- China

- /

- Real Estate

- /

- SHSE:600675

China Enterprise Company Limited (SHSE:600675) Not Flying Under The Radar

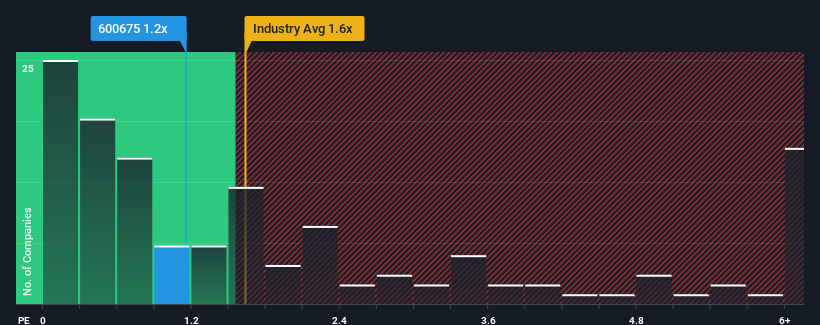

It's not a stretch to say that China Enterprise Company Limited's (SHSE:600675) price-to-sales (or "P/S") ratio of 1.2x right now seems quite "middle-of-the-road" for companies in the Real Estate industry in China, where the median P/S ratio is around 1.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for China Enterprise

What Does China Enterprise's Recent Performance Look Like?

China Enterprise certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for China Enterprise, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like China Enterprise's to be considered reasonable.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Thanks to this gigantic uplift, it also grew revenue by 20% in total over the last three years. So while the recent revenue growth has been good for the company, we do note that it does tend to experience some large revenue swings, particularly over the last 12 months.

Comparing that to the industry, which is predicted to deliver 6.2% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this information, we can see why China Enterprise is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

What Does China Enterprise's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It appears to us that China Enterprise maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

There are also other vital risk factors to consider and we've discovered 3 warning signs for China Enterprise (2 can't be ignored!) that you should be aware of before investing here.

If you're unsure about the strength of China Enterprise's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600675

China Enterprise

Engages in the real estate development and operation activities in China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives