- China

- /

- Other Utilities

- /

- SHSE:605580

Undiscovered Gems And 2 Other Promising Small Caps To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a mixed landscape, with major indices like the S&P 500 and Nasdaq Composite closing out strong years despite recent volatility, small-cap stocks have shown resilience, highlighted by the Russell 2000's notable gains. In this environment of cautious optimism and selective profit-taking, identifying promising small-cap companies can be key to enhancing portfolio diversification. A good stock in such times often combines solid fundamentals with growth potential that may not yet be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Anpec Electronics | 3.15% | 3.67% | 9.94% | ★★★★★★ |

| Macnica Galaxy | 52.99% | 8.23% | 18.45% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Beijing Foyou PharmaLTD | 1.88% | 7.27% | 17.56% | ★★★★★★ |

| Anapass | 7.88% | 5.06% | 41.70% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Interactive Digital Technologies | 1.30% | 6.10% | 4.63% | ★★★★★☆ |

| Zhejiang Chinastars New Materials Group | 36.20% | 2.98% | 3.98% | ★★★★★☆ |

| Feedback Technology | 23.09% | 11.19% | 19.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

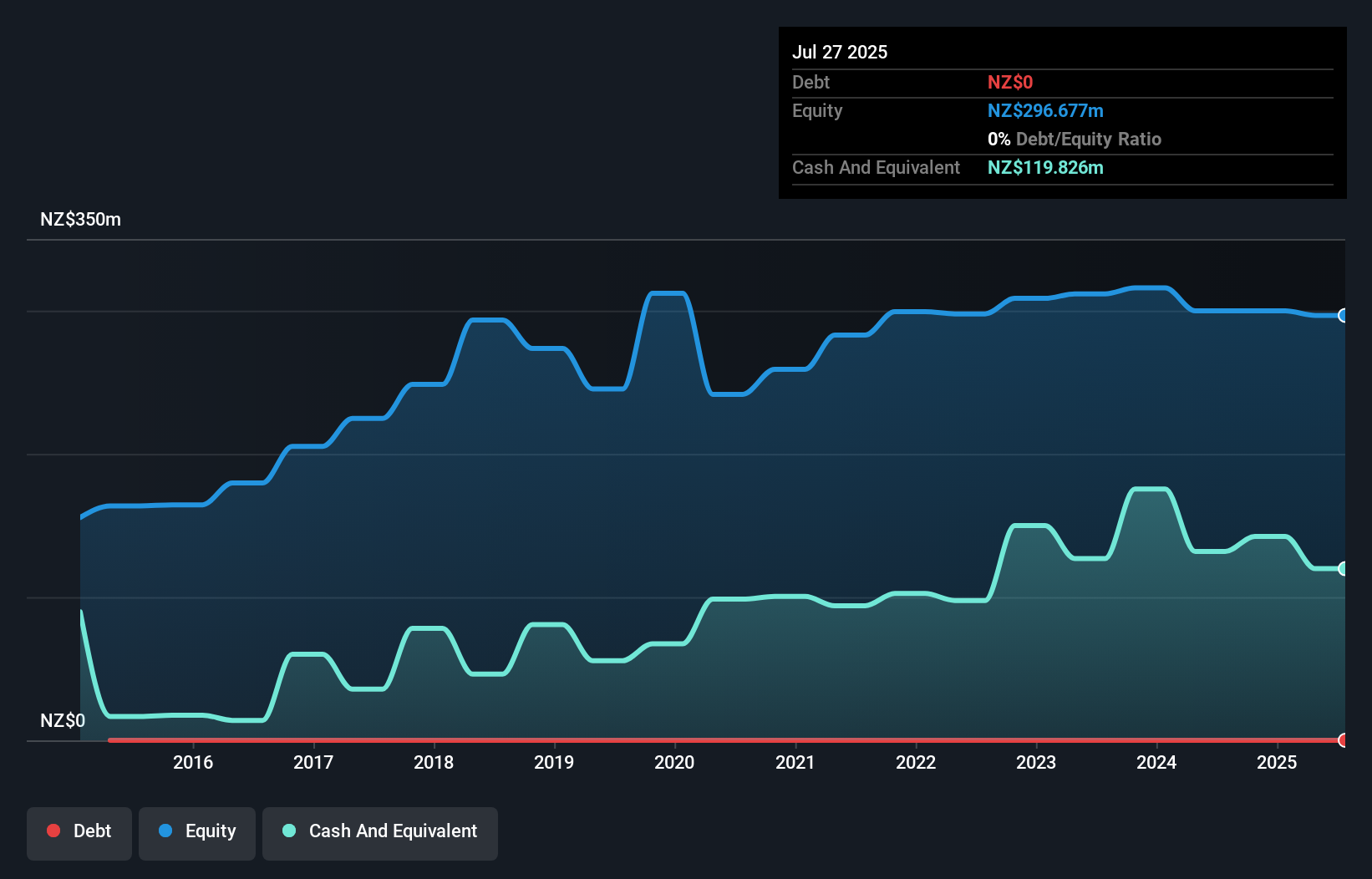

Briscoe Group (NZSE:BGP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Briscoe Group Limited operates as a retailer of homeware and sporting products in New Zealand, with a market capitalization of NZ$1.13 billion.

Operations: Briscoe Group generates revenue primarily from its homeware segment, contributing NZ$490.75 million, and its sporting goods segment, which adds NZ$304.04 million.

Briscoe Group, a notable player in the retail sector, stands out with its debt-free status over the past five years. This financial prudence is complemented by high-quality earnings and positive free cash flow, which was A$108.25 million as of early 2024. Despite trading at 0.3% below its estimated fair value and being considered a good relative value compared to industry peers, it faced challenges with negative earnings growth of -12.8% last year against the industry average of -0.5%. Looking ahead, earnings are expected to grow by 3.4% annually, suggesting potential for recovery and value appreciation in the future.

- Click here and access our complete health analysis report to understand the dynamics of Briscoe Group.

Review our historical performance report to gain insights into Briscoe Group's's past performance.

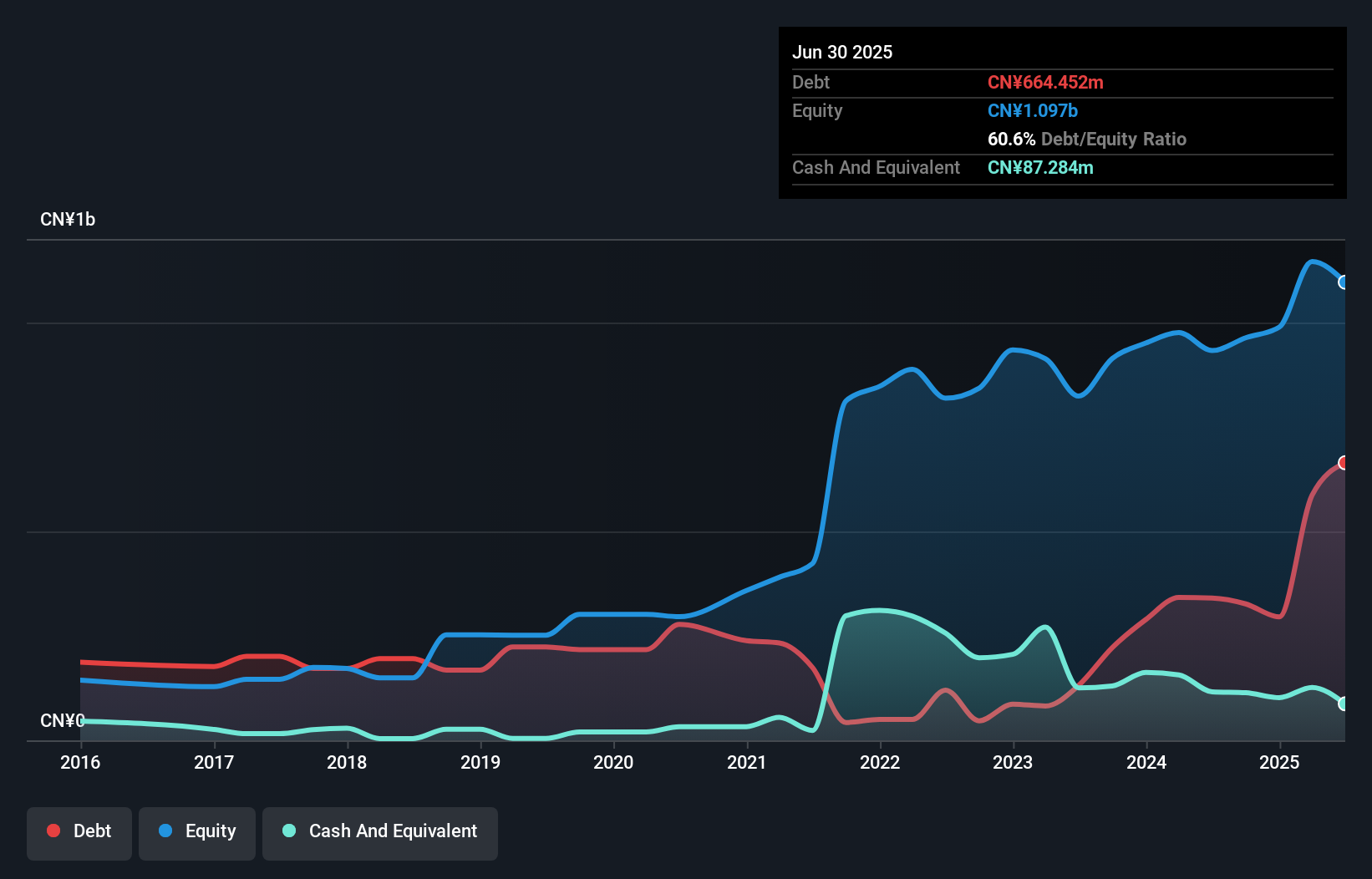

Hengsheng Energy (SHSE:605580)

Simply Wall St Value Rating: ★★★★★★

Overview: Hengsheng Energy Co., Ltd operates in the coal-fired thermal power sector in China and has a market capitalization of CN¥3.31 billion.

Operations: The primary revenue stream for Hengsheng Energy comes from its power and steam industry, generating CN¥822.06 million.

Hengsheng Energy, a smaller player in the energy sector, has shown promising financials with net income reaching CNY 110.77 million for the nine months ending September 2024, up from CNY 98.51 million the previous year. The company's earnings per share increased to CNY 0.4 from CNY 0.35, reflecting solid growth amidst industry challenges. Despite not having positive free cash flow recently, Hengsheng's interest payments are well-covered by EBIT at a robust 29x coverage ratio. With its price-to-earnings ratio of 22x below the market average and a satisfactory net debt to equity ratio of 22%, it seems positioned for potential value realization in its niche market space.

- Take a closer look at Hengsheng Energy's potential here in our health report.

Gain insights into Hengsheng Energy's past trends and performance with our Past report.

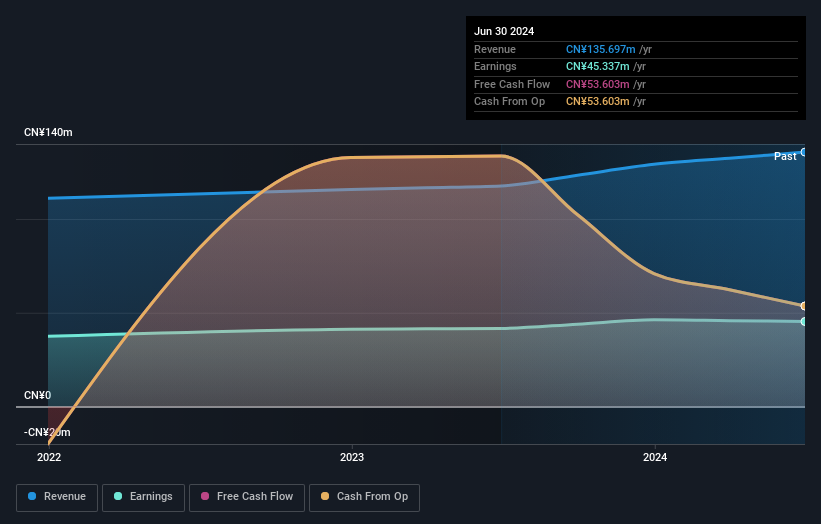

Hotland Yantian Port Warehouse Logistics (SZSE:180301)

Simply Wall St Value Rating: ★★★★★★

Overview: Hotland Yantian Port Warehouse Logistics, with a market cap of CN¥1.99 billion, operates in the logistics sector focusing on warehouse and port services.

Operations: Hotland Yantian Port Warehouse Logistics generates revenue primarily from real estate rentals, totaling CN¥135.70 million. The company's market cap stands at CN¥1.99 billion, reflecting its position in the logistics sector.

Hotland Yantian Port Warehouse Logistics has been making waves with an 8.9% earnings growth over the past year, outpacing the Industrial REITs industry average of 5.8%. The company operates without debt, a notable advantage in its financial strategy, and showcases high-quality earnings. Free cash flow remains positive, indicating sound operational management and stability. Recent events include a cash dividend of CNY 0.03 scheduled for November 7, 2024. These elements suggest potential for continued robust performance within its sector while providing investors with steady returns through dividends.

Key Takeaways

- Access the full spectrum of 4665 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hengsheng Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605580

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives