- China

- /

- Real Estate

- /

- SZSE:002377

Further weakness as Hubei Guochuang Hi-tech MaterialLtd (SZSE:002377) drops 18% this week, taking five-year losses to 62%

Statistically speaking, long term investing is a profitable endeavour. But along the way some stocks are going to perform badly. For example, after five long years the Hubei Guochuang Hi-tech Material Co.,Ltd (SZSE:002377) share price is a whole 64% lower. That's not a lot of fun for true believers. We also note that the stock has performed poorly over the last year, with the share price down 25%. The last week also saw the share price slip down another 18%.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Hubei Guochuang Hi-tech MaterialLtd

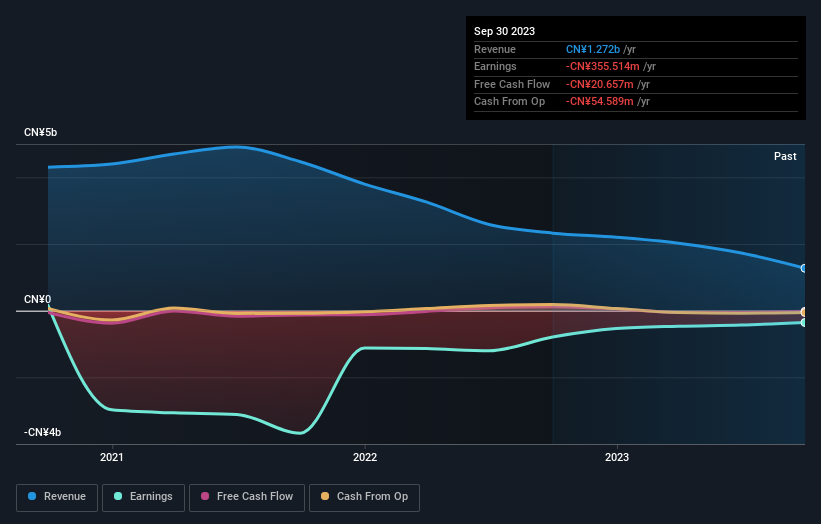

Because Hubei Guochuang Hi-tech MaterialLtd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last five years Hubei Guochuang Hi-tech MaterialLtd saw its revenue shrink by 18% per year. That's definitely a weaker result than most pre-profit companies report. Arguably, the market has responded appropriately to this business performance by sending the share price down 10% (annualized) in the same time period. We don't generally like to own companies that lose money and don't grow revenues. You might be better off spending your money on a leisure activity. You'd want to research this company pretty thoroughly before buying, it looks a bit too risky for us.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We regret to report that Hubei Guochuang Hi-tech MaterialLtd shareholders are down 25% for the year. Unfortunately, that's worse than the broader market decline of 16%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Hubei Guochuang Hi-tech MaterialLtd better, we need to consider many other factors. For instance, we've identified 3 warning signs for Hubei Guochuang Hi-tech MaterialLtd that you should be aware of.

Of course Hubei Guochuang Hi-tech MaterialLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hubei Guochuang Hi-tech MaterialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002377

Hubei Guochuang Hi-tech MaterialLtd

Engages in the real estate service business and the research, development, production, and sale of modified asphalt in China.

Adequate balance sheet and overvalued.

Market Insights

Community Narratives