- China

- /

- General Merchandise and Department Stores

- /

- SHSE:600785

Yinchuan Xinhua Commercial (Group)'s (SHSE:600785) earnings have declined over year, contributing to shareholders 19% loss

Yinchuan Xinhua Commercial (Group) Co., Ltd. (SHSE:600785) shareholders should be happy to see the share price up 23% in the last month. But that doesn't change the reality of under-performance over the last twelve months. In fact the stock is down 20% in the last year, well below the market return.

On a more encouraging note the company has added CN¥456m to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

See our latest analysis for Yinchuan Xinhua Commercial (Group)

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

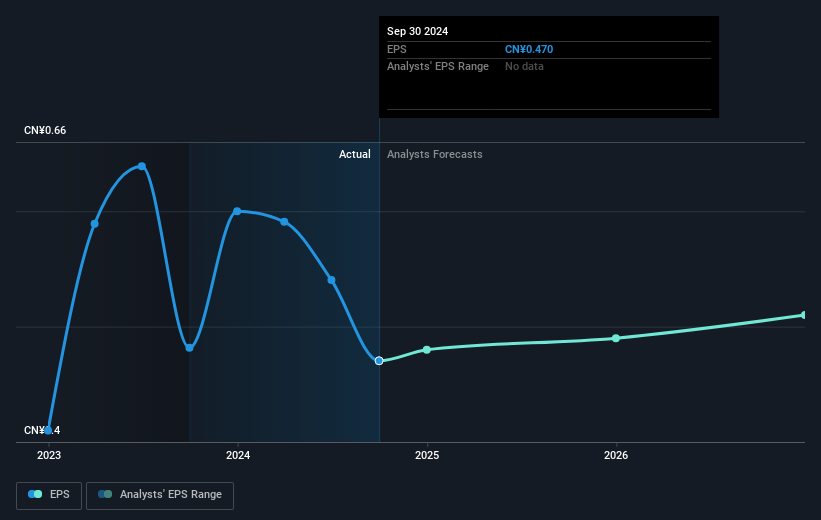

Unfortunately Yinchuan Xinhua Commercial (Group) reported an EPS drop of 2.3% for the last year. The share price decline of 20% is actually more than the EPS drop. This suggests the EPS fall has made some shareholders more nervous about the business.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Yinchuan Xinhua Commercial (Group) has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Yinchuan Xinhua Commercial (Group) shareholders are down 19% for the year (even including dividends), but the market itself is up 22%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.8% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Yinchuan Xinhua Commercial (Group) better, we need to consider many other factors. Even so, be aware that Yinchuan Xinhua Commercial (Group) is showing 3 warning signs in our investment analysis , you should know about...

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600785

Yinchuan Xinhua Commercial (Group)

Yinchuan Xinhua Commercial (Group) Co., Ltd.

Fair value second-rate dividend payer.

Market Insights

Community Narratives