As global markets navigate the complexities of trade policies and inflation dynamics, investors are closely monitoring developments that influence equity performance. With U.S. stocks showing resilience despite tariff uncertainties and European indices buoyed by slowing inflation, dividend stocks present an appealing option for those seeking income in a fluctuating market environment. In this context, selecting dividend stocks with stable yields can provide a reliable income stream amidst ongoing economic shifts.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 4.39% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.25% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.88% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.49% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.38% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.05% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.61% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.42% | ★★★★★★ |

Click here to see the full list of 1580 stocks from our Top Global Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

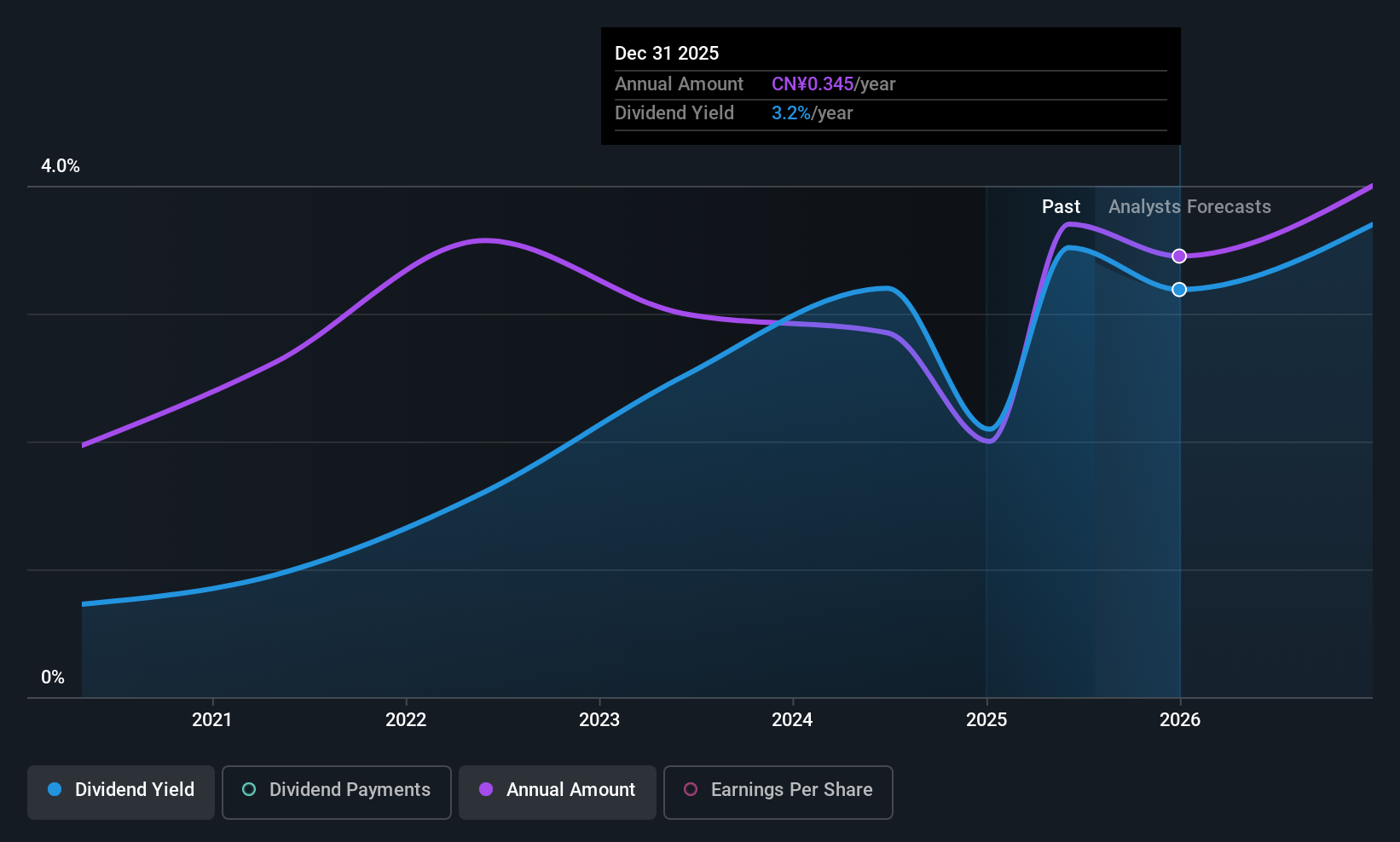

New DaZheng Property Group (SZSE:002968)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New DaZheng Property Group Co., LTD, along with its subsidiaries, focuses on the operation and management of public buildings and facilities in China, with a market cap of CN¥2.44 billion.

Operations: New DaZheng Property Group Co., LTD generates revenue through its core activities of operating and managing public buildings and facilities in China.

Dividend Yield: 3.1%

New DaZheng Property Group's dividend payout is covered by earnings and cash flows, with a payout ratio of 59.2% and a cash payout ratio of 41.7%. The company approved a final cash dividend for 2024, indicating ongoing shareholder returns despite an unstable track record over the past five years. Trading at 76.5% below its estimated fair value, it offers good relative value compared to peers, but its dividends have been volatile and unreliable historically.

- Take a closer look at New DaZheng Property Group's potential here in our dividend report.

- Our expertly prepared valuation report New DaZheng Property Group implies its share price may be lower than expected.

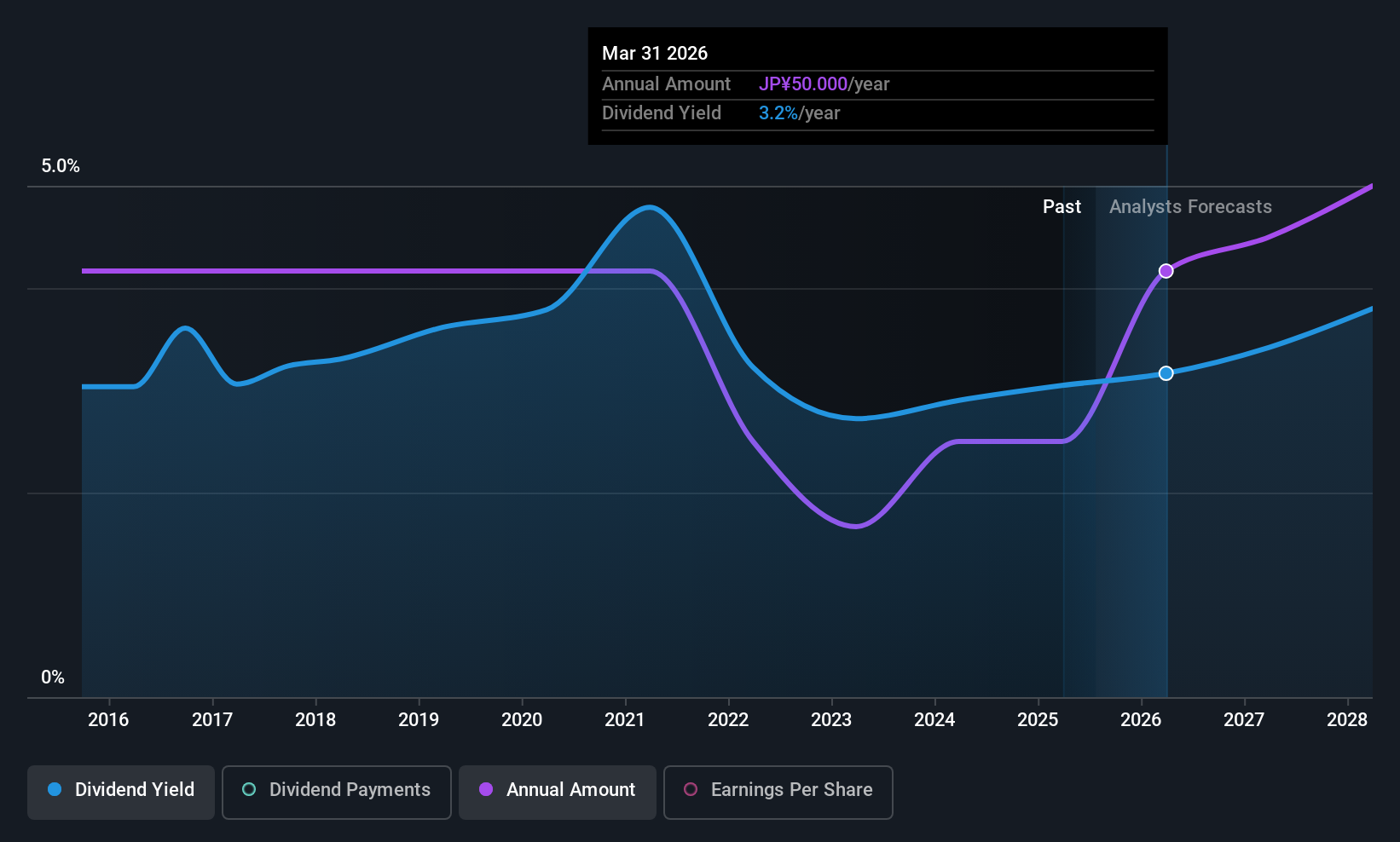

Oki Electric Industry (TSE:6703)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oki Electric Industry Co., Ltd. is engaged in the manufacturing and sale of products, technologies, software, and solutions for telecommunication and information systems both in Japan and internationally, with a market cap of ¥119.49 billion.

Operations: Oki Electric Industry Co., Ltd.'s revenue is derived from its diverse offerings in telecommunication and information systems, encompassing products, technologies, software, and solutions on a global scale.

Dividend Yield: 3.3%

Oki Electric Industry's dividends are covered by earnings and cash flows, with a payout ratio of 31.3% and a cash payout ratio of 19.3%. Despite a historically volatile dividend track record, recent increases from ¥30.00 to ¥45.00 per share suggest potential improvement in shareholder returns. However, profit margins have declined from last year, and the stock's price-to-earnings ratio indicates good relative value compared to the broader JP market despite high debt levels.

- Click here to discover the nuances of Oki Electric Industry with our detailed analytical dividend report.

- The analysis detailed in our Oki Electric Industry valuation report hints at an deflated share price compared to its estimated value.

Omni-Plus System (TSE:7699)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Omni-Plus System Limited is involved in the manufacturing and distribution of commodity and engineering plastics both in Singapore and internationally, with a market cap of ¥17.16 billion.

Operations: Omni-Plus System Limited generates revenue primarily from its Engineering Polymer Business, amounting to $371.59 million.

Dividend Yield: 4.6%

Omni-Plus System's dividends are well-supported by earnings and cash flows, with payout ratios of 35.2% and 43.6%, respectively. Despite a volatile share price, the company offers a dividend yield in the top 25% of the JP market at 4.63%. Recent earnings report shows significant growth, with sales reaching US$371.59 million and net income rising to US$16.16 million. However, dividends have only been paid for four years, indicating limited historical stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Omni-Plus System.

- Our comprehensive valuation report raises the possibility that Omni-Plus System is priced lower than what may be justified by its financials.

Taking Advantage

- Take a closer look at our Top Global Dividend Stocks list of 1580 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7699

Omni-Plus System

Engages in the manufacture and distribution of commodity and engineering plastics in Southeast Asia, rest of Asia, the Americas, and internationally.

Average dividend payer and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)