- China

- /

- Retail Distributors

- /

- SHSE:600128

Undiscovered Gems to Explore This January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets have shown a mixed performance with the S&P 500 capping off a strong two-year stretch despite recent volatility, while small-cap indices like the Russell 2000 have seen modest gains. Amidst these fluctuations, economic indicators such as the Chicago PMI and GDP forecasts highlight ongoing challenges for smaller companies seeking growth opportunities. In this environment, identifying promising stocks involves looking beyond current market sentiment to find those with solid fundamentals and potential resilience in sectors experiencing shifts or expansion.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| An Phat Bioplastics | 58.77% | 10.41% | -1.47% | ★★★★★★ |

| Ampire | NA | 1.50% | 11.39% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Bank Of Sharjah P.J.S.C (ADX:BOS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bank Of Sharjah P.J.S.C., along with its subsidiaries, offers commercial and investment banking products and services in the United Arab Emirates, with a market capitalization of AED2.81 billion.

Operations: The bank generates revenue primarily from its commercial banking segment, contributing AED328.96 million, and its investment banking segment, which adds AED406.73 million. The net profit margin reflects the company's efficiency in converting revenue into actual profit.

Sharjah's bank, with AED40.7 billion in assets and AED3.8 billion in equity, has seen a significant earnings surge of 2546.7% over the past year, outpacing its industry peers. Despite this growth, a one-off loss of AED73.4 million has impacted recent results. Total deposits stand at AED29.5 billion against loans of AED23.4 billion, yet the allowance for bad loans remains low at 83%, while non-performing loans are high at 8.3%. The bank primarily relies on low-risk funding sources for liabilities, accounting for 80%. Recent fixed-income offerings included $500 million senior unsecured bonds due in 2029.

- Click here to discover the nuances of Bank Of Sharjah P.J.S.C with our detailed analytical health report.

Understand Bank Of Sharjah P.J.S.C's track record by examining our Past report.

Arabian Cement (SASE:3010)

Simply Wall St Value Rating: ★★★★★★

Overview: Arabian Cement Company operates in the production, trading, and selling of cement primarily in Saudi Arabia and Jordan, with a market capitalization of SAR2.51 billion.

Operations: The company's revenue primarily comes from the production and selling of cement and clinker, amounting to SAR852.90 million.

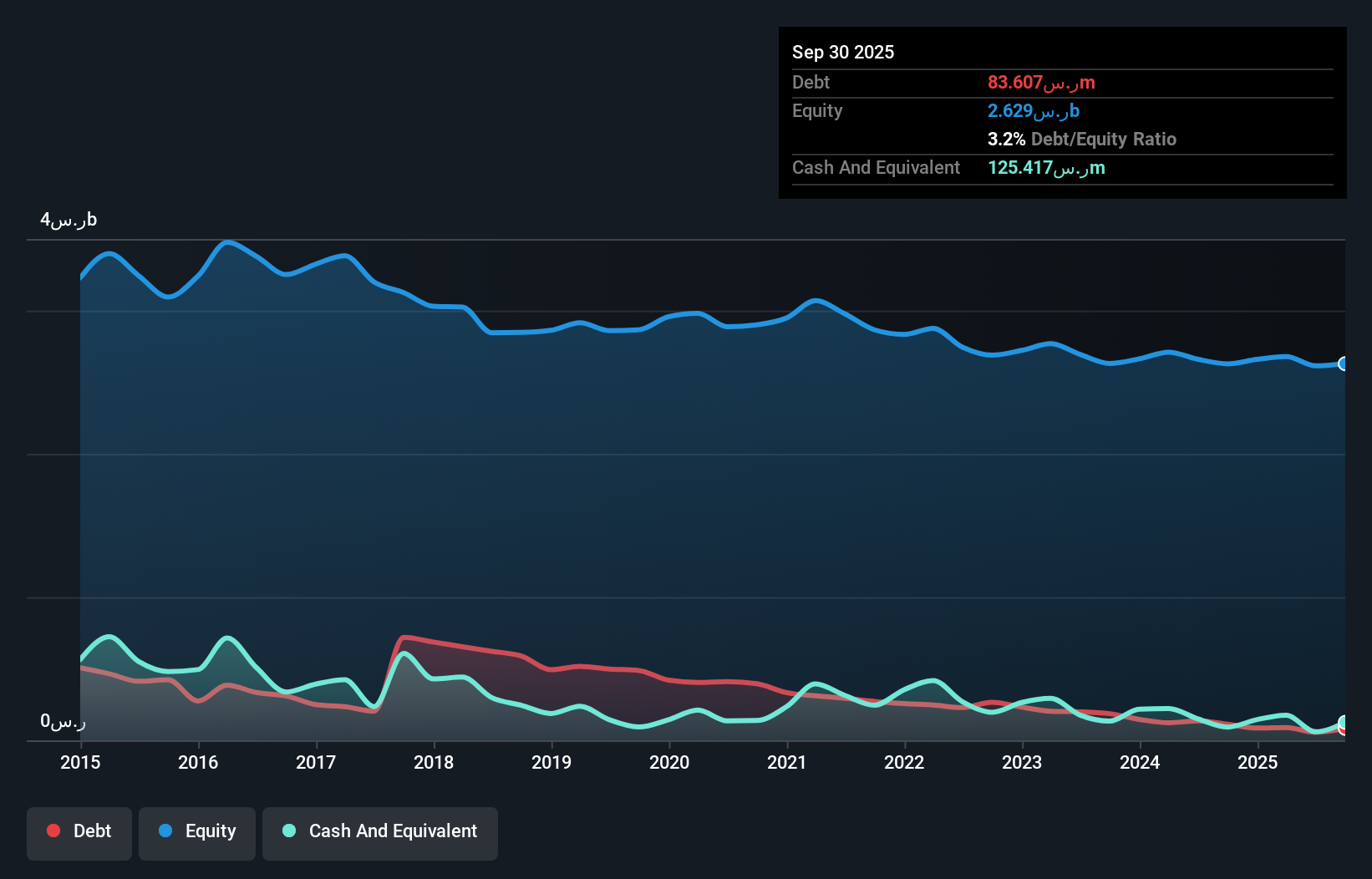

Arabian Cement, a smaller player in the cement industry, is showing promising signs with its recent performance. The company reported third-quarter sales of SAR 224.94 million, up from SAR 213.71 million the previous year, and net income surged to SAR 45.79 million compared to SAR 29.69 million last year. Basic earnings per share improved to SAR 0.46 from SAR 0.3 over the same period, indicating solid growth potential. With a net debt to equity ratio of just 0.8%, Arabian Cement's financial health appears robust and satisfactory for continued operations and investment appeal in its sector.

- Unlock comprehensive insights into our analysis of Arabian Cement stock in this health report.

Review our historical performance report to gain insights into Arabian Cement's's past performance.

Soho Holly (SHSE:600128)

Simply Wall St Value Rating: ★★★★☆☆

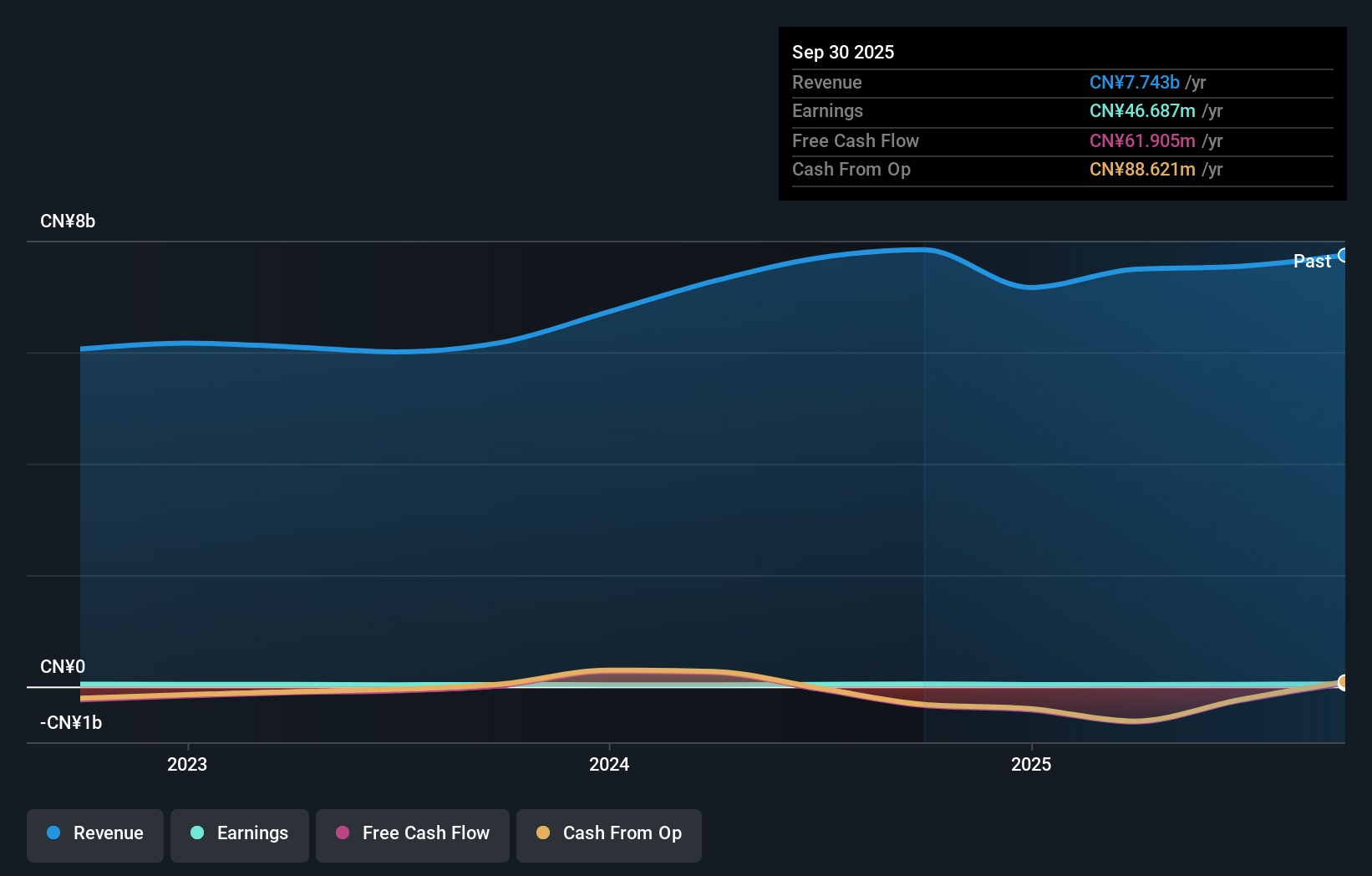

Overview: Soho Holly Corporation engages in the manufacturing and trading of various products in Mainland China, with a market cap of CN¥2.14 billion.

Operations: Due to the lack of specific financial data provided, a detailed analysis of Soho Holly Corporation's revenue streams and cost breakdowns cannot be conducted.

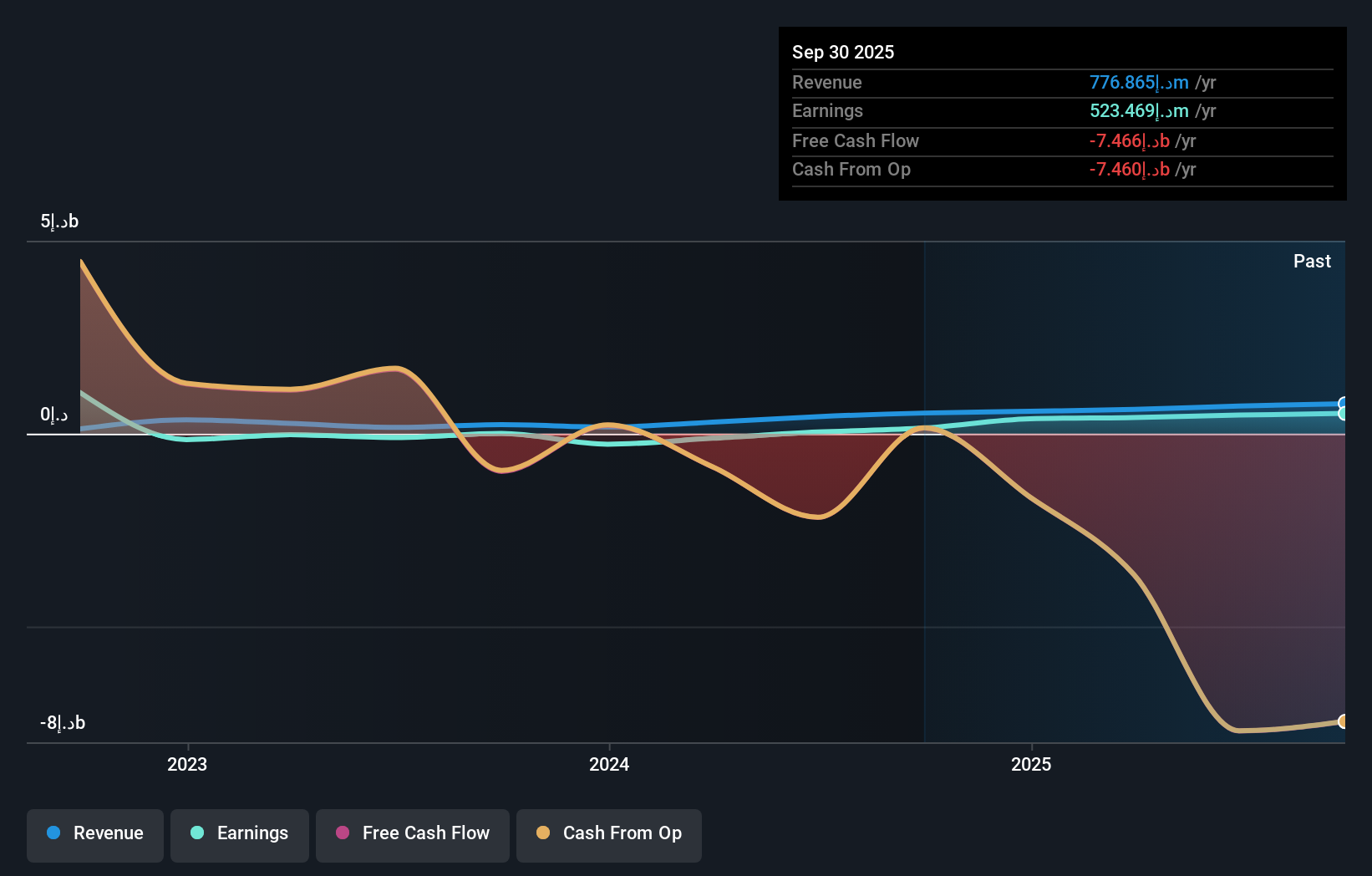

Soho Holly, a smaller player in its industry, has shown promising growth with earnings up 30.7% over the past year, outpacing the Retail Distributors sector's -6.8%. The company's net income for the nine months ended September 2024 was CN¥36.45 million, an improvement from CN¥21.12 million last year. Despite a one-off gain of CN¥39.3 million affecting recent results, Soho Holly remains profitable and covers its interest payments comfortably. Sales reached CN¥5,408.51 million compared to last year's CN¥4,288.48 million, indicating robust business momentum despite challenges in debt management as seen by an increased debt-to-equity ratio from 22% to 24%.

- Delve into the full analysis health report here for a deeper understanding of Soho Holly.

Explore historical data to track Soho Holly's performance over time in our Past section.

Where To Now?

- Explore the 4660 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600128

Soho Holly

Engages in export, import, and domestic trading business in Mainland China.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives