- China

- /

- Real Estate

- /

- SZSE:002305

Revenues Working Against Langold Real Estate Co., Ltd.'s (SZSE:002305) Share Price Following 27% Dive

Langold Real Estate Co., Ltd. (SZSE:002305) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Longer-term shareholders would now have taken a real hit with the stock declining 8.4% in the last year.

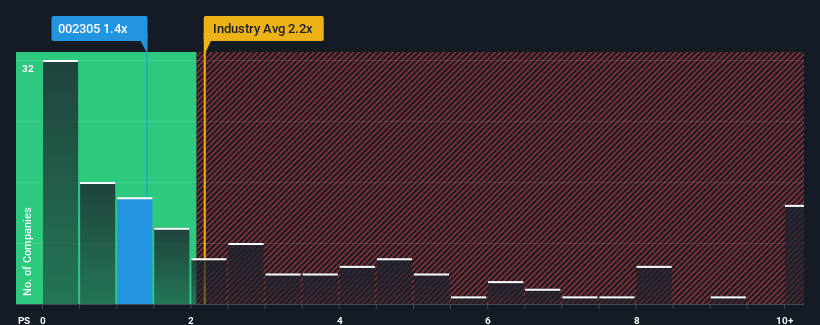

Since its price has dipped substantially, Langold Real Estate's price-to-sales (or "P/S") ratio of 1.4x might make it look like a buy right now compared to the Real Estate industry in China, where around half of the companies have P/S ratios above 2.2x and even P/S above 6x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Langold Real Estate

What Does Langold Real Estate's P/S Mean For Shareholders?

For instance, Langold Real Estate's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Langold Real Estate will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Langold Real Estate's earnings, revenue and cash flow.How Is Langold Real Estate's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Langold Real Estate's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 70%. This means it has also seen a slide in revenue over the longer-term as revenue is down 16% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 12% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we are not surprised that Langold Real Estate is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Final Word

The southerly movements of Langold Real Estate's shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's no surprise that Langold Real Estate maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Langold Real Estate that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Langold Real Estate, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002305

Langold Real Estate

Engages in real estate development activities in China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives