- China

- /

- General Merchandise and Department Stores

- /

- SHSE:600828

Investors more bullish on Maoye Commercial (SHSE:600828) this week as stock rallies 7.0%, despite earnings trending downwards over past year

If you want to compound wealth in the stock market, you can do so by buying an index fund. But if you pick the right individual stocks, you could make more than that. For example, the Maoye Commercial Co., Ltd. (SHSE:600828) share price is up 36% in the last 1 year, clearly besting the market return of around 19% (not including dividends). That's a solid performance by our standards! Unfortunately the longer term returns are not so good, with the stock falling 1.9% in the last three years.

The past week has proven to be lucrative for Maoye Commercial investors, so let's see if fundamentals drove the company's one-year performance.

Check out our latest analysis for Maoye Commercial

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last twelve months, Maoye Commercial actually shrank its EPS by 96%.

So we don't think that investors are paying too much attention to EPS. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

We doubt the modest 0.7% dividend yield is doing much to support the share price. Maoye Commercial's revenue actually dropped 19% over last year. So the fundamental metrics don't provide an obvious explanation for the share price gain.

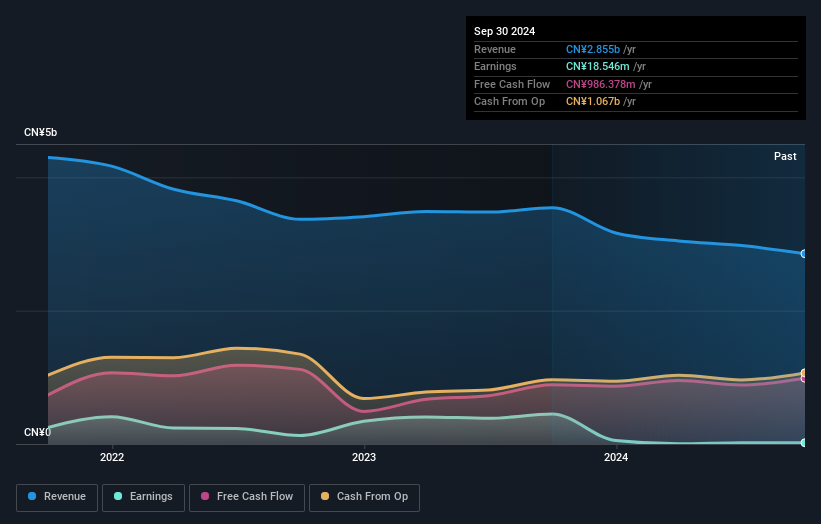

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Maoye Commercial shareholders have received a total shareholder return of 37% over the last year. That's including the dividend. That's better than the annualised return of 2% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Maoye Commercial better, we need to consider many other factors. To that end, you should learn about the 6 warning signs we've spotted with Maoye Commercial (including 2 which are a bit unpleasant) .

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600828

Maoye Commercial

Operates and manages department stores, supermarkets, shopping centers, and outlets in the People’s Republic of China.

Medium-low and slightly overvalued.

Market Insights

Community Narratives