- China

- /

- Real Estate

- /

- SZSE:000031

Shareholders in Grandjoy Holdings Group (SZSE:000031) have lost 49%, as stock drops 3.2% this past week

It is doubtless a positive to see that the Grandjoy Holdings Group Co., Ltd. (SZSE:000031) share price has gained some 40% in the last three months. But that doesn't change the fact that the returns over the last five years have been less than pleasing. You would have done a lot better buying an index fund, since the stock has dropped 51% in that half decade.

With the stock having lost 3.2% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Grandjoy Holdings Group

Grandjoy Holdings Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over five years, Grandjoy Holdings Group grew its revenue at 3.1% per year. That's not a very high growth rate considering it doesn't make profits. This lacklustre growth has no doubt fueled the loss of 9% per year, in that time. We want to see an acceleration of revenue growth (or profits) before showing much interest in this one. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term).

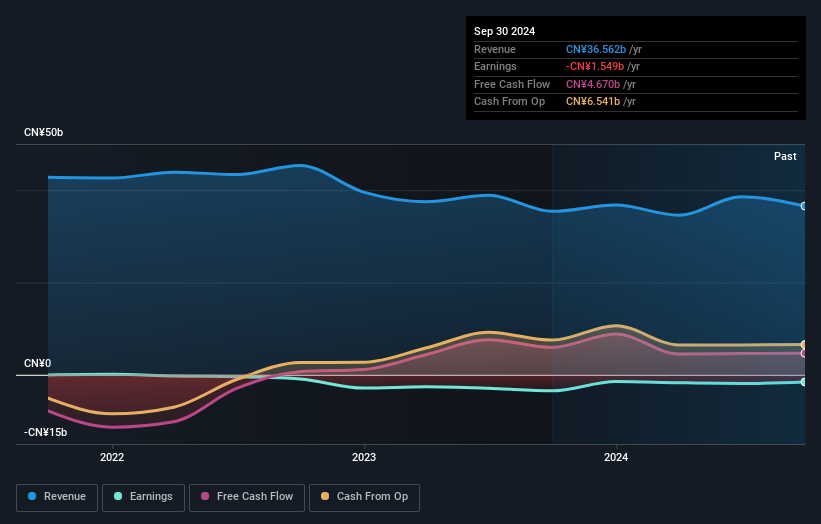

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Grandjoy Holdings Group's financial health with this free report on its balance sheet.

A Different Perspective

Grandjoy Holdings Group provided a TSR of 3.8% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 8% endured over half a decade. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand Grandjoy Holdings Group better, we need to consider many other factors. For example, we've discovered 2 warning signs for Grandjoy Holdings Group that you should be aware of before investing here.

But note: Grandjoy Holdings Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000031

Grandjoy Holdings Group

Engages in the real estate development in China and internationally.

Good value with adequate balance sheet.