- China

- /

- Real Estate

- /

- SZSE:002305

Langold Real Estate (SZSE:002305 investor five-year losses grow to 59% as the stock sheds CN¥382m this past week

We think intelligent long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. For example, after five long years the Langold Real Estate Co., Ltd. (SZSE:002305) share price is a whole 60% lower. That's not a lot of fun for true believers. And it's not just long term holders hurting, because the stock is down 42% in the last year. Furthermore, it's down 30% in about a quarter. That's not much fun for holders.

After losing 14% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Langold Real Estate

Langold Real Estate isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last half decade, Langold Real Estate saw its revenue increase by 9.8% per year. That's a pretty good rate for a long time period. The share price return isn't so respectable with an annual loss of 10% over the period. It seems probably that the business has failed to live up to initial expectations. A pessimistic market can create opportunities.

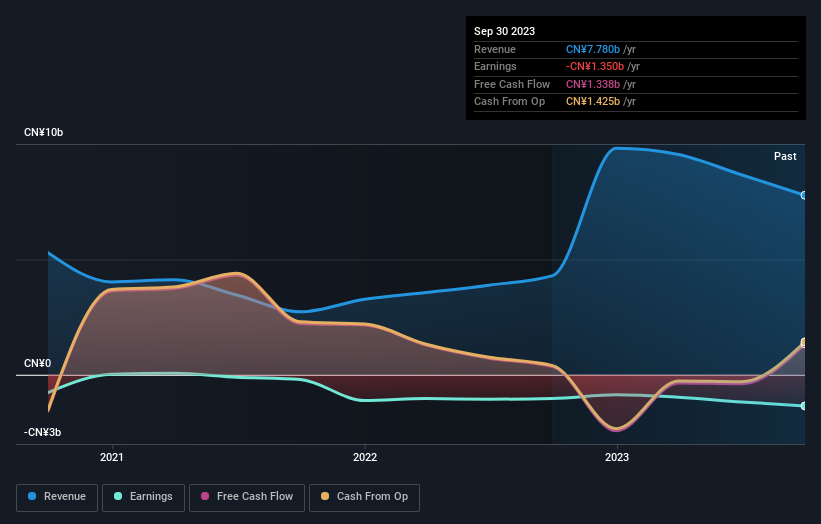

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Langold Real Estate's earnings, revenue and cash flow.

A Different Perspective

We regret to report that Langold Real Estate shareholders are down 42% for the year. Unfortunately, that's worse than the broader market decline of 17%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Langold Real Estate better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Langold Real Estate .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002305

Langold Real Estate

Engages in real estate development activities in China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives