- China

- /

- Real Estate

- /

- SHSE:603506

Top Asian Dividend Stocks To Consider In March 2025

Reviewed by Simply Wall St

As global markets grapple with tariff uncertainties and inflationary pressures, Asian economies are navigating these challenges with a mix of policy adjustments and strategic growth targets. Amid this backdrop, dividend stocks in Asia present an intriguing opportunity for investors seeking stability and income, especially as they look for companies with strong fundamentals that can weather economic fluctuations.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.51% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.87% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.05% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.15% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.09% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.86% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.86% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.29% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.23% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.33% | ★★★★★★ |

Click here to see the full list of 1133 stocks from our Top Asian Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

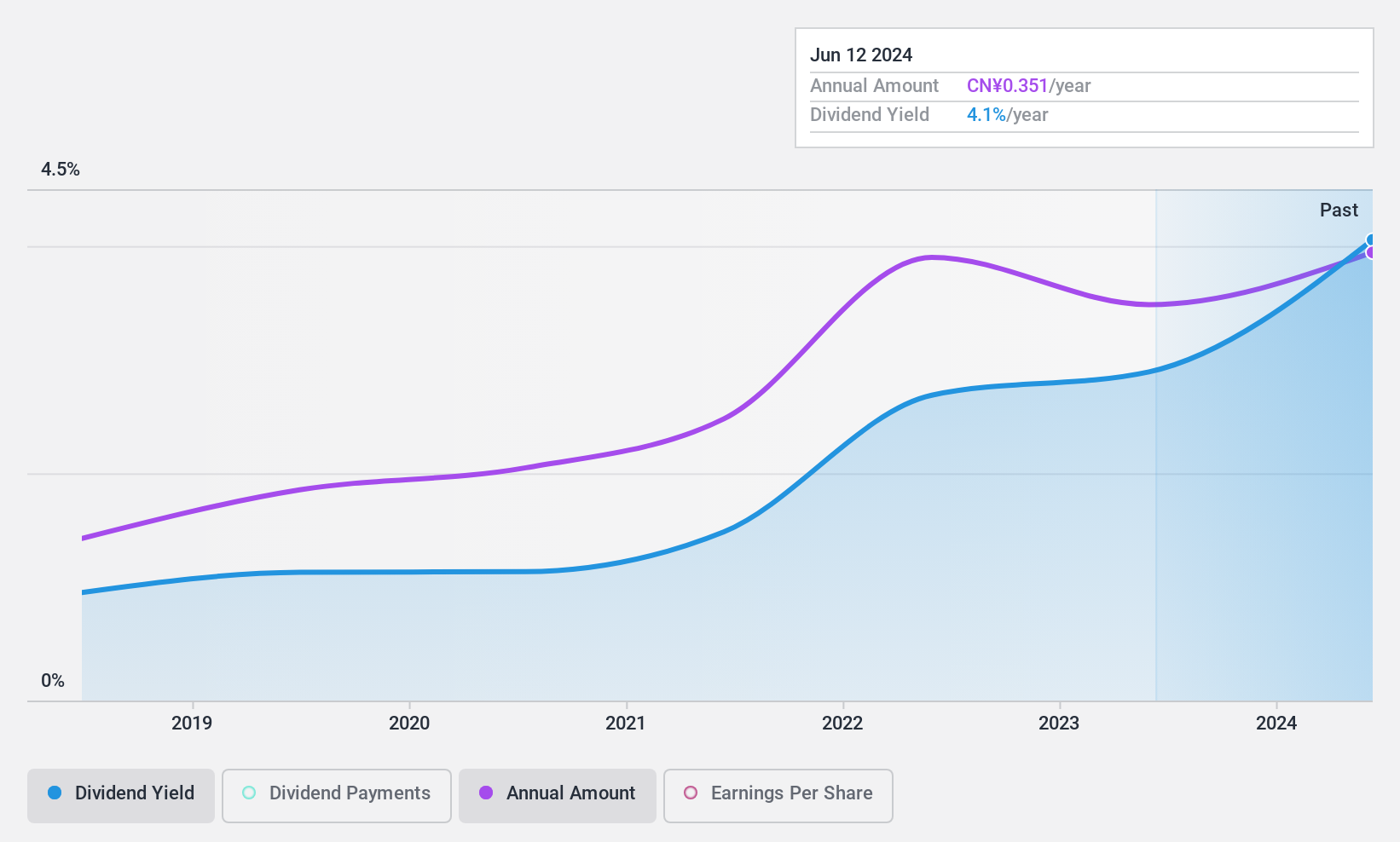

Nacity Property Service GroupLtd (SHSE:603506)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nacity Property Service Group Co., Ltd. provides real estate property management services in China and has a market cap of CN¥1.94 billion.

Operations: Nacity Property Service Group Co., Ltd. generates revenue through its real estate property management services in China.

Dividend Yield: 3.4%

Nacity Property Service Group Ltd. offers a compelling dividend yield of 3.35%, ranking in the top 25% of CN market payers. The dividends are well-supported by earnings and cash flows, with payout ratios around 50%. Despite only seven years of dividend history, payments have been stable and growing. Its Price-To-Earnings ratio at 14.7x suggests good value compared to the broader market's 38.7x, though recent earnings include significant one-off items impacting results.

- Unlock comprehensive insights into our analysis of Nacity Property Service GroupLtd stock in this dividend report.

- In light of our recent valuation report, it seems possible that Nacity Property Service GroupLtd is trading beyond its estimated value.

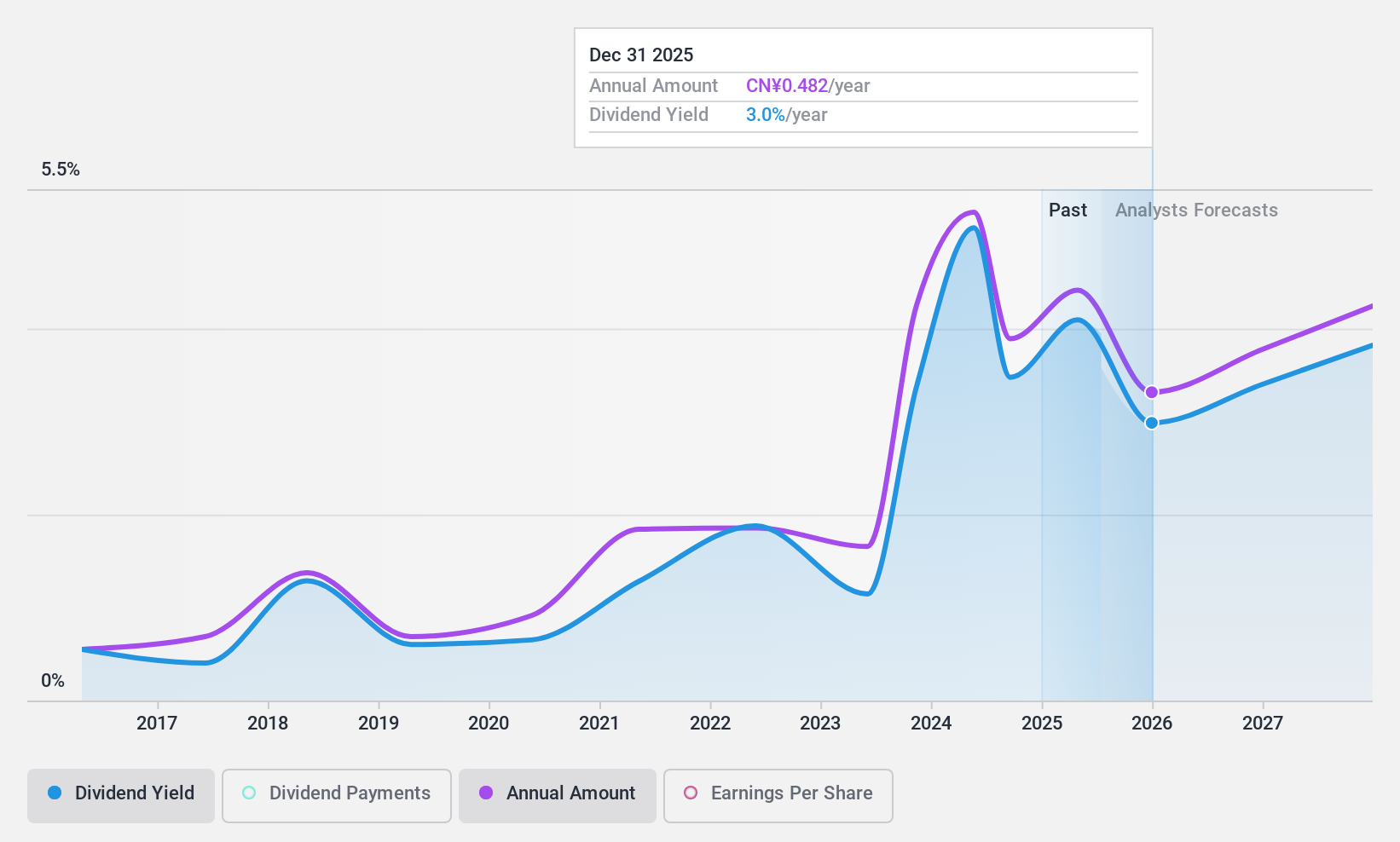

Zhejiang Dahua Technology (SZSE:002236)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Dahua Technology Co., Ltd. operates in the intelligent Internet of Things industry globally and has a market cap of approximately CN¥61.60 billion.

Operations: Zhejiang Dahua Technology Co., Ltd. generates revenue primarily from the research, development, production, and sales of video Internet of Things products, totaling CN¥32.39 billion.

Dividend Yield: 3%

Zhejiang Dahua Technology's dividend yield of 3.01% places it in the top 25% of CN market payers, yet its sustainability is questionable due to a high cash payout ratio (93.6%) and volatile past payments. Despite trading at 36.2% below estimated fair value, dividends are not well covered by free cash flows and have been unreliable over the last decade. Earnings grew significantly last year but are forecasted to decline annually by 12.7%.

- Click here to discover the nuances of Zhejiang Dahua Technology with our detailed analytical dividend report.

- Our valuation report unveils the possibility Zhejiang Dahua Technology's shares may be trading at a discount.

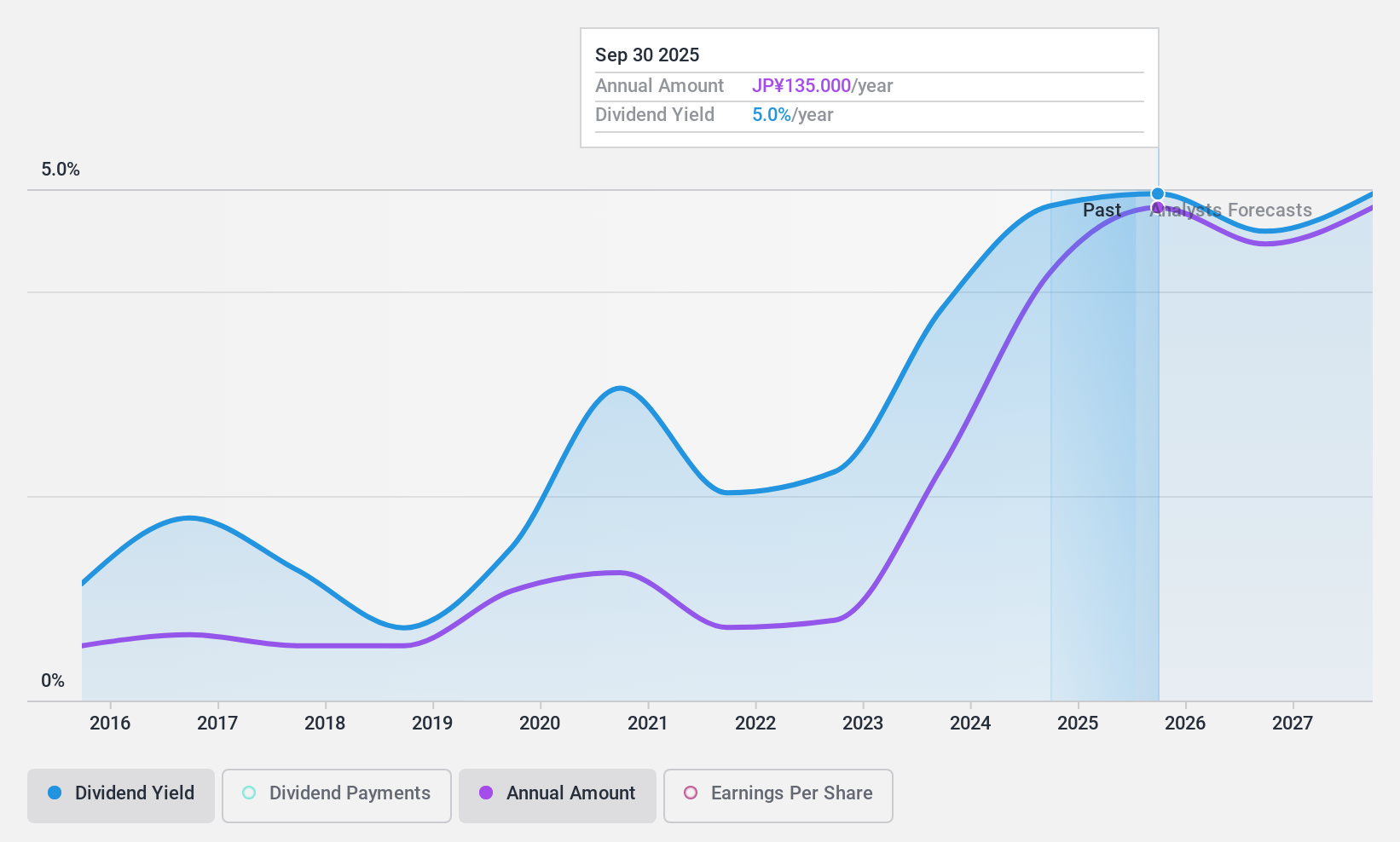

SK-ElectronicsLTD (TSE:6677)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SK-Electronics CO., LTD. manufactures and sells large-format photomasks both in Japan and internationally, with a market cap of ¥24.93 billion.

Operations: SK-Electronics CO., LTD. generates revenue primarily from its Large Photomask Business, which accounts for ¥26.23 billion, and its Solution Business, contributing ¥91.79 million.

Dividend Yield: 5.2%

SK-Electronics LTD offers a dividend yield of 5.16%, ranking in the top 25% of JP market payers, but its sustainability is questionable as dividends aren't covered by free cash flows. Despite a low payout ratio (35.3%), past payments have been volatile, though they have increased over the last decade. Recent guidance indicates an increase in dividends to ¥124 per share for fiscal year 2025, reflecting potential growth despite forecasted earnings decline.

- Get an in-depth perspective on SK-ElectronicsLTD's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of SK-ElectronicsLTD shares in the market.

Make It Happen

- Unlock more gems! Our Top Asian Dividend Stocks screener has unearthed 1130 more companies for you to explore.Click here to unveil our expertly curated list of 1133 Top Asian Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nacity Property Service GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603506

Nacity Property Service GroupLtd

Offers real estate property management services in China.

Flawless balance sheet with proven track record and pays a dividend.