- China

- /

- General Merchandise and Department Stores

- /

- SHSE:600778

Xinjiang Youhao(Group)Co.,Ltd (SHSE:600778) Not Doing Enough For Some Investors As Its Shares Slump 31%

The Xinjiang Youhao(Group)Co.,Ltd (SHSE:600778) share price has fared very poorly over the last month, falling by a substantial 31%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 35% in that time.

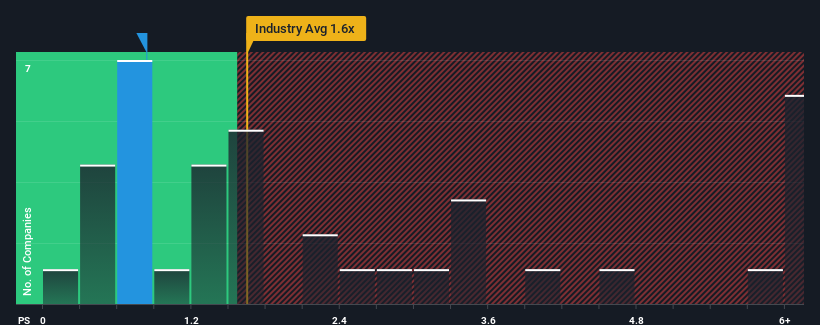

After such a large drop in price, Xinjiang Youhao(Group)Co.Ltd may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.8x, considering almost half of all companies in the Multiline Retail industry in China have P/S ratios greater than 1.6x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Xinjiang Youhao(Group)Co.Ltd

What Does Xinjiang Youhao(Group)Co.Ltd's P/S Mean For Shareholders?

For example, consider that Xinjiang Youhao(Group)Co.Ltd's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Xinjiang Youhao(Group)Co.Ltd's earnings, revenue and cash flow.How Is Xinjiang Youhao(Group)Co.Ltd's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Xinjiang Youhao(Group)Co.Ltd's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.1%. As a result, revenue from three years ago have also fallen 45% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 24% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we understand why Xinjiang Youhao(Group)Co.Ltd's P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Key Takeaway

The southerly movements of Xinjiang Youhao(Group)Co.Ltd's shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that Xinjiang Youhao(Group)Co.Ltd maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Xinjiang Youhao(Group)Co.Ltd is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600778

Xinjiang Youhao(Group)Co.Ltd

Operates as a commercial retail enterprise in China.

Slightly overvalued with questionable track record.

Market Insights

Community Narratives