- China

- /

- General Merchandise and Department Stores

- /

- SHSE:600778

Revenues Working Against Xinjiang Youhao(Group)Co.,Ltd's (SHSE:600778) Share Price Following 26% Dive

Xinjiang Youhao(Group)Co.,Ltd (SHSE:600778) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 65%, which is great even in a bull market.

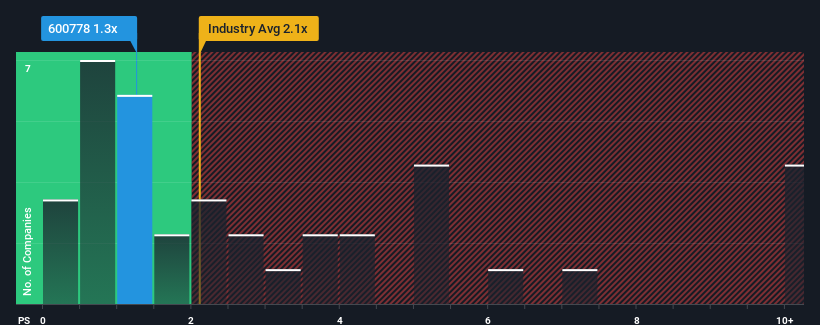

Since its price has dipped substantially, Xinjiang Youhao(Group)Co.Ltd may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.3x, considering almost half of all companies in the Multiline Retail industry in China have P/S ratios greater than 2.1x and even P/S higher than 6x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Xinjiang Youhao(Group)Co.Ltd

What Does Xinjiang Youhao(Group)Co.Ltd's Recent Performance Look Like?

Xinjiang Youhao(Group)Co.Ltd has been doing a decent job lately as it's been growing revenue at a reasonable pace. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

Although there are no analyst estimates available for Xinjiang Youhao(Group)Co.Ltd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Xinjiang Youhao(Group)Co.Ltd?

The only time you'd be truly comfortable seeing a P/S as low as Xinjiang Youhao(Group)Co.Ltd's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 2.9% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 23% overall drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 8.9% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's understandable that Xinjiang Youhao(Group)Co.Ltd's P/S would sit below the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Final Word

Xinjiang Youhao(Group)Co.Ltd's P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Xinjiang Youhao(Group)Co.Ltd revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Xinjiang Youhao(Group)Co.Ltd, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Xinjiang Youhao(Group)Co.Ltd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600778

Xinjiang Youhao(Group)Co.Ltd

Operates as a commercial retail enterprise in China.

Slightly overvalued with questionable track record.

Market Insights

Community Narratives