As global markets react to rising U.S. Treasury yields, the S&P 500 has experienced a downturn after several weeks of gains, highlighting the ongoing influence of macroeconomic factors on equity performance. In such a landscape, investors often turn their attention to smaller or newer companies that may offer unique opportunities for growth and value. Penny stocks, despite their name suggesting an outdated concept, remain relevant as they can reveal hidden potential when backed by strong financials. This article explores three penny stocks that demonstrate financial resilience and could present promising opportunities for those seeking under-the-radar investments with long-term potential.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.57 | MYR2.86B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.78 | HK$488.79M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.50 | £173.92M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.71 | MYR124.72M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.865 | £459.28M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.905 | MYR305.39M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.28 | £323.7M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.235 | £409.76M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$145.87M | ★★★★☆☆ |

Click here to see the full list of 5,818 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

KNT Holdings (SEHK:1025)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: KNT Holdings Limited is an investment holding company engaged in the manufacturing, retailing, and trading of garments across the United States, Hong Kong, Europe, Australia, and the United Kingdom with a market cap of HK$23.59 million.

Operations: The company's revenue primarily comes from its manufacturing and trading of garment products, along with trading accessories, totaling HK$54.31 million.

Market Cap: HK$23.59M

KNT Holdings Limited, with a market cap of HK$23.59 million, is currently unprofitable and has seen its losses increase by 4.8% annually over the past five years. The company's debt to equity ratio has risen to 48.3%, indicating increased leverage, though its net debt to equity remains satisfactory at 38.8%. Despite high volatility in share price recently, KNT's seasoned management team and board offer stability with average tenures of 7.4 and 5.8 years respectively. The company completed a follow-on equity offering raising HK$5.31 million, potentially extending its cash runway beyond the current four months forecasted from free cash flow estimates.

- Take a closer look at KNT Holdings' potential here in our financial health report.

- Learn about KNT Holdings' historical performance here.

Hubei Guochuang Hi-tech MaterialLtd (SZSE:002377)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hubei Guochuang Hi-tech Material Co., Ltd operates in the real estate service sector and specializes in the research, development, production, and sale of modified asphalt in China, with a market cap of CN¥2.79 billion.

Operations: Hubei Guochuang Hi-tech Material Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥2.79B

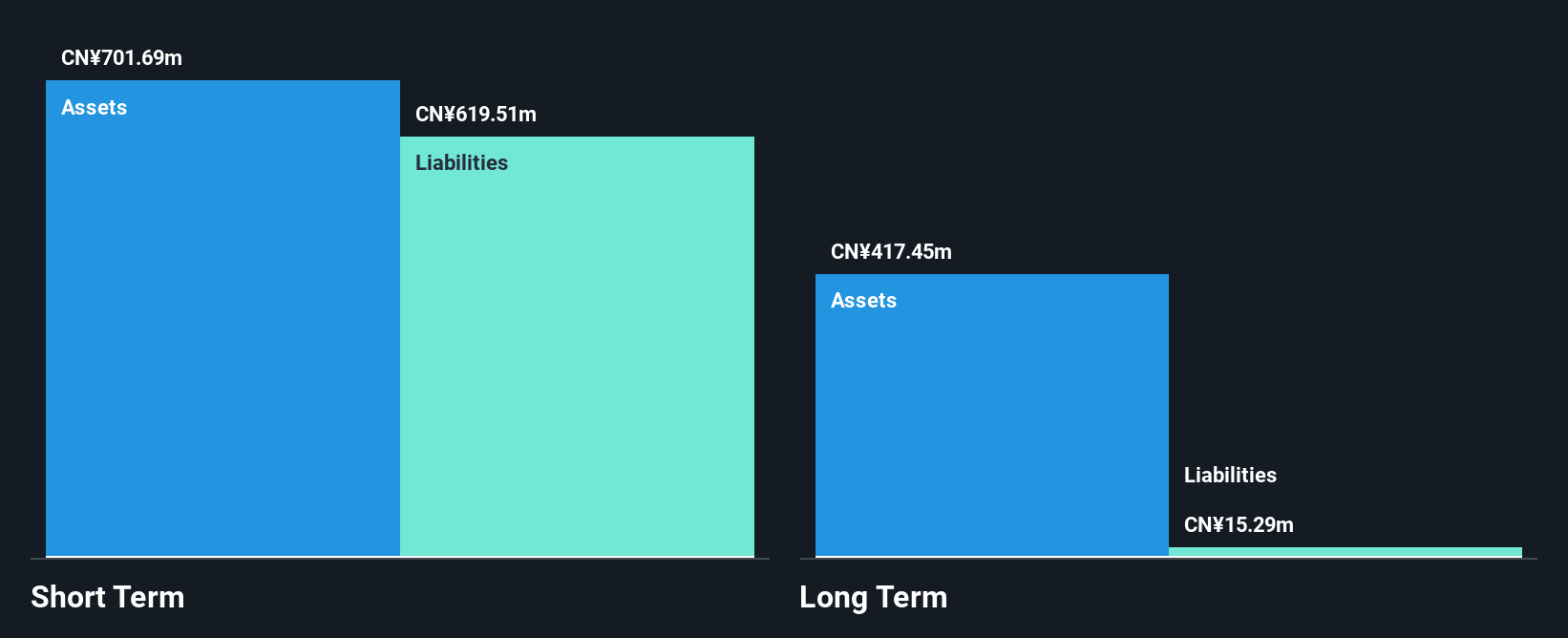

Hubei Guochuang Hi-tech Material Co., Ltd, with a market cap of CN¥2.79 billion, operates in the real estate service sector and has shown financial resilience despite challenges. Its short-term assets of CN¥611.6 million comfortably cover both short and long-term liabilities, indicating solid liquidity management. However, the company remains unprofitable with a negative return on equity of -18.59%, although it has managed to reduce losses by 7.2% annually over five years. Recent earnings reports reveal a decline in sales to CN¥432.19 million for the nine months ending September 2024, but net losses have narrowed significantly from previous periods.

- Navigate through the intricacies of Hubei Guochuang Hi-tech MaterialLtd with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Hubei Guochuang Hi-tech MaterialLtd's track record.

Nanjing Xinlian Electronics (SZSE:002546)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nanjing Xinlian Electronics Co., Ltd specializes in manufacturing power consumption information collection systems for power grid enterprises and enterprise users in China, with a market cap of CN¥3.24 billion.

Operations: Nanjing Xinlian Electronics Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥3.24B

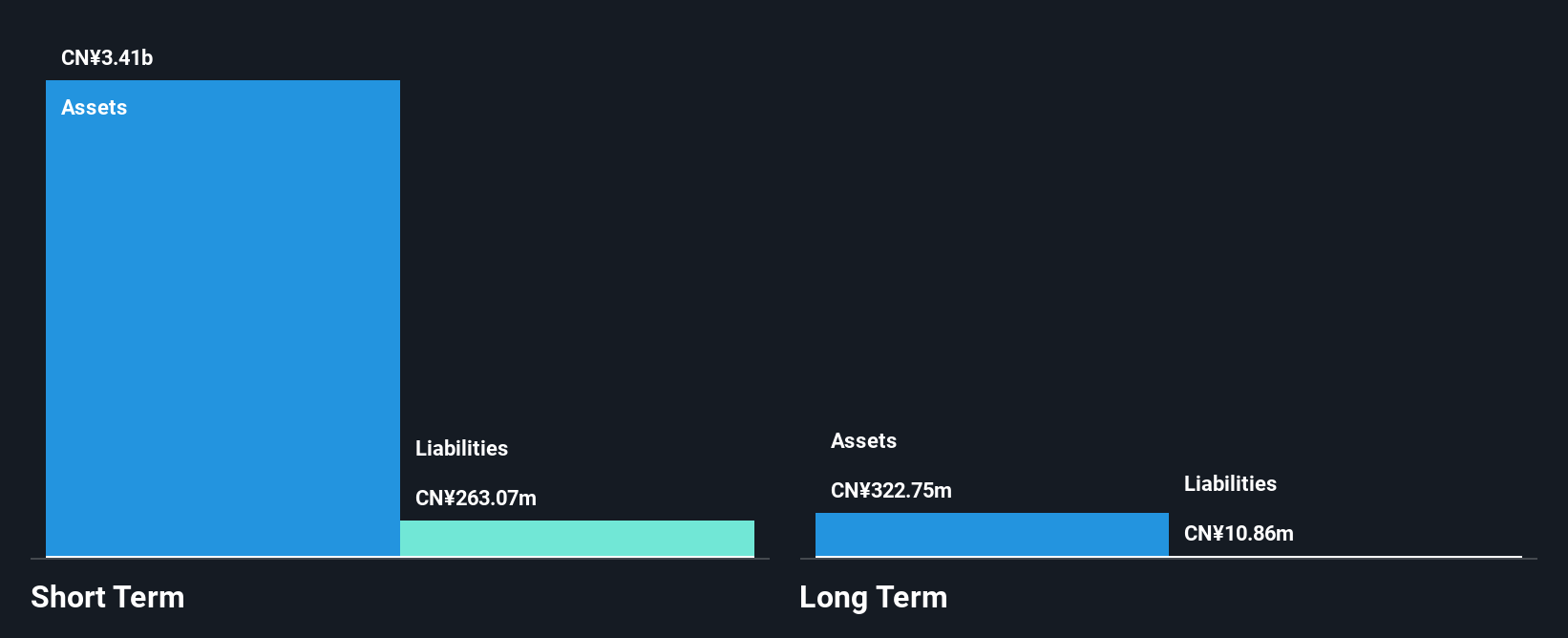

Nanjing Xinlian Electronics Co., Ltd, with a market cap of CN¥3.24 billion, operates in the electronics sector and has shown mixed financial performance. While it remains unprofitable, the company's short-term assets of CN¥3.0 billion exceed both short and long-term liabilities, indicating strong liquidity. Recent earnings for the nine months ending September 2024 show sales growth to CN¥552.3 million from CN¥450.65 million a year ago; however, net income decreased to CN¥102.59 million from CN¥112.58 million previously. Despite stable weekly volatility and no significant shareholder dilution recently, profitability challenges persist with a negative return on equity of -3.04%.

- Click here to discover the nuances of Nanjing Xinlian Electronics with our detailed analytical financial health report.

- Gain insights into Nanjing Xinlian Electronics' past trends and performance with our report on the company's historical track record.

Make It Happen

- Get an in-depth perspective on all 5,818 Penny Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KNT Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1025

KNT Holdings

An investment holding company, manufactures, retails, and trades in garments in the United States of America, Hong Kong, Europe, Australia, and the United Kingdom.

Mediocre balance sheet low.

Market Insights

Community Narratives