- China

- /

- Real Estate

- /

- SZSE:001914

These 4 Measures Indicate That China Merchants Property Operation & Service (SZSE:001914) Is Using Debt Reasonably Well

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies China Merchants Property Operation & Service Co., Ltd. (SZSE:001914) makes use of debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for China Merchants Property Operation & Service

How Much Debt Does China Merchants Property Operation & Service Carry?

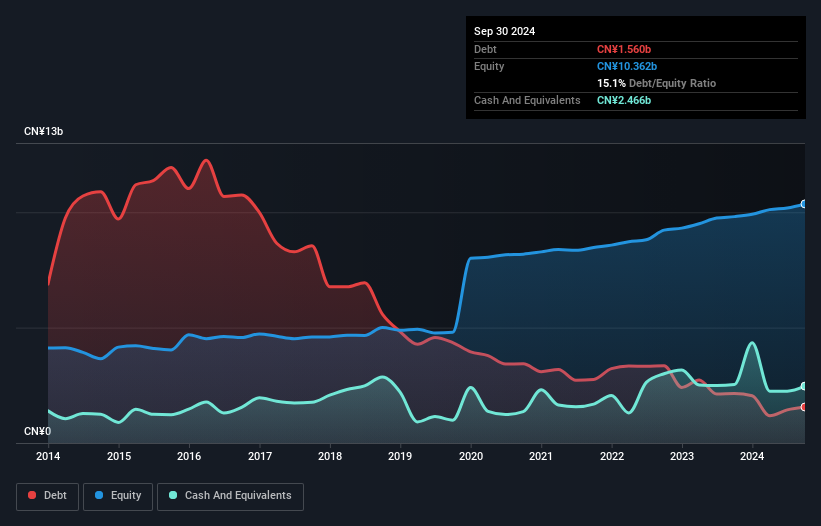

You can click the graphic below for the historical numbers, but it shows that China Merchants Property Operation & Service had CN¥1.56b of debt in September 2024, down from CN¥2.15b, one year before. However, its balance sheet shows it holds CN¥2.47b in cash, so it actually has CN¥905.4m net cash.

How Strong Is China Merchants Property Operation & Service's Balance Sheet?

We can see from the most recent balance sheet that China Merchants Property Operation & Service had liabilities of CN¥6.45b falling due within a year, and liabilities of CN¥2.24b due beyond that. Offsetting these obligations, it had cash of CN¥2.47b as well as receivables valued at CN¥5.28b due within 12 months. So it has liabilities totalling CN¥942.7m more than its cash and near-term receivables, combined.

Given China Merchants Property Operation & Service has a market capitalization of CN¥11.7b, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Despite its noteworthy liabilities, China Merchants Property Operation & Service boasts net cash, so it's fair to say it does not have a heavy debt load!

On the other hand, China Merchants Property Operation & Service saw its EBIT drop by 5.8% in the last twelve months. That sort of decline, if sustained, will obviously make debt harder to handle. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine China Merchants Property Operation & Service's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While China Merchants Property Operation & Service has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, China Merchants Property Operation & Service recorded free cash flow worth a fulsome 96% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Summing Up

While it is always sensible to look at a company's total liabilities, it is very reassuring that China Merchants Property Operation & Service has CN¥905.4m in net cash. And it impressed us with free cash flow of CN¥909m, being 96% of its EBIT. So we don't think China Merchants Property Operation & Service's use of debt is risky. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - China Merchants Property Operation & Service has 1 warning sign we think you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:001914

China Merchants Property Operation & Service

China Merchants Property Operation & Service Co., Ltd.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives