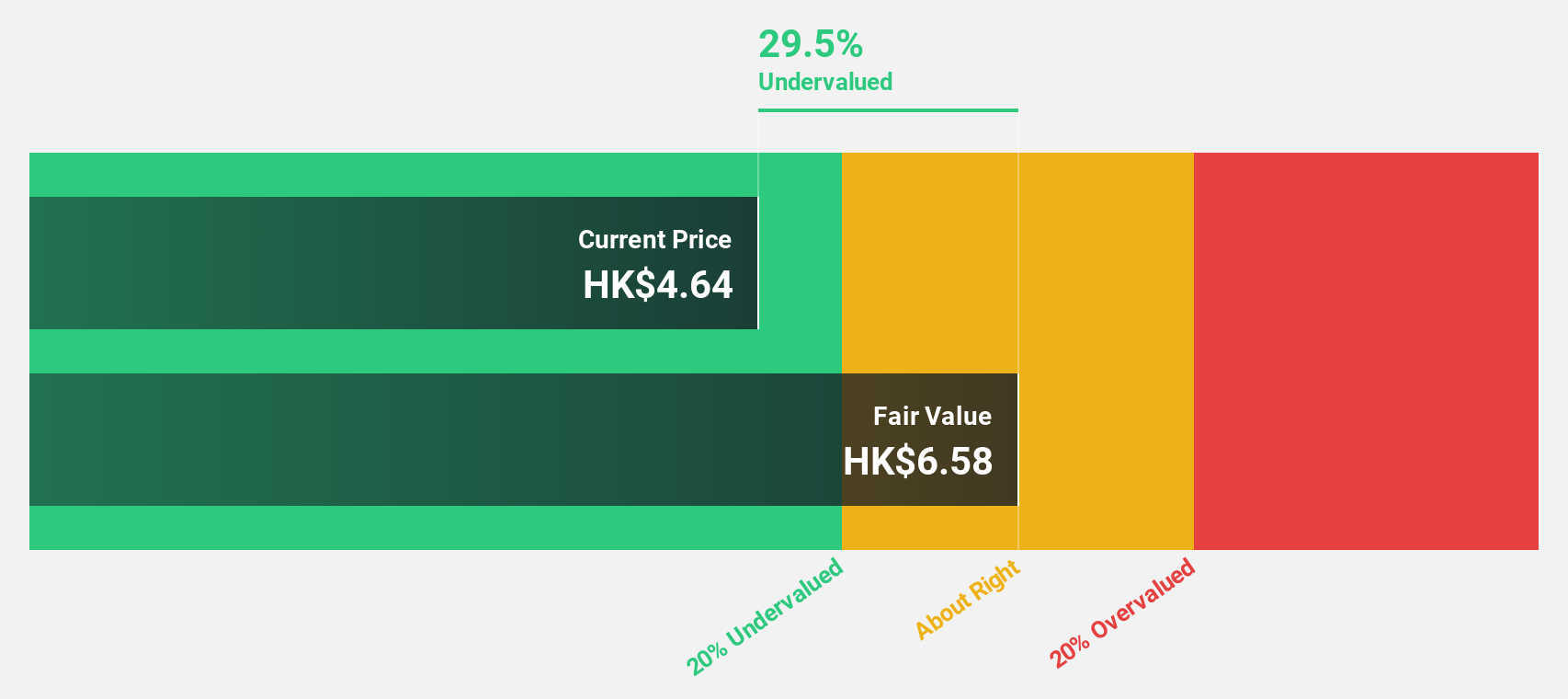

Bosideng International Holdings (SEHK:3998)

Overview: Bosideng International Holdings Limited operates in the apparel business in the People’s Republic of China, with a market cap of HK$44.20 billion.

Operations: The company's revenue segments include Down Apparels with CN¥20.66 billion, Ladieswear Apparels at CN¥735.22 million, Diversified Apparels totaling CN¥254.12 million, and Original Equipment Manufacturing (OEM) Management contributing CN¥2.97 billion.

Estimated Discount To Fair Value: 23.8%

Bosideng International Holdings is trading at HK$3.85, below its estimated fair value of HK$5.05, indicating potential undervaluation based on cash flows. Recent share buyback announcements aim to enhance net asset value and earnings per share, utilizing available cash flow. Despite an unstable dividend track record, the company reported increased earnings and revenue in the latest half-year results, with future earnings growth expected to outpace the Hong Kong market average.

- The growth report we've compiled suggests that Bosideng International Holdings' future prospects could be on the up.

- Take a closer look at Bosideng International Holdings' balance sheet health here in our report.

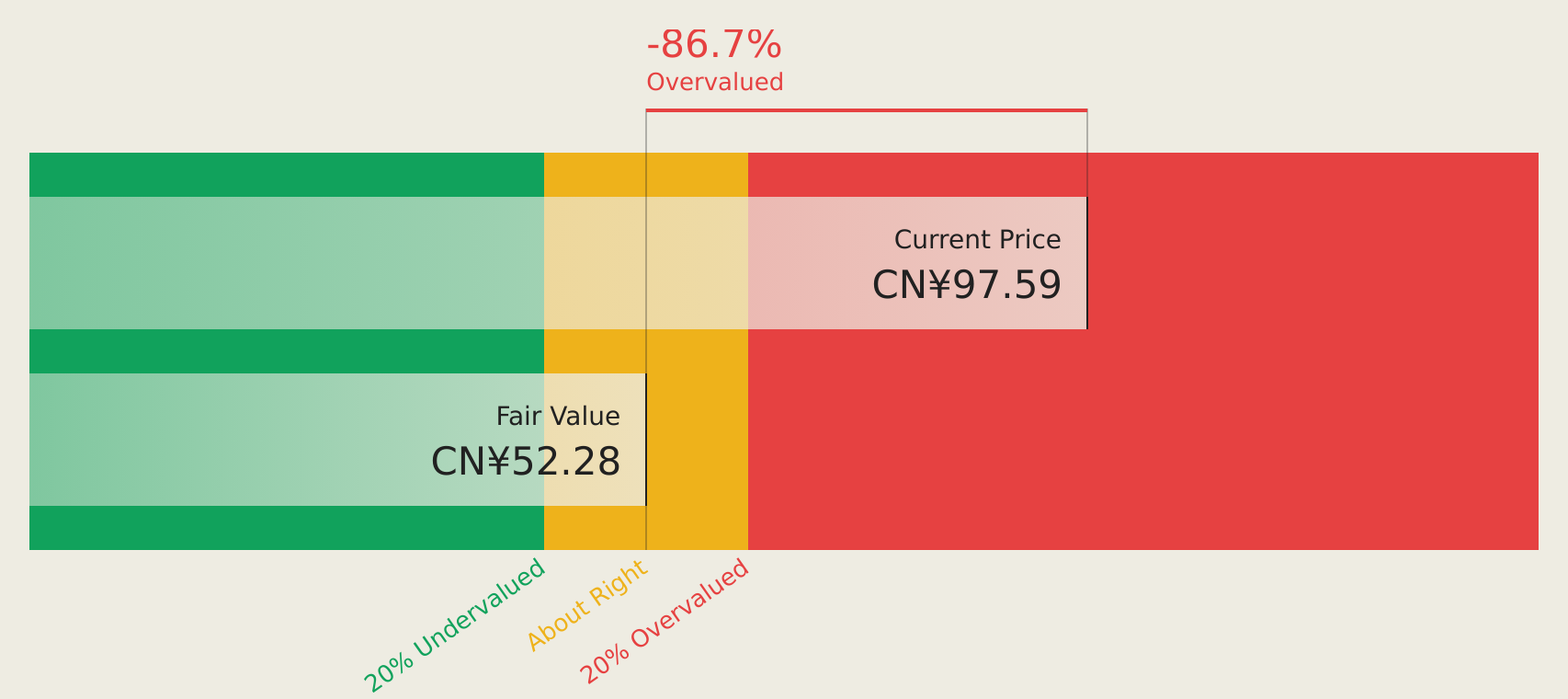

StarPower Semiconductor (SHSE:603290)

Overview: StarPower Semiconductor Ltd. is engaged in the research, design, development, production, and sale of power semiconductor components globally with a market cap of CN¥22.64 billion.

Operations: The company's revenue primarily comes from its Power Semiconductor Devices segment, which generated CN¥3.46 billion.

Estimated Discount To Fair Value: 32.1%

StarPower Semiconductor is trading at CN¥94.56, below its estimated fair value of CN¥139.17, highlighting potential undervaluation based on cash flows. The company is expected to see revenue growth of 21% annually, outpacing the Chinese market average. Despite being removed from major indices like the SSE 180 Index, StarPower's earnings are projected to grow significantly over the next three years, though its return on equity remains a concern for future performance.

- In light of our recent growth report, it seems possible that StarPower Semiconductor's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of StarPower Semiconductor.

Where To Now?

- Access the full spectrum of 906 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603290

StarPower Semiconductor

Researches, designs, develops, produces, and sells power semiconductor components worldwide.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives