Undervalued Opportunities: Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

Global markets have experienced a mixed week, with the Dow Jones Industrial Average achieving modest gains amidst a backdrop of volatile corporate earnings and emerging AI competition fears. In such an uncertain climate, investors often look beyond the well-trodden paths to discover hidden opportunities in lesser-known areas. Penny stocks, while an outdated term, remain relevant as they typically represent smaller or newer companies that can offer growth potential at lower price points. When these stocks are supported by strong financial health and solid fundamentals, they present intriguing opportunities for those willing to explore beyond traditional investments.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.74 | HK$44.23B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.86 | £471.38M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £174.08M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.09B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$141.28M | ★★★★☆☆ |

| Lever Style (SEHK:1346) | HK$1.15 | HK$710.96M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.22 | £154.81M | ★★★★★☆ |

Click here to see the full list of 5,708 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Global Top E-Commerce (SZSE:002640)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Global Top E-Commerce Co., Ltd. operates in the cross-border e-commerce sector both within China and internationally, with a market capitalization of CN¥6.62 billion.

Operations: No specific revenue segments are reported for Global Top E-Commerce Co., Ltd.

Market Cap: CN¥6.62B

Global Top E-Commerce Co., Ltd. operates debt-free, with short-term assets of CN¥2.1 billion exceeding both its short and long-term liabilities, indicating a strong financial position despite being unprofitable. The company has a sufficient cash runway for over three years due to positive free cash flow, providing some stability amidst high share price volatility. Recent changes in the board and company bylaws may impact governance positively or negatively, but the removal from the S&P Global BMI Index could affect investor perception. Trading significantly below estimated fair value might attract interest from risk-tolerant investors seeking potential undervalued opportunities in penny stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Global Top E-Commerce.

- Gain insights into Global Top E-Commerce's historical outcomes by reviewing our past performance report.

Tianjin Chase Sun PharmaceuticalLtd (SZSE:300026)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tianjin Chase Sun Pharmaceutical Co., Ltd is involved in the research, development, production, and sale of pharmaceutical products both in China and internationally, with a market cap of CN¥10.45 billion.

Operations: No specific revenue segments are reported for Tianjin Chase Sun Pharmaceutical Co., Ltd.

Market Cap: CN¥10.45B

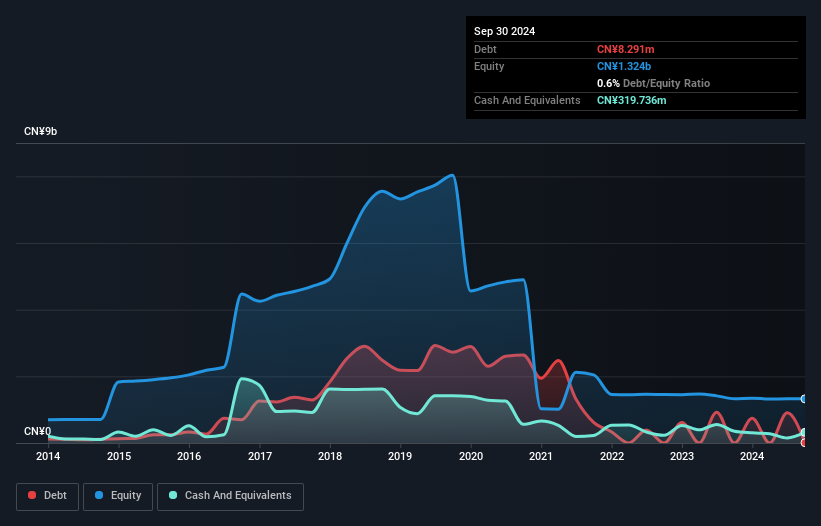

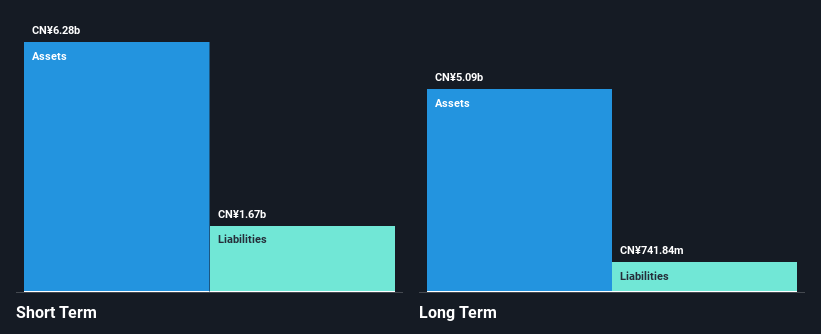

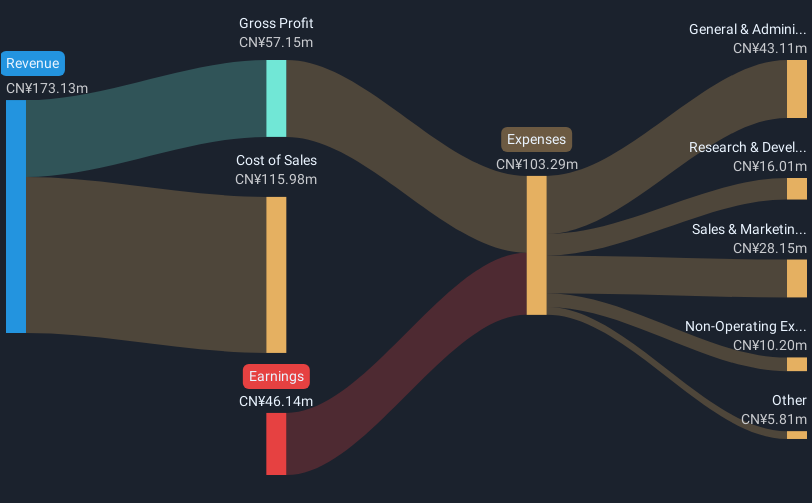

Tianjin Chase Sun Pharmaceutical Co., Ltd. presents a mixed picture for investors interested in penny stocks. The company has experienced negative earnings growth over the past year, with profit margins declining from 9.9% to 2.9%. Despite this, it maintains a strong balance sheet, as short-term assets of CN¥6.3 billion exceed both its short and long-term liabilities, and cash reserves surpass total debt levels. Interest payments are well-covered by EBIT at five times coverage, indicating financial stability despite low return on equity (2%). Recent board changes could influence governance outcomes positively or negatively moving forward.

- Dive into the specifics of Tianjin Chase Sun PharmaceuticalLtd here with our thorough balance sheet health report.

- Examine Tianjin Chase Sun PharmaceuticalLtd's earnings growth report to understand how analysts expect it to perform.

Hainan Shennong Seed Industry Technology (SZSE:300189)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hainan Shennong Seed Industry Technology Co., Ltd. operates in the agricultural sector, focusing on seed production and technology, with a market cap of CN¥3.71 billion.

Operations: Hainan Shennong Seed Industry Technology Co., Ltd. does not report specific revenue segments, focusing broadly on seed production and technology within the agricultural sector.

Market Cap: CN¥3.71B

Hainan Shennong Seed Industry Technology Co., Ltd. presents a complex scenario for penny stock investors. The company remains unprofitable but has managed to reduce its losses by 39.8% annually over the past five years, indicating some operational improvements. It holds more cash than total debt, suggesting financial prudence, and short-term assets of CN¥285.4 million exceed both short and long-term liabilities, providing a buffer against obligations. However, the board's average tenure is just 2.8 years, signaling potential governance challenges due to inexperience. Shareholders have not faced significant dilution recently despite high share price volatility and limited cash runway under current conditions.

- Take a closer look at Hainan Shennong Seed Industry Technology's potential here in our financial health report.

- Explore historical data to track Hainan Shennong Seed Industry Technology's performance over time in our past results report.

Where To Now?

- Gain an insight into the universe of 5,708 Penny Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tianjin Chase Sun PharmaceuticalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300026

Tianjin Chase Sun PharmaceuticalLtd

Engages in the research and development, production, and sale of various pharmaceutical products in China and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives