- China

- /

- Semiconductors

- /

- SHSE:600732

Insider Picks For High Growth In January 2025

Reviewed by Simply Wall St

As global markets navigate a choppy start to 2025, with U.S. equities facing pressure from inflation concerns and political uncertainties, investors are keenly observing insider activities as potential indicators of confidence amid the volatility. In this environment, companies with high insider ownership can be particularly appealing, as they often signal strong belief in the firm's growth prospects by those who know it best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Medley (TSE:4480) | 34% | 27.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.2% | 66.2% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

We'll examine a selection from our screener results.

Shanghai Aiko Solar EnergyLtd (SHSE:600732)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Aiko Solar Energy Co., Ltd. is involved in the research, manufacture, and sale of crystalline silicon solar cells, with a market cap of CN¥17.60 billion.

Operations: Shanghai Aiko Solar Energy Co., Ltd. generates revenue primarily through its activities in the research, production, and distribution of crystalline silicon solar cells.

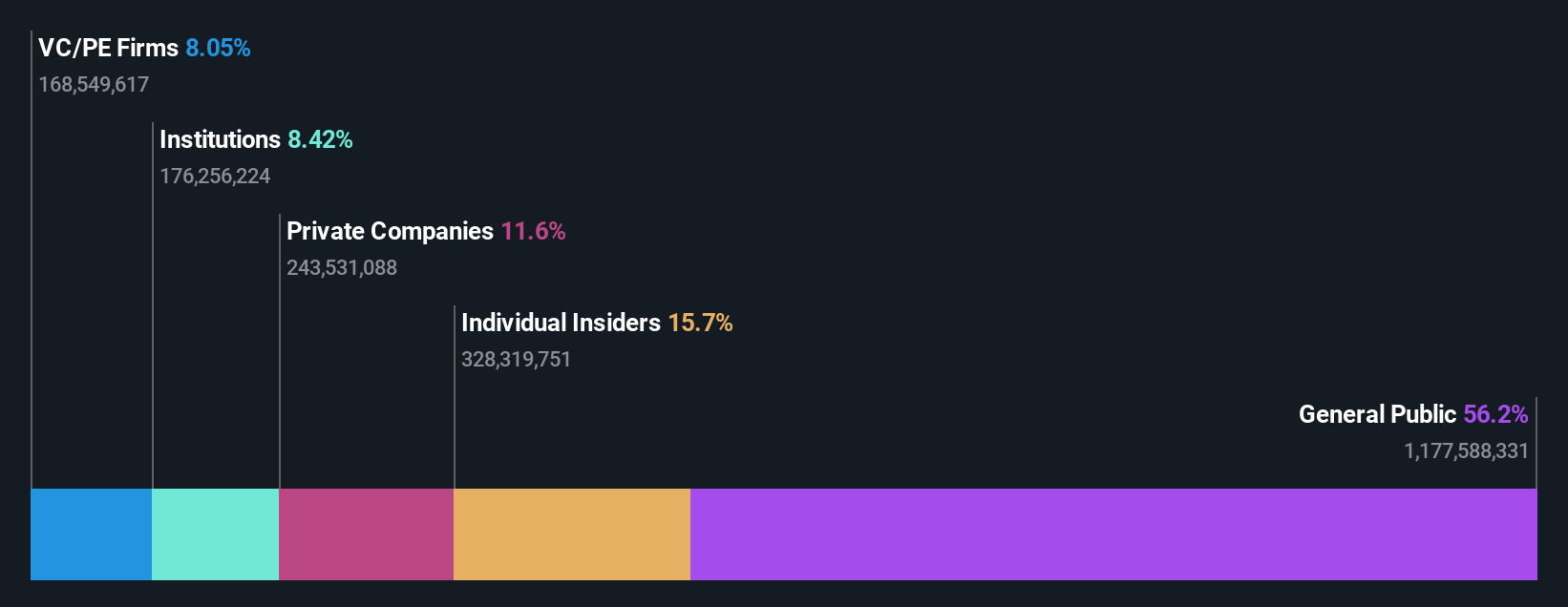

Insider Ownership: 18.2%

Earnings Growth Forecast: 112.5% p.a.

Shanghai Aiko Solar Energy Ltd. exhibits significant growth potential with forecasted revenue growth of 53.1% annually, outpacing the Chinese market's average. Despite recent removal from key indices and reporting a net loss of CNY 2.83 billion for the first nine months of 2024, it is expected to become profitable within three years, indicating above-average market growth prospects. The stock trades at a substantial discount to its estimated fair value but faces challenges with high volatility and inadequate debt coverage by operating cash flow.

- Unlock comprehensive insights into our analysis of Shanghai Aiko Solar EnergyLtd stock in this growth report.

- Our comprehensive valuation report raises the possibility that Shanghai Aiko Solar EnergyLtd is priced lower than what may be justified by its financials.

Asian Star Anchor Chain Jiangsu (SHSE:601890)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Asian Star Anchor Chain Jiangsu, with a market cap of CN¥7.02 billion, manufactures and sells anchor chains, marine mooring chains, and related accessories globally through its subsidiaries.

Operations: The company's revenue is derived from the production and distribution of anchor chains, marine mooring chains, and associated accessories on a global scale.

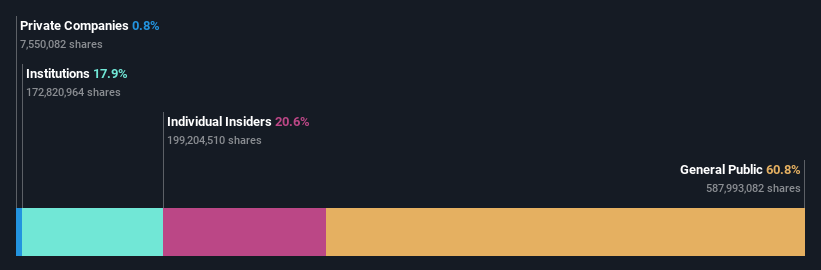

Insider Ownership: 37.6%

Earnings Growth Forecast: 21.4% p.a.

Asian Star Anchor Chain Jiangsu shows promising growth potential with forecasted annual revenue growth of 20.9%, surpassing the Chinese market average. Recent earnings reveal a net income increase to CNY 193.17 million for the first nine months of 2024, despite slightly lower sales compared to the previous year. The stock's price-to-earnings ratio of 29.8x is favorable relative to the market, though its return on equity is expected to remain low at 9.8% in three years.

- Click here to discover the nuances of Asian Star Anchor Chain Jiangsu with our detailed analytical future growth report.

- Our valuation report unveils the possibility Asian Star Anchor Chain Jiangsu's shares may be trading at a discount.

Shenzhen Sunway Communication (SZSE:300136)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Sunway Communication Co., Ltd. is involved in the research, development, manufacture, and sale of antennas, wireless charging modules, precision connectors and cables, passive components, and EMC/EMI solutions both in China and internationally with a market cap of CN¥21.54 billion.

Operations: The company generates revenue of CN¥8.35 billion from its electronic component segment.

Insider Ownership: 20.8%

Earnings Growth Forecast: 31.9% p.a.

Shenzhen Sunway Communication's earnings are projected to grow significantly at 31.9% annually, outpacing the Chinese market average. Despite a price-to-earnings ratio of 42.4x, it remains below the industry norm, suggesting potential value. The company's revenue growth forecast of 16.3% per year is strong but not exceptional compared to high-growth benchmarks. Recent earnings show an increase in net income to CNY 533.24 million for the first nine months of 2024, reflecting steady financial performance amidst no substantial recent insider trading activity.

- Dive into the specifics of Shenzhen Sunway Communication here with our thorough growth forecast report.

- Our valuation report here indicates Shenzhen Sunway Communication may be overvalued.

Summing It All Up

- Click through to start exploring the rest of the 1439 Fast Growing Companies With High Insider Ownership now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600732

Shanghai Aiko Solar EnergyLtd

Engages in the research, manufacture, and sale of crystalline silicon solar cells.

Undervalued with high growth potential.