- China

- /

- Healthcare Services

- /

- SZSE:301015

Undiscovered Gems to Explore in December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape with major indexes showing mixed results, small-cap stocks have faced recent declines after periods of outperformance. Amid these fluctuations, the pursuit of undiscovered gems becomes particularly appealing for investors seeking opportunities in under-the-radar companies that may benefit from current market dynamics. Identifying such stocks often involves looking at those with strong fundamentals and potential for growth despite broader economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Ingersoll-Rand (India) | NA | 15.75% | 28.28% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Master Trust | 33.35% | 28.01% | 41.50% | ★★★★★☆ |

| Abans Holdings | 94.08% | 16.32% | 18.24% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Dashang (SHSE:600694)

Simply Wall St Value Rating: ★★★★★★

Overview: Dashang Co., Ltd. operates a chain of department stores, supermarkets, and electrical appliance stores in China with a market cap of CN¥7.51 billion.

Operations: Dashang generates revenue primarily through its department stores, supermarkets, and electrical appliance stores in China. The company's net profit margin has shown variability, reflecting changes in operating efficiency and cost management.

Dashang showcases a compelling mix of financial strength and growth potential, with its earnings growing by 18.8% over the past year, outpacing the Multiline Retail industry which saw a -6.7% shift. The company is debt-free now, contrasting its 11% debt-to-equity ratio five years ago, indicating improved financial health. Trading at 12.9% below estimated fair value suggests it offers good relative value compared to peers and industry standards. Recent earnings results show net income at CNY 531 million for nine months ending September 2024, up from CNY 450 million last year, reflecting strong operational performance despite sales dipping slightly to CNY 5.29 billion from CNY 5.68 billion previously.

- Navigate through the intricacies of Dashang with our comprehensive health report here.

Assess Dashang's past performance with our detailed historical performance reports.

Shanghai Haixin Group (SHSE:600851)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Haixin Group Co., Ltd. operates in the pharmaceutical, textile and clothing, and finance sectors with a market capitalization of CN¥5.58 billion.

Operations: Haixin Group generates revenue primarily from its pharmaceutical, textile and clothing, and finance operations. The company reported a gross profit margin of 25% in the latest period.

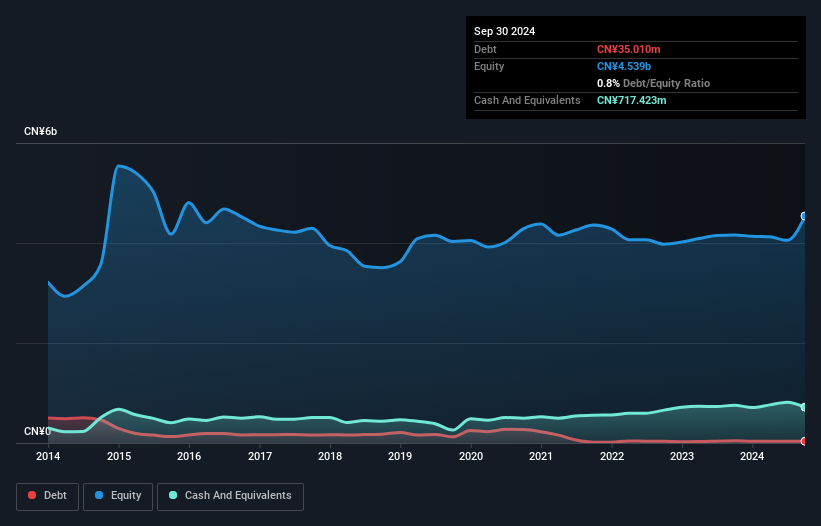

Shanghai Haixin Group, a small player in the pharmaceuticals industry, has been making waves with its impressive earnings growth of 49.3% over the past year, outpacing the industry average of -2.5%. The company's debt situation appears favorable as it holds more cash than its total debt and has successfully reduced its debt-to-equity ratio from 3% to 0.8% over five years. Despite a dip in sales to CNY 605 million from CNY 947 million last year, net income rose to CNY 138.67 million from CNY 125.94 million, reflecting high-quality earnings and robust interest coverage capabilities.

- Delve into the full analysis health report here for a deeper understanding of Shanghai Haixin Group.

Qingdao Baheal Medical (SZSE:301015)

Simply Wall St Value Rating: ★★★★★★

Overview: Qingdao Baheal Medical INC. is involved in the research, development, production, and sale of pharmaceutical products with a market cap of CN¥14.42 billion.

Operations: Qingdao Baheal Medical generates its revenue primarily from the sale of pharmaceutical products. The company has a market cap of CN¥14.42 billion, reflecting its position in the industry.

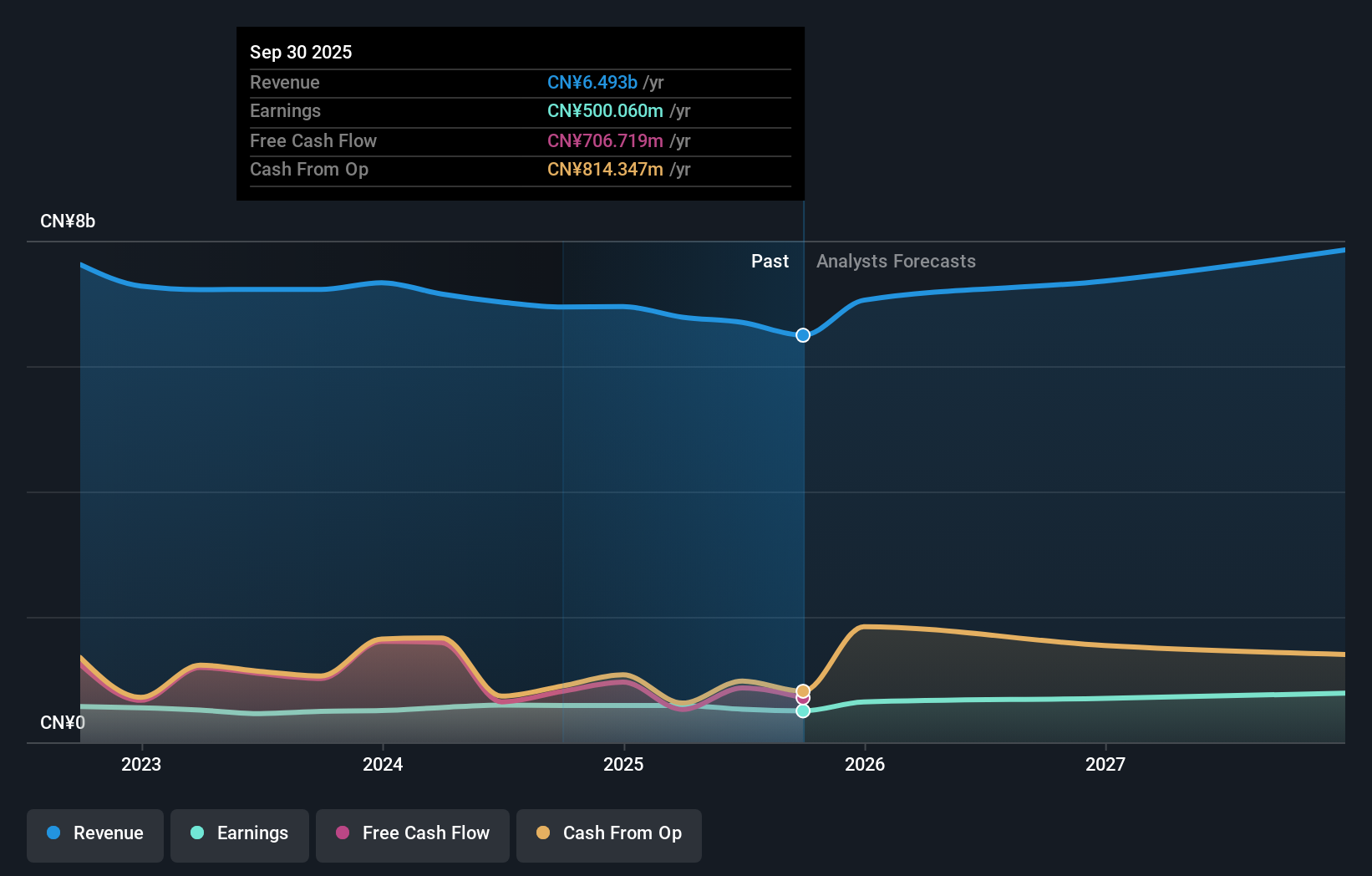

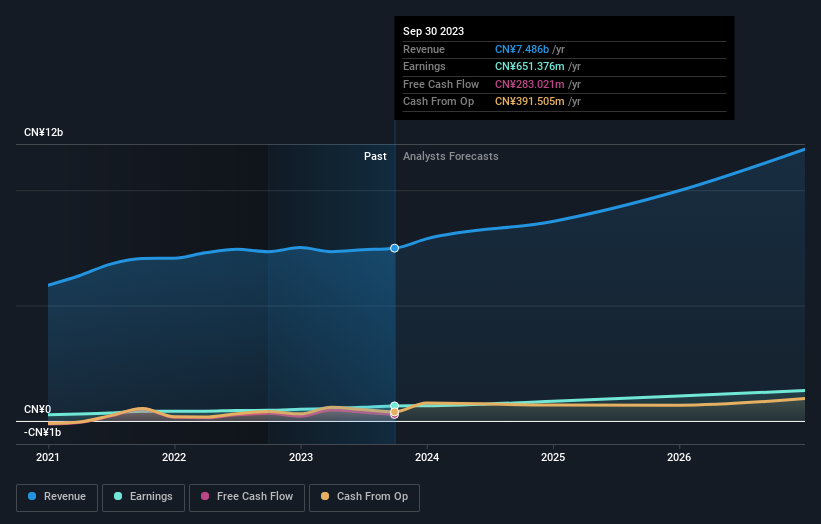

Qingdao Baheal Medical, a dynamic player in the healthcare sector, has shown impressive earnings growth of 53.5% over the past year, outpacing the industry average of -5.7%. The company boasts high-quality earnings and a satisfactory net debt to equity ratio of 7%, reflecting financial prudence. Its price-to-earnings ratio stands at 21x, favorably below the CN market's 37.6x. Recent performance highlights include sales reaching CNY 6.14 billion and net income rising to CNY 641 million for nine months ending September 2024, demonstrating robust operational strength and potential for continued success in its field.

- Unlock comprehensive insights into our analysis of Qingdao Baheal Medical stock in this health report.

Learn about Qingdao Baheal Medical's historical performance.

Next Steps

- Investigate our full lineup of 4629 Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qingdao Baheal Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301015

Qingdao Baheal Medical

Engages in research and development, production, and sale of pharmaceutical products.

Moderate growth potential unattractive dividend payer.

Market Insights

Community Narratives